Gold investors betting on prices are being affected by the market's uncertainty that the US Federal Reserve (FED) will cut interest rates in December, although most previously thought that this possibility was almost certain.

Most Asian and European stock markets fell overnight. US stock indexes are expected to open lower when the New York session begins.

US and global stocks became chaotic. After a strong sell-off in the US market on Monday, global markets continued to decline overnight.

Artificial intelligence-themed transactions are starting to waver as investors worry that borrowing to finance this sector will become a burden. Amazon raised $15 billion through bond issuance alone on Monday. The US economy shows signs of slowing down, especially the labor market, and the low-income consumer group is under increasing pressure. With technical indicators also sending warning signals - both the S&P 500 and Nasdaq 100 are closing below the 50-day moving average - Wall Street strategists question whether a year-end rally is still feasible, Bloomberg reported.

The rest of the week is expected to be very important for the market to return to historical peaks. Major consumer businesses such as Walmart, Home Depot and Target will announce results and comments on the year-end shopping season. Nvidia is the last company in the Big Seven group to prepare a report. US Government economic data that has been interrupted for the past seven weeks will also begin to be released again.

Bitcoin's drop below $90,000 has further exacerbated the decline in global financial markets, raising concerns that investors using leverage could create a sell-off spiral. The decline in the world's largest digital currency comes as investors worry about the speed of US interest rate cuts and shift their attention to the profit reporting season. Selling can increase on its own even without leverage, especially as digital and securities both increased strongly this year but confidence in the outlook has weakened, Bloomberg said.

Meanwhile, Japanese government stocks and bonds continued to fall today due to concerns about Japan-China relations and domestic fiscal conditions. Investors are further concerned that the upcoming stimulus package announced by Prime Minister Sanae Takaichi could put pressure on the public budget, causing long-term bond yields to increase sharply.

Concerns about high valuations in the technology industry also put pressure on the market, with AI-related stocks dragging the Topix index and semiconductor device manufacturers becoming the strongest downside group on Nikkei.

Government financial instability is rising, along with concerns about Japan-China relations. The overall market sentiment is deteriorating, said Mr. Vin Vinoshoshita, global market strategist at Invesco Asset Management Japan.

In another development, unemployment claims are rising in the US. The initial number of unemployment benefit applications in the week ended October 18 was 232,000,000, continuing to be significantly higher than the average from the end of the second quarter to date. This is the first updated data from the US Department of Labor since the federal government's shutdown on October 1, threatening the jobs of a large number of civil servants.

With the new figures, the number of outstanding allowances increased to 1.957 million last week (without seasonal adjustments), nearly the highest level since 2021 and in line with other signs of weak recruitment in the economy.

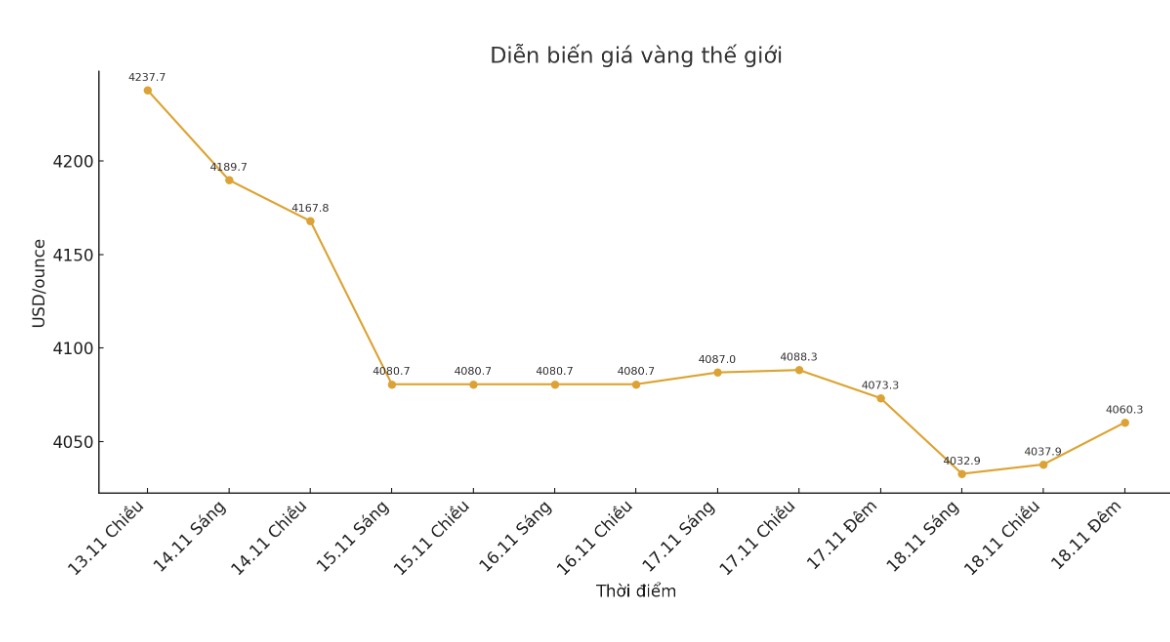

Technically, the next target for December gold buyers is to close above a solid resistance level at a historical peak of $4,398/ounce. The target for the sellers is to pull the price below the strong support zone of 4,000 USD/ounce.

The first resistance level was an overnight high of $4,055.4 an ounce, followed by a weekly high of $4,107.6 an ounce. First support was $4,000/ounce, followed by an overnight low of $3,997.4/ounce.

In the outside market, the USD index decreased slightly. Crude oil prices are almost flat around $60/barrel. The yield on the 10-year US Treasury note was 4.1%.