Gold prices rose in the morning trading session of January 10 and are heading for a week to rise, as investors assess US jobs data as weaker than expected along with continued instability in policy and geopolitics.

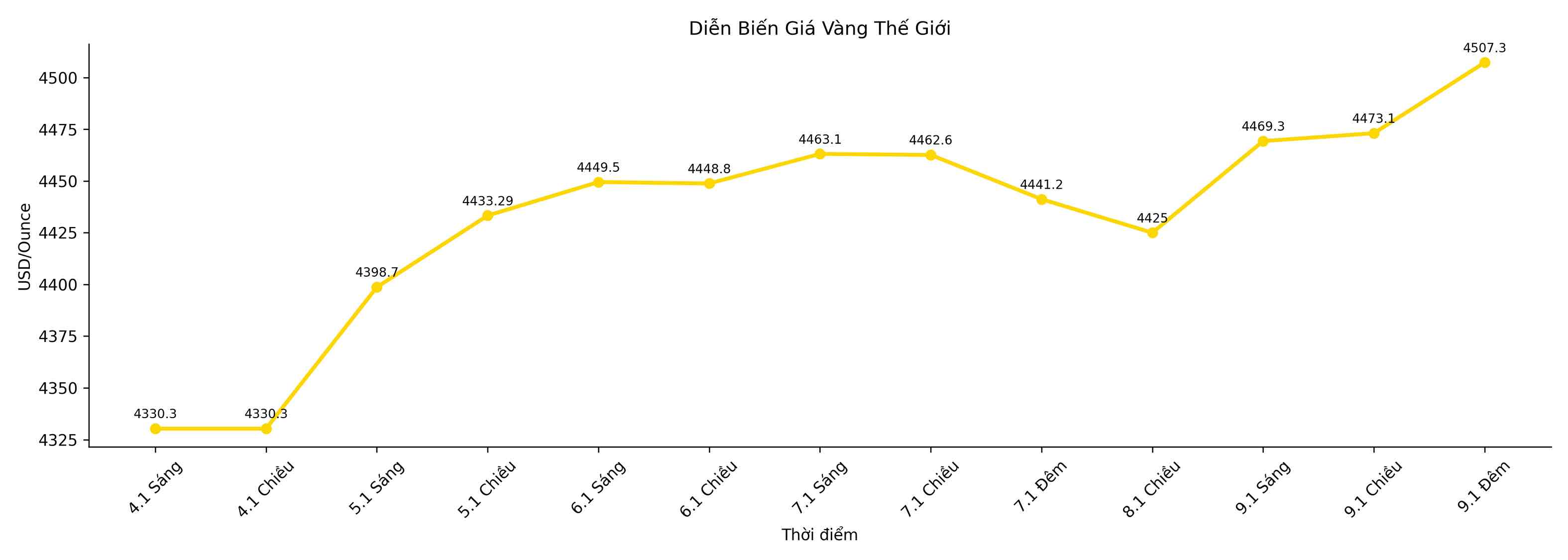

Spot gold rose 0.6% to 4,502.98 USD/ounce and is on an upward trend of more than 4% this week. This precious metal set a record of 4,549.71 USD/ounce on December 26. US gold futures for February delivery rose 1.2% to 4,513.60 USD/ounce.

The US December non-farm payroll only increased by 50,000 jobs, lower than the forecast of 60,000, while the unemployment rate fell to 4.4%, lower than expected by 4.5%.

“The figures show that the job market is weakening. In addition, geopolitical tensions, higher oil prices causing inflationary pressure, uncertainty and the US Federal Reserve (Fed) trending to ease, all create a favorable environment for precious metals,” said Bart Melek, Global Commodity Strategy Director at TD Securities.

Investors continue to bet that the Fed will cut interest rates at least twice this year, a context where capital always supports gold – a non-profit asset.

Geopolitical tensions are still increasing as instability in Iran escalates, conflict in Ukraine prolongs, the US arrests Venezuelan President Nicolas Maduro and Washington re-sends signals about its ambition to control Greenland.

Metals Focus forecasts that gold prices could set a new record of exceeding $5,000/ounce in 2026, thanks to the trend of dedollarization and increased geopolitical risks.

Retail gold demand in India continues to decrease due to high prices, while the gold price difference in China is widening.

Meanwhile, uncertainty about tariffs remains as the US Supreme Court said it would not rule on January 10 on the lawsuit related to the legality of President Donald Trump's global tax imposition, with the decision postponed to next Wednesday.

Spot gold rose 3.9% to 79.88 USD/ounce, heading towards an increase of about 10% in the week. Platinum rose 1.3% to 2,296 USD/ounce, and palladium rose 2.3% to 1,826.89 USD/ounce; both are on a weekly uptrend.

Bank of America (BoA) has raised its forecast for the average price of platinum and palladium in 2026, citing trade tensions disrupting the market and tight supply, while Chinese imports continue to play a supporting role.