According to Cushman & Wakefield's Ho Chi Minh City Office Market Report Q4/2025, in this quarter the market recorded about 25,554m2 of new supply, down 41.2% compared to Q3/2025. Total supply reached approximately 1,713,680m2, up 1.51% compared to the previous quarter and 4.83% compared to the same period last year.

In which, the Grade B segment continues to dominate in scale with about 1,060,369m2, while the Grade A segment reaches about 650,851m2, mainly supplementing high-quality projects at strategic locations.

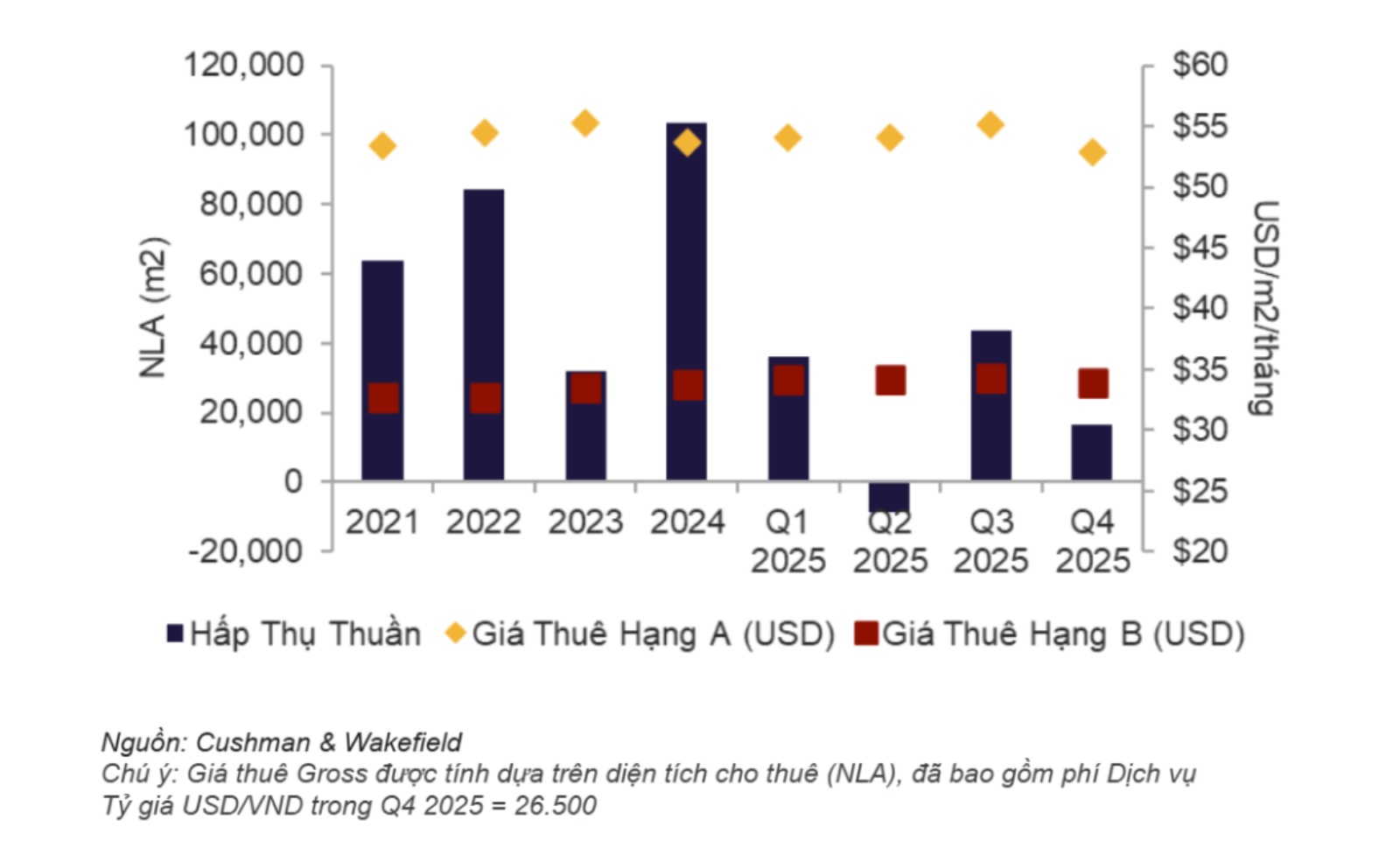

In the fourth quarter of 2025, the net market absorption volume reached 16,658m2, a sharp decrease of 61.9% compared to the third quarter of 2025 and 49.9% compared to the same period in 2024. This development reflects the slow seasonal pace at the end of the year as well as the cautious sentiment of tenants, when most of the new leases or large-scale expansion decisions were made in the middle of the year. However, in the context of new supply not increasing, this absorption level is still considered a positive signal, contributing to helping the market-wide vacancy rate continue to improve slightly.

In the Grade A segment, net absorption only reached 186m2, much lower than the level of 24,132m2 in the third quarter of 2025 and 11,052m2 in the same period of 2024. The occupancy rate is maintained stably around 86%, showing that large enterprises are taking advantage of preferential policies from building owners to maintain or extend lease contracts in prime locations, where brand image and green operating standards (ESG) are prioritized.

Meanwhile, the Grade B segment recorded 16,472 m2 of net absorption, down 15.9% compared to the previous quarter and 25.8% compared to the same period last year, but accounted for almost the entire market absorption in the quarter. This shows that Grade B, especially in areas outside the CBD (commercial and business center of the city), continues to play a role as the main demand driver, benefiting from the trend of cost optimization and moving out of the central area, while reflecting the higher sustainability of this segment in the market adjustment period.

Regarding rental prices, the Grade A segment in the fourth quarter of 2025 averaged about 52.89 USD/m2/month (equivalent to 1.4 million VND/m2), down 3.96% compared to the previous quarter and 1.46% compared to the same period last year. The decrease mainly came from newly put into operation buildings with actual asking rents lower than expected, causing the Grade A price level to adjust after the increase in the third quarter of 2025, and also reflecting the strategy of prioritizing quick filling in new projects.

For the Grade B segment, rental prices remained around 33.97 USD/m2/month (900,000 VND/m2), slightly down 0.91% compared to the previous quarter but still up 0.40% compared to the same period last year. This development shows the stability of the Grade B segment, as building owners continue to maintain competitive prices to support occupancy rates, while benefiting from the shift flow of tenants to optimize costs from Grade A and CBD areas.

In general, the Ho Chi Minh City office market in the fourth quarter of 2025 shows clear differentiation, when the Grade A segment adjusts to absorb new supply, while the Grade B segment maintains stability, keeping pace for the entire market in the rebalancing phase.

In the near future, the market is expected to be supplemented with about 291,891m2 of net rental area (NLA). The market enters a new competitive cycle, in which operating quality, utilities and sustainable standards become key factors determining the ability to retain tenants.

Ms. Hoang Nguyet Minh - General Director of Cushman & Wakefield Vietnam - said: "The office market is entering a more mature period. We note that businesses are increasingly focusing on prioritizing area, costs, and suitable quality. They are looking for workspaces that can improve productivity, attract and retain talent, while still ensuring financial efficiency. At the same time, building owners are also more proactive in price policies and incentive packages to close transactions.

Ms. Hoang Nguyet Minh said that this is a positive signal - promoting transparency and market orientation towards high-quality products that operate more efficiently.

We believe that projects that converge a solid foundation, professional management and sustainable factors will shape the next growth cycle of the Ho Chi Minh City office market" - Ms. Minh said.