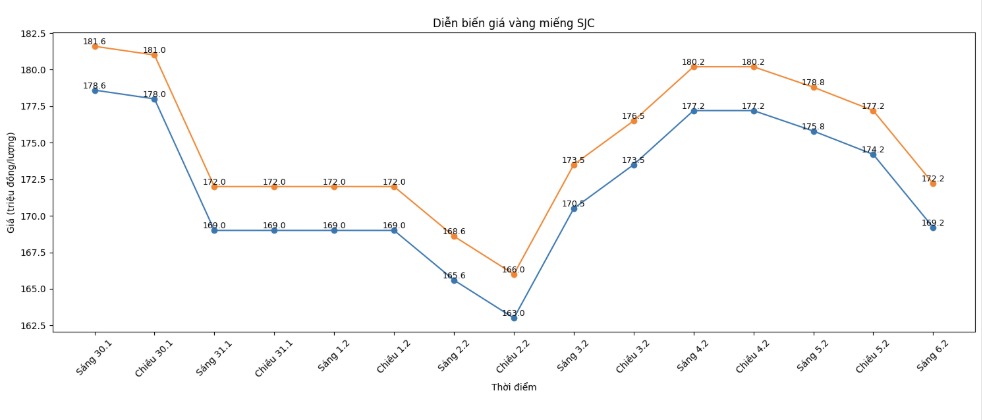

SJC gold bar price

As of 9:15 am, SJC gold bar prices were listed by DOJI Group at the threshold of 169.2-172.2 million VND/tael (buying - selling), a sharp decrease of 6.6 million VND/tael in both buying and selling directions. The difference between buying and selling prices is at the threshold of 3 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 169.2-172.2 million VND/tael (buying - selling), a sharp decrease of 6.6 million VND/tael in both buying and selling directions. The difference between buying and selling prices is at the threshold of 3 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at the threshold of 169.2-172.2 million VND/tael (buying - selling), a sharp decrease of 6.6 million VND/tael in both buying and selling directions. The difference between buying and selling prices is at the threshold of 3 million VND/tael.

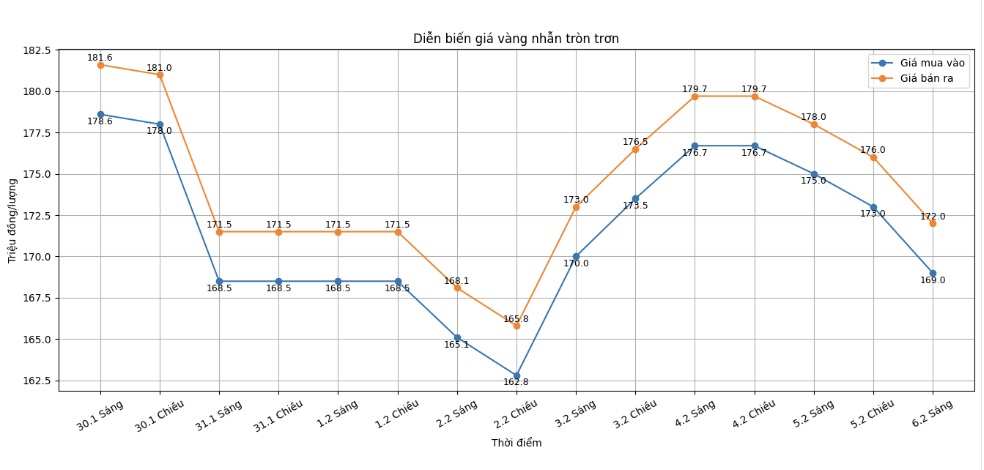

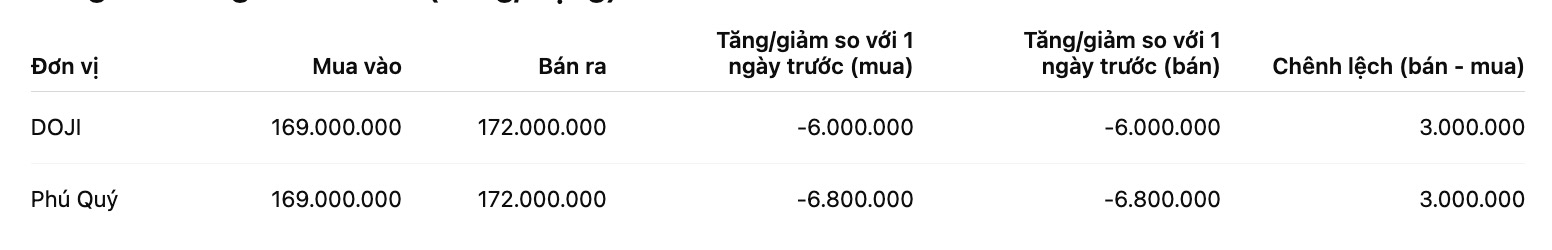

9999 gold ring price

As of 9:15 am, DOJI Group listed the price of gold rings at 169-172 million VND/tael (buying - selling), down 6 million VND/tael in both directions compared to the previous day. The buying - selling difference is at 3 million VND/tael.

