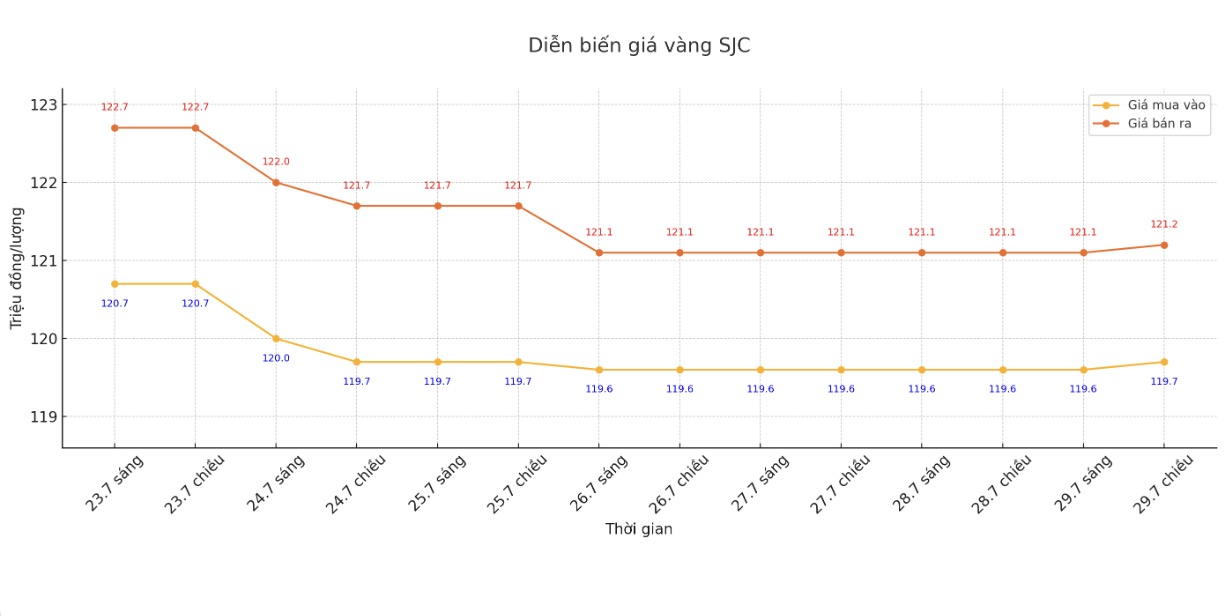

SJC gold bar price

As of 6:00 a.m. on July 30, the price of SJC gold bars was listed by Saigon Jewelry Company at VND 119.7-121.2 million/tael (buy in - sell out); increased by VND 100,000/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

DOJI Group listed at 119.7-121.2 million VND/tael (buy - sell); increased by 100,000 VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 119.7-121.2 million VND/tael (buy - sell); increased by 100,000 VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 119.2-121.2 million VND/tael (buy - sell); increased by 400,000 VND/tael for buying and increased by 100,000 VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

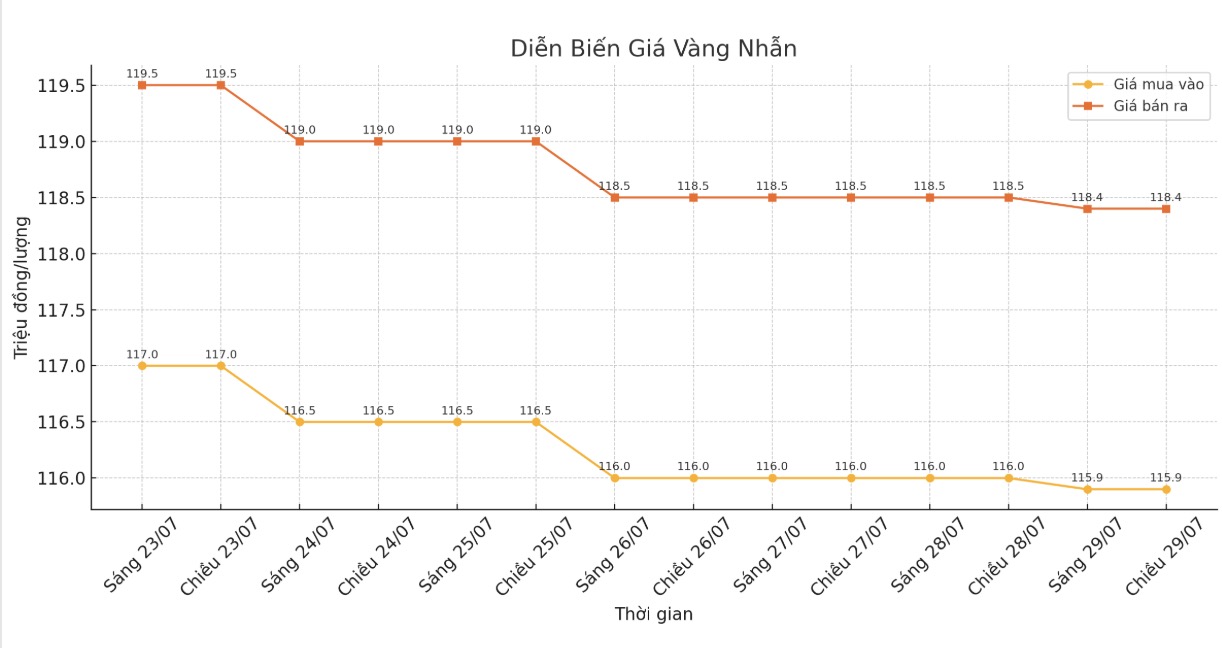

9999 gold ring price

As of 6:00 a.m. on July 30, DOJI Group listed the price of gold rings at VND 115.9-118.4 million/tael (buy in - sell out), down VND 100,000/tael in both directions. The difference between buying and selling is 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116.3-119.19.3 million VND/tael (buy - sell), an increase of 100,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 115-118 million VND/tael (buy - sell), down 100,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

