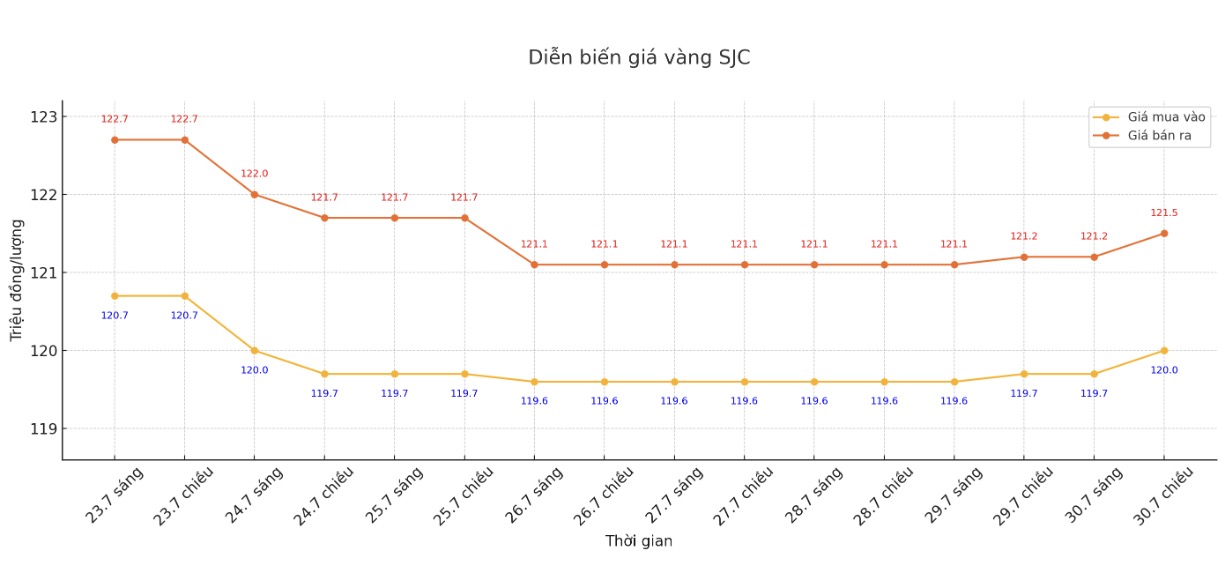

SJC gold bar price

As of 6:00 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 120-121.5 million/tael (buy in - sell out); increased by VND 300,000/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

DOJI Group listed at 120-121.5 million VND/tael (buy - sell); increased by 300,000 VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 120-121.5 million VND/tael (buy - sell); increased by 300,000 VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at VND 119.5-121.5 million/tael (buy in - sell out); increased by VND 300,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

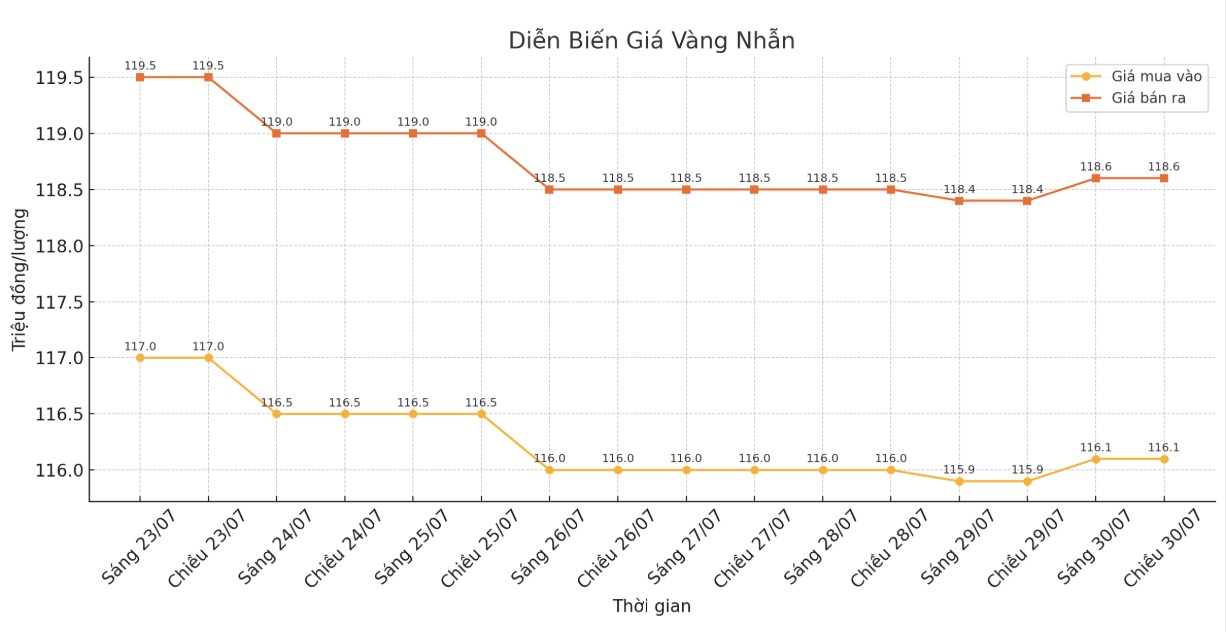

9999 gold ring price

As of 6:00 p.m., DOJI Group listed the price of gold rings at 116.1-118.6 million VND/tael (buy in - sell out), an increase of 200,000 VND/tael in both directions. The difference between buying and selling is 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116.3-119.19.3 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 115.2-118.2 million VND/tael (buy in - sell out), an increase of 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

