According to the provisions of the Law on Social Insurance (SI) 2024, the subjects participating in voluntarySI Social Insurance include Vietnamese citizens aged 15 and over who are not subject to compulsorySI and are not pensioners,SI beneficiaries, monthly allowances; employees (NLD) temporarily suspending the implementation of labor contracts, work contracts, except in cases where the two parties have agreed on compulsorySI payment during this time.

The pension calculation for those who have both participated in compulsory social insurance and voluntary social insurance is based on Article 11 of Decree 159/2025/ND-CP. Accordingly, the period of calculating the pension regime for people who have paid compulsory social insurance and voluntary social insurance is the total period of compulsory social insurance and voluntary social insurance contributions.

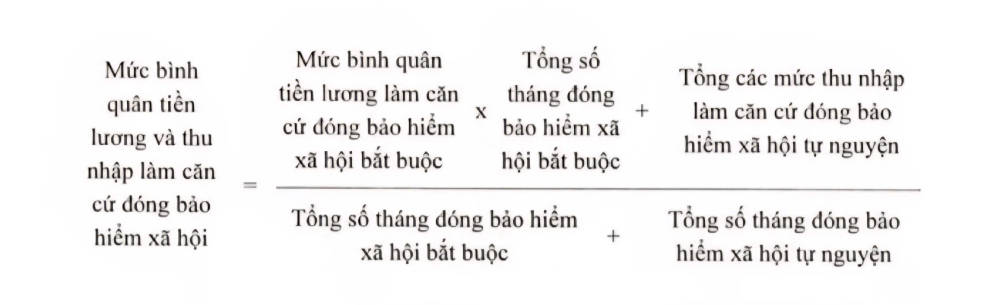

The pension is calculated by multiplying the monthly pension rate by the average monthly salary and income for social insurance contributions. The average salary and income used as the basis for social insurance contributions is calculated according to the following formula:

In particular, the average salary used as the basis for compulsory social insurance contributions is implemented according to the provisions of Articles 72 and 73 of the Law on Social Insurance. The total income levels used as the basis for voluntary social insurance contributions are the total income levels used as the basis for voluntary social insurance contributions that have been adjusted according to the provisions of Article 10 of Decree 159.

In case a person who has both paid compulsory social insurance and paid voluntary social insurance has participated in social insurance according to the subjects specified in Points a, b, c, d, dd, g and i, Clause 1, Article 2 of the Social Insurance Law before July 1, 2025 and has paid compulsory social insurance for 20 years or more when calculating the monthly pension lower than the reference level, it will be calculated at the reference level.