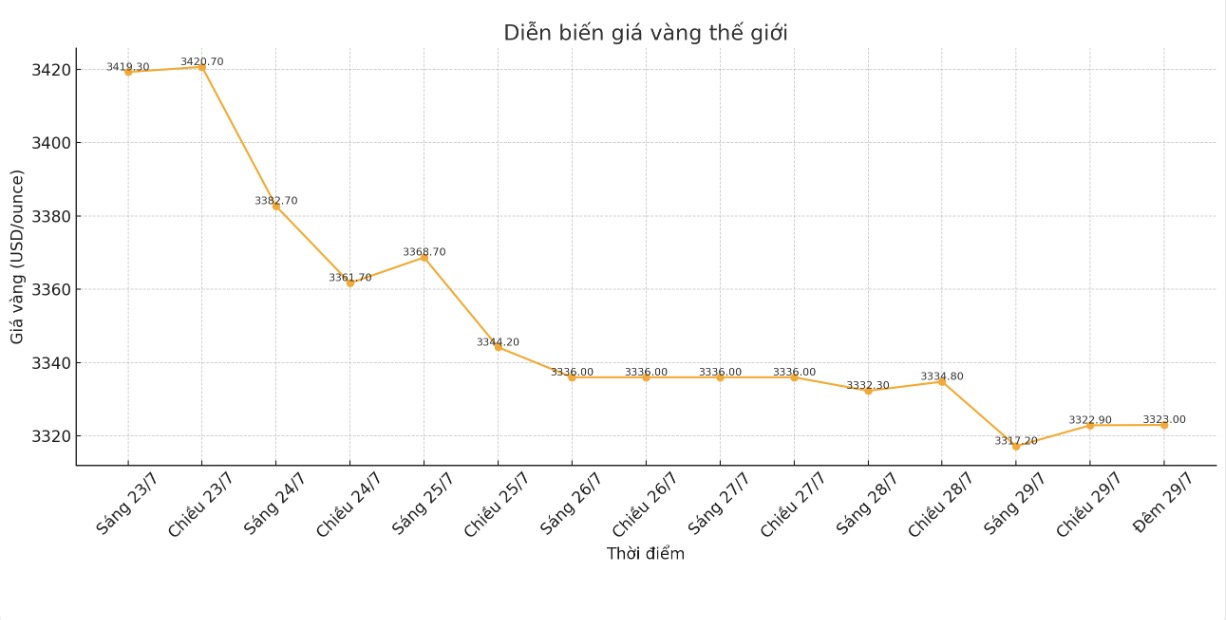

World gold price

The world gold price was listed at 9:40 p.m. on July 29 at 3,323 USD/ounce, recovering slightly compared to 1 day ago.

Gold price forecast

World gold prices recovered slightly but were still under pressure as the USD index increased to a 5-week high. metals traders are also cautious as an important meeting of the US Federal Reserve (FED) is taking place.

August gold futures rose $4 to $3,314 an ounce. September silver futures fell slightly by $0.001 to $18.22 an ounce.

The Fed's Federal Open Market Committee (FOMC) meeting began this morning and ended Wednesday afternoon with a policy announcement and press conference by Fed Chairman Jerome Powell.

Analysts expect the Fed to keep the benchmark interest rate unchanged this week. However, after being criticized by US President Donald Trump and asked to reduce interest rates, many people believe that Mr. Powell could signal a loosening of monetary policy in the fall.

Asian and European stocks fluctuated in opposite directions overnight. US stock indexes are expected to open up slightly in New York.

In terms of trade with the EU, the currency market seems to think that the US is the more profitable side. The USD index has risen to a 5-week peak, while the Euro fell below the 1.16 USD mark - falling again after losing 1.3% on Monday (the strongest day decline in more than 2 months).

There are growing concerns that the new trade deal between the US and the EU is in the interests of the US, without significantly improving the economic outlook of the Eurozone, according to TradingEconomics.

Fidelity International predicts that gold prices could reach $4,000/ounce by the end of 2026, thanks to the Fed's interest rate cut policy and central banks increasing gold reserves.

Fidelity International market analyst Han Samson said the organization remains optimistic about gold prospects due to expectations of a more dovish Fed stance and a weaking US dollar.

He also emphasized that gold, as a tangible asset, will continue to be attractive in the context of increasing budget deficits and an uptrend that is not too much in the current context of the price market.

Overseas markets are currently recording the highest increase in the USD index in 5 weeks. Nymex crude oil prices are almost flat, around 66.75 USD/barrel. The yield on the 10-year US government bond is currently at 4.394%.

Economic data to watch this week

Tuesday: New employment numbers (JOLTS), US consumer confidence.

Wednesday: ADP employment data, US preliminary GDP, Bank of Canada monetary policy decision, pending home sales, FED interest rate decision, Bank of Japan decision.

Thursday: US PCE, weekly jobless claims.

Friday: US non-farm payrolls, ISM manufacturing PMI.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...