Phu Quy Jewelry Group listed the price of gold rings at 169-172 million VND/tael (buying - selling), down 6.8 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Currently, the buying - selling price difference of gold is at a very high level, around 2 to 3 million VND/tael, posing a risk of losses for investors.

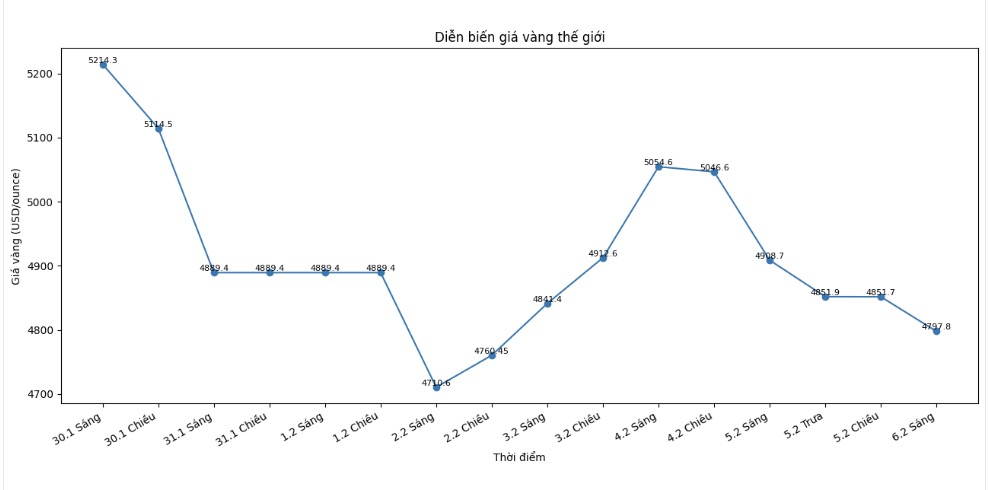

World gold price

At 9:20 am, world gold prices were listed around the threshold of 4, 797.8 USD/ounce, a sharp decrease of 110.9 USD compared to the previous day.

Gold price forecast

World gold prices are experiencing unusually volatile sessions in decades, as this precious metal has just recorded its deepest drop since the early 1980s. However, major financial institutions around the world still maintain an optimistic view of gold price prospects in the medium and long term, especially in the late 2026 period.

According to assessments by many international experts, the recent strong correction was mainly technical and affected by the wave of profit-taking and position clearing in the futures contract market. The sharp drop in silver prices in a short time, along with the recovery of the USD and weakening crude oil prices, has created spillover pressure on the gold market, making investor sentiment more cautious in the short term.

However, the long-term outlook for gold is still positively assessed. In its latest report, JP Morgan said that current fluctuations have not changed the structural upward trend of this precious metal.

This bank forecasts that gold prices may set new peaks by the end of 2026, as global investors continue to seek safe haven assets against geopolitical risks and economic instability.

Even when the market faces strong corrections in the short term, gold still benefits from the trend of asset diversification and the role of real assets in the context of unpredictable financial asset volatility" - JP Morgan commented.

In addition, physical gold demand is forecast to remain at a high level, especially from central banks and institutional investors. This is considered an important factor helping gold prices maintain an upward trend in the medium term, despite short-term shocks from the derivatives market.

Sharing the same view, Deutsche Bank believes that gold prices still have room to increase in 2026, with the possibility of exceeding the 6,000 USD/ounce mark if global economic conditions continue to be complicated. According to this organization, the increase in monetary policy instability and geopolitical risks will strengthen the safe-haven role of gold in the investment portfolio.

From a technical perspective, analysts warn that gold may continue to fluctuate strongly in the short term, with important support and resistance areas to be closely monitored. However, in the long term, the upward trend of gold has not been broken, as the foundational factors supporting this precious metal are still present.

Gold price data is compared to the previous day.

The world gold market operates through two main pricing mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

The second is the futures contract market, where prices are set for futures delivery. Due to year-end closing activities, December gold futures contracts are currently the most actively traded type on the CME.

See more news related to gold prices HERE...