The new law is available, but implementation is not effective

In the first 4 months of 2025 alone, the accumulated amount of late social insurance payments was nearly VND17,700 billion, of which the number of late payments of 3 months or more accounted for nearly 64%. According to Vietnam Social Insurance (VSS), this amount accounts for 2.96% of the total amount to be collected and has decreased compared to the same period in 2024. Late payment of 3 months or more accounts for the most with more than VND 11,300 billion of more than 173,000 enterprises.

According to the latest statistics from Vietnam Social Insurance, as of the third quarter of 2025, the total amount of late payment of social insurance, health insurance (HI) and unemployment insurance (UI) is VND 18,427 billion of 217,199 units, accounting for 3.30.30 of the total receivables.

From July 1, 2025, the 2024 amended Law on Social Insurance (Law No. 41/2024/QH15 of the National Assembly, issued on June 29, 2024) officially takes effect. Notably, this law has strengthened strict sanctions for late payment and evasion of social insurance payment to ensure maximum protection of the immediate rights and interests of employees as well as the expectation of further improving compliance with social insurance laws by employers.

The new point is that the law clearly defines behaviors such as: Late payment is payment of under, late, and incomplete social insurance within 60 days. Payment capital is not to establish or not to establish a complete list of employees participating in social insurance after 60 days from the prescribed date. From there, additional specific sanctions are added, direct to employers. For evasion of payment, employers may also be prosecuted for criminal liability according to the provisions of law. However, sanctions are one thing, whether they can be implemented or not is another matter.

Tax evasion is strictly handled criminally, and evasion of social insurance payment is not strictly handled

Discussing this issue with Lao Dong reporter, Prof. Dr. Giang Thanh Long ( Senior Lecturer, National Economics University) expert on public policy and social security - said that the prolonged situation of late and evasion of social insurance payment not only directly affects the rights of employees, but also has many potential long-term consequences for the social security system.When workers see that paying social insurance does not provide real protection, they will have a "fulfillment" mentality without considering this an advantage that is closely linked to their lives.

One reason why businesses are deliberately delaying, according to Prof. Dr. Giang Thanh Long, is that the current sanctions are too light.

Enterprises owe insurance, but they may have billions of dong that they should have paid and they can deposit them in banks or do business with interest and that interest can be squeezed by the administrative fine for social insurance payment debts. Such a regulation can create motivation for evasion and social insurance debt" - he pointed out. "The social insurance policy can also be compared to the tax evasion or evasion policy, late payment of social insurance is also an evasion or failure to fulfill obligations to the State, appropriating the State's payment from the employee's money. Not to mention, the further consequences are the loss of social trust in the social insurance system. I think that there needs to be equivalent sanctions in terms of law to be able to handle this long-standing problem" - Prof. Dr. Giang Thanh Long emphasized.

Social insurance agencies must strictly implement

Discussing solutions to this problem, Professor Giang Thanh Long said that social insurance agencies must " scoring" a few cases of late payment and evasion. It is necessary to immediately start and strictly implement the provisions of the law in the field of social insurance. It is necessary to put the protection of workers' rights first and foremost. In addition to supporting employees immediately, it is necessary to quickly coordinate with relevant authorities to recover as much as possible of the company's social insurance debts.

According to Professor Giang Thanh Long, it is necessary to have drastic changes from the social insurance management system as well as change the awareness of employees towards social insurance to protect their own rights.

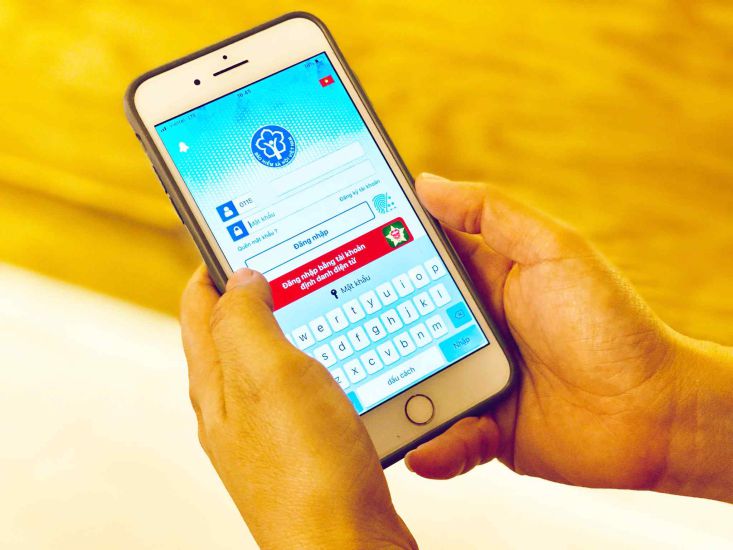

"Currently, the VSSID system is working and can be used on different devices, including smartphones, but how many people are really interested and regularly come to monitor whether their businesses pay social insurance for them or not and how social insurance is accumulated at that time? I don't think that not many people do so out of the tens of millions of workers participating in social insurance. Therefore, there must be effective measures to propagate to employees to change their awareness, be close to their rights and create trust in the social insurance system. In addition, there should also be an information channel to notify employees even within the month the enterprise has not paid social insurance so that employees know and handle the problem, including suing employers if they do not comply with the correct payment regime, have enough money according to regulations and on time" - Professor Long recommended.

Need to give the Union more rights - review from the root, handle early

In Nghe An, Mr. Kha Van Tam - Member of the Provincial Party Committee, Chairman of the Provincial Labor Federation - said that the fact that enterprises have long-term owed social insurance has seriously violated the legitimate and legal rights of workers, especially those in difficult circumstances, with unstable incomes, and dependent entirely on social security regimes.

"There have been workers who have owed social insurance for many years, and when they quit their jobs, they could not close their books, and were not eligible for unemployment benefits or maternity leave under the correct regime. Grassroots unions in many places have to support and mobilize businesses, even go to social insurance agencies to work with. But without strong enough legal tools, the efforts of the Trade Union organization will only stop at recommendations" - Mr. Tam shared.

According to the Chairman of Nghe An Provincial Federation of Labor, to effectively and sustainably combat social insurance losses, it is necessary to have a clear mechanism regulating the responsibilities of each level and each sector, especially the local government where the enterprise operates. Along with that, it is necessary to give the role and authority to the Trade Union organization, not only stopping at supervision and recommendation but also directly participating in the process of inspection, examination and monitoring units with signs of evasion and late payment of social insurance.

"We recommend that there should be a specific coordination mechanism between social insurance - trade unions - grassroots authorities to closely grasp the current situation of enterprises. Once there is a risk of outstanding debt, it is necessary to give early warnings and intervene promptly. If we had allowed the debt to continue and then enforced it, it would have been too late, and the disadvantaged would still be workers" - Mr. Tam emphasized.