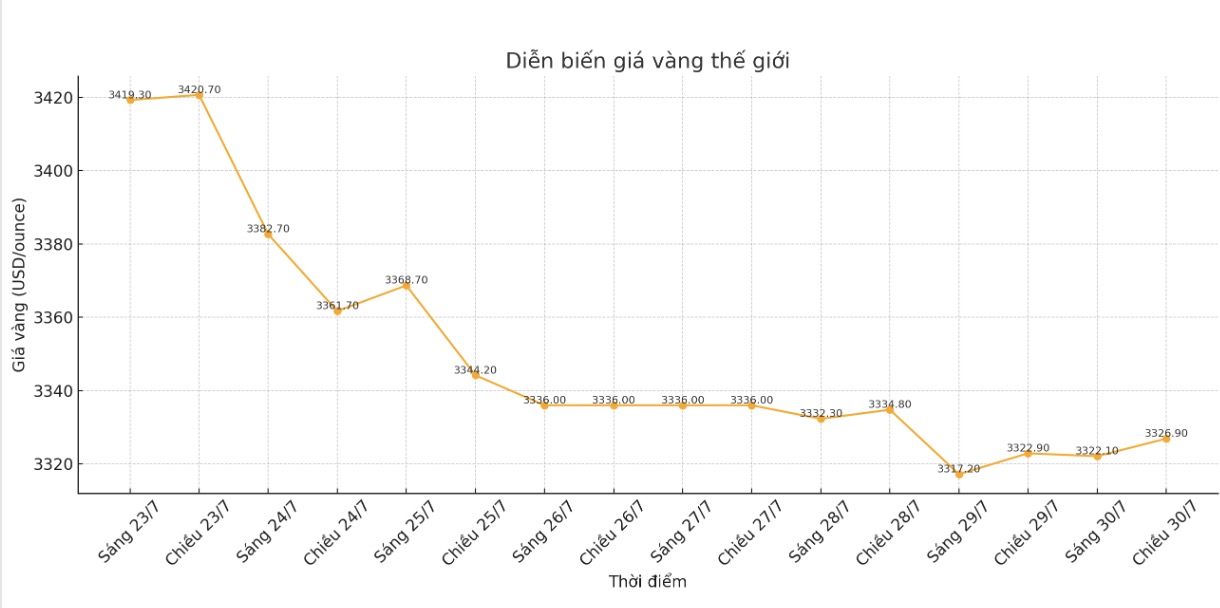

World gold price

The world gold price was listed at 6:10 p.m. at 3,326.9 USD/ounce, up 4 USD compared to 1 day ago.

Gold price forecast

Gold prices recovered slightly due to the weakening of the USD. Investors are waiting for the policy decision and the Federal Reserve's (FED) statement.

The US dollar fell 0.1% after reaching a more than one-month high on Tuesday, making gold cheaper for holders of other currencies.

There are many factors combining which are making gold prices almost unchanged. Geopolitically, there seems to be progress in tariff negotiations, but neither side is really ready for a clear commitment, said StoneX analyst Rhona O'Connell.

The market is now expecting two cuts between now and the end of the year, said StoneX analyst Rhona O'Connell: "But that expectation may be too optimistic. The Fed will not yield to political pressure, but it is worth noting whether this vote will reach a consensus, OConnell said.

Gold and silver prices may be standing still this summer, but according to Florian Grummes CEO of Midas Touch Consulting a bigger breakthrough is approaching, and patient investors will be rewarded.

Gold is trading around $3,320 an ounce on Tuesday, after falling more than $130 in just four trading sessions last week. Grummes said this was a typical summer event.

Gold prices are moving sideways, accumulating and digesting fluctuations. Just need more time. Everyone needs to be patient, he said.

He identified the support zone at $3,285 an ounce and resistance at $3,450, with a long-term target of $4,000 an ounce. In the rest of the year, I think we can see it above $4,000 an ounce, Grummes said.

On the short-term trend, Grummes said he would switch to an uptrend if prices surpassed $3.365/ounce. Before, it tended to go sideways until it decreased slightly. But that is not a deep decline, he said.

Economic data to watch this week

Wednesday: ADP employment data, US preliminary GDP, Bank of Canada monetary policy decision, pending home sales, FED interest rate decision, Bank of Japan decision.

Thursday: US PCE, weekly jobless claims.

Friday: US non-farm payrolls, ISM manufacturing PMI.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...