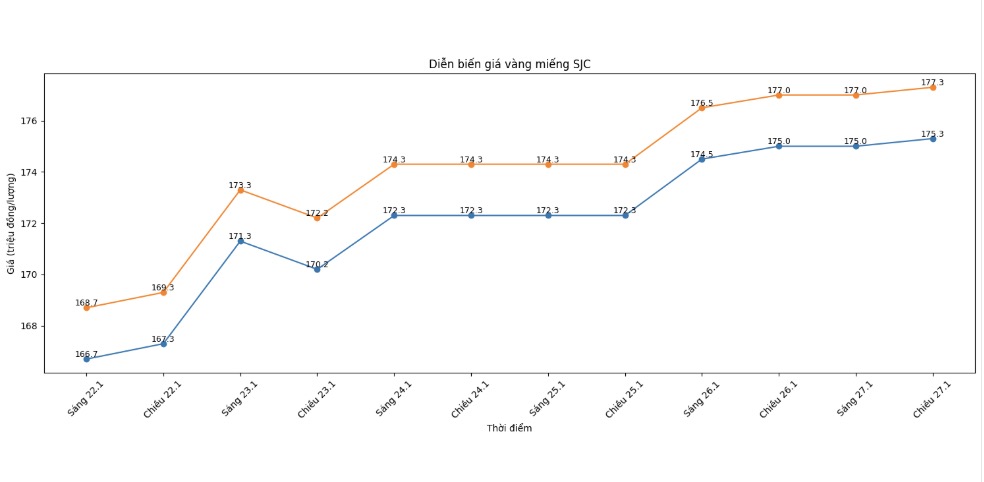

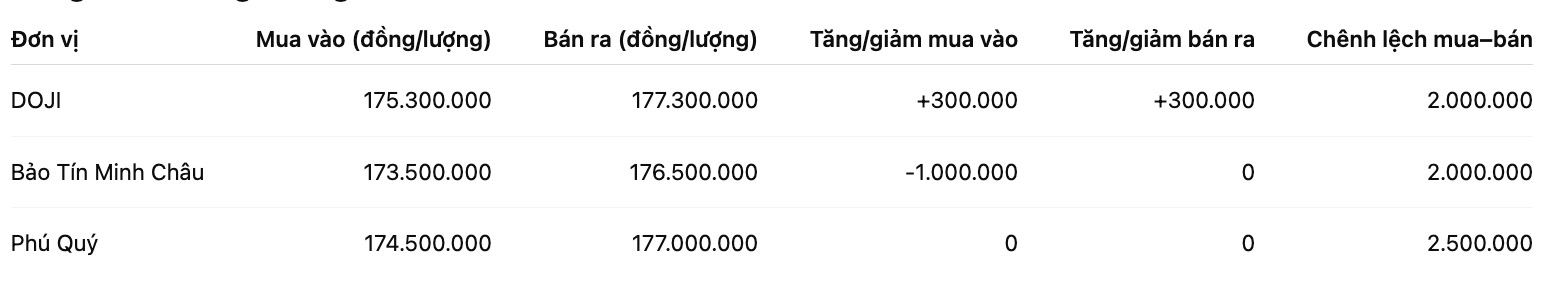

SJC gold bar price

As of 6:00 AM, SJC gold bar prices were listed by DOJI Group at the threshold of 175.3-177.3 million VND/tael (buying - selling), an increase of 300,000 VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price is listed by Bao Tin Minh Chau at the threshold of 173.5-176.5 million VND/tael (buying - selling), down 1 million VND/tael on the buying side and unchanged on the selling side. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed SJC gold bar prices at the threshold of 174.5-177 million VND/tael (buying - selling), going sideways in both directions. The difference between buying and selling prices is at the threshold of 2.5 million VND/tael.

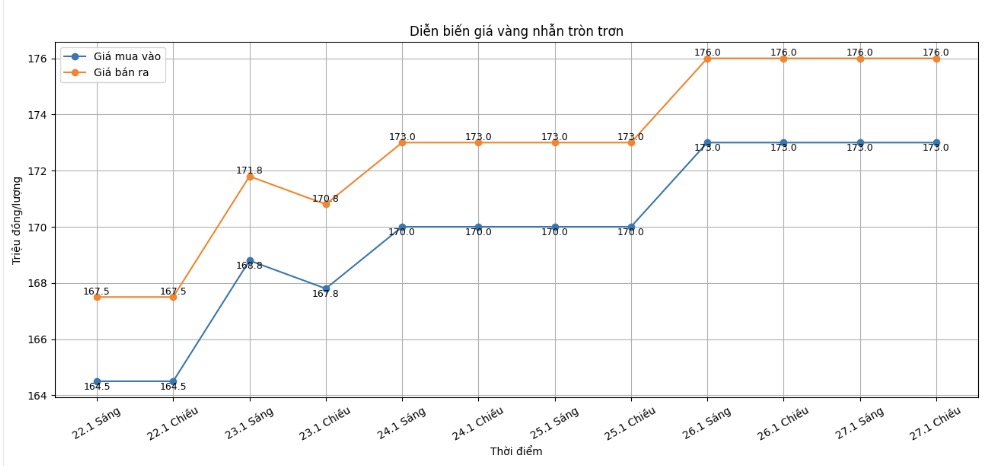

