CME Group - the operator of the world's largest commodity derivatives exchange continues to raise margin requirements for gold and silver futures contracts, in order to minimize risks in the context of a volatile precious metals market.

Margin is the amount of money that investors in the futures contract market must pay to the exchange or clearing organization to secure payment obligations. When price fluctuations increase, exchanges often raise the margin level to limit the risk of default.

According to CME Group's announcement issued on Thursday, the initial margin and maintenance margin for COMEX 100 gold futures contracts have been raised to 9% from 8% for accounts not in high-risk groups. Meanwhile, the margin for COMEX 5000 silver futures contracts has been adjusted to increase from 15% to 18%.

The new margin levels will take effect after the end of the trading session on Friday, February 6.

Previously, since January 13, CME Group has applied the margin determination method based on the percentage of contract value for gold, silver, platinum and palladium, instead of the fixed cash level calculation method as before. Since changing this method, CME has increased margins three times, on January 30, February 2 and the latest adjustment.

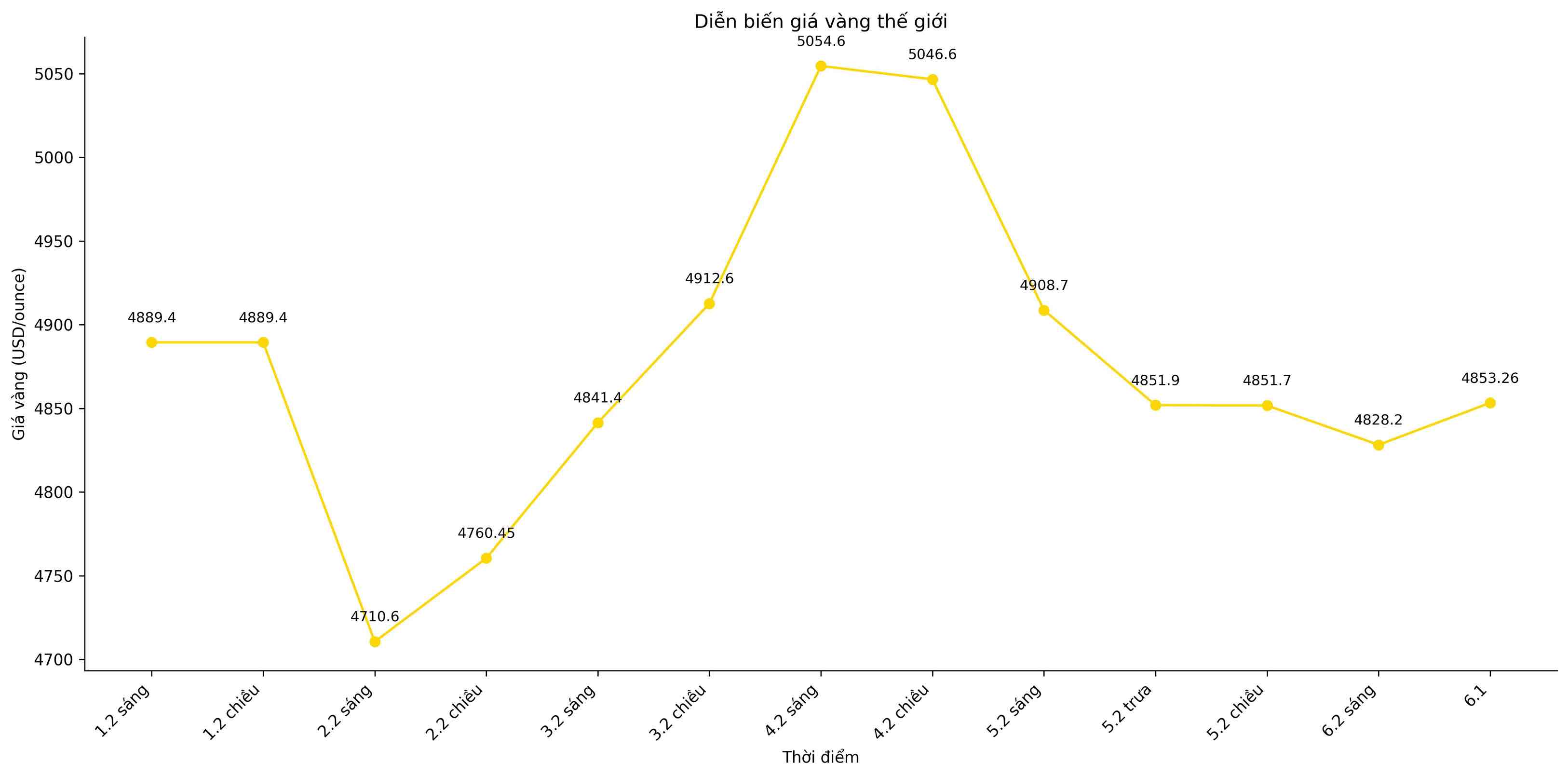

The precious metals market has recently recorded strong fluctuations, as gold and silver prices plummeted the most in decades on Friday last week, after simultaneously setting historical highs just a few days earlier.

In Friday morning trading, spot gold prices rose 2.6% to 4,841.67 USD/ounce in today's afternoon trading session, after falling to 4,654.29 USD/ounce at one point during the session. Spot silver prices rose 5.5% to 75.15 USD/ounce, recovering from a nearly two-month low of 63.99 USD/ounce.

In the US futures market, gold futures for April delivery rose 0.4% to 4,905.8 USD/ounce, while silver futures fell 3% to 74.46 USD/ounce.