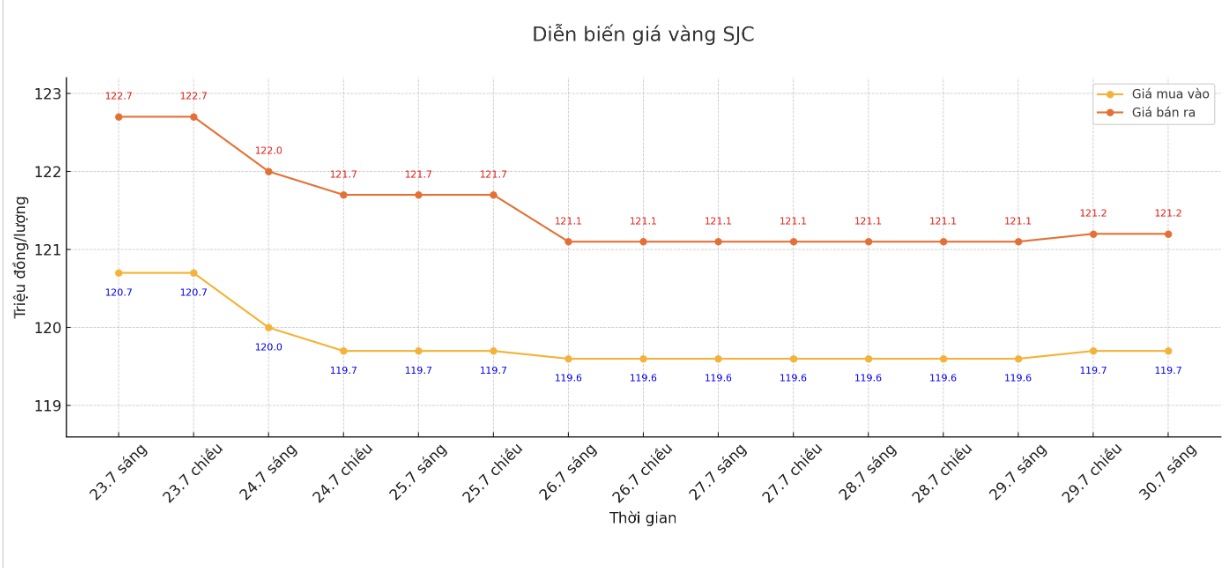

Updated SJC gold price

As of 9:00 a.m., DOJI Group listed the price of SJC gold bars at VND 119.7-121.2 million/tael (buy in - sell out), an increase of VND 100,000/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 120-121.5 million VND/tael (buy - sell), an increase of 400,000 VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at VND 119.5-121.5 million/tael (buy in - sell out), an increase of VND 500,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

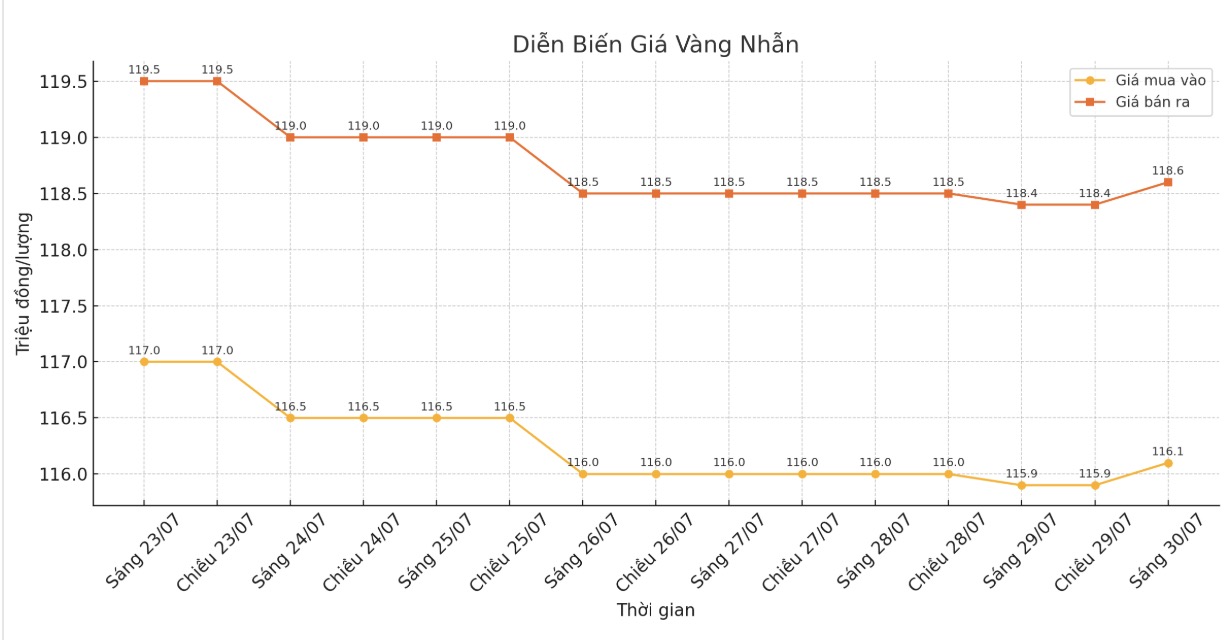

9999 round gold ring price

As of 9:00 a.m., DOJI Group listed the price of gold rings at 116.1-118.6 million VND/tael (buy in - sell out), an increase of 200,000 VND/tael in both directions. The difference between buying and selling is 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116.3-119.19.3 million VND/tael (buy - sell), an increase of 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 115.2-118.2 million VND/tael (buy in - sell out), an increase of 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

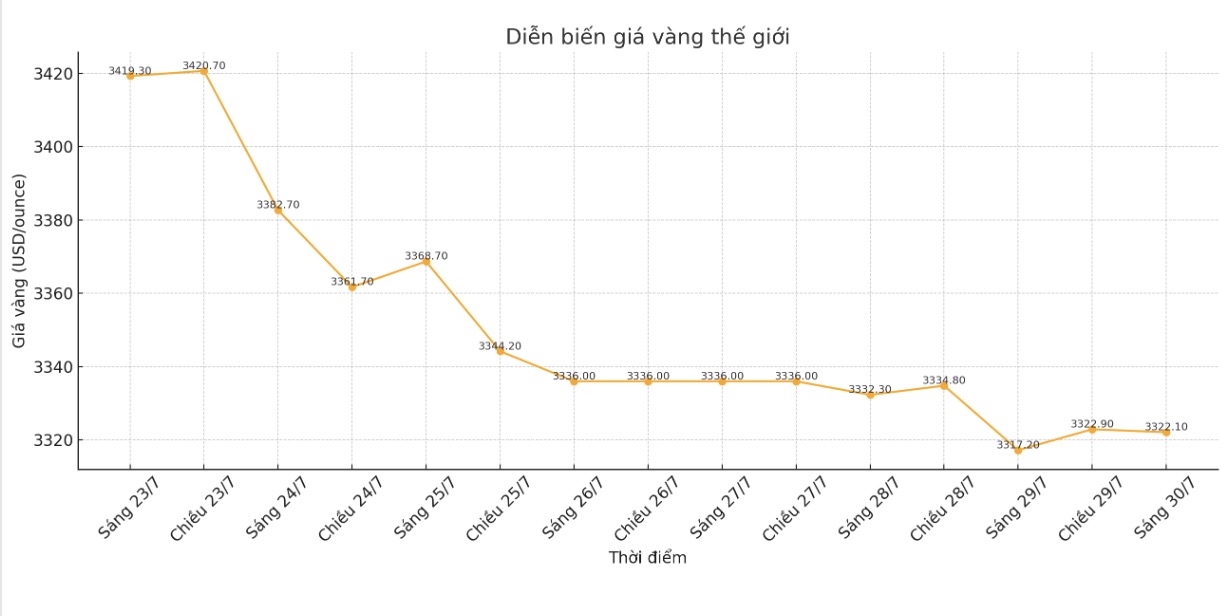

World gold price

At 9:00 a.m., the world gold price was listed around 3,322.1 USD/ounce, up 4.9 USD/ounce.

Gold price forecast

Gold prices are still holding strong resistance at $3,300/ounce. The precious metal is struggling to attract new momentum as trade deals between the US, Japan and Europe have eased concerns about a trade war.

Gold is also under pressure from the possibility that the US Federal Reserve (FED) will keep interest rates unchanged at the ongoing meeting. However, after being warned by US President Donald Trump and pressured about cutting interest rates, many market observers believe that FED Chairman Jerome Powell may make more pigeon statements, possibly referring to loosening monetary policy this fall.

Geopolitical tensions have also cooled in many parts of the world, including the Middle East, India - Pakistan and recently Thailand - Cambodia. This is a factor that reduces the demand for safe havens.

Peter Grant - Vice President and senior strategist at Zaner Metals, the market is predicting that the FED will cut interest rates by a total of about 50 basis points from now until the end of the year, in which October is considered the most feasible starting point.

However, if two more Fed members express their support for easing, it is expected to be leaning towards the possibility of a cut in September. This is a factor that can continue to support gold prices.

Meanwhile, Fawad Razaqzada, an analyst at City Index and FOREX.com, said: "The risk of a broken deal remains, so some investors continue to hold safe-haven assets such as gold as a hedge against uncertainty."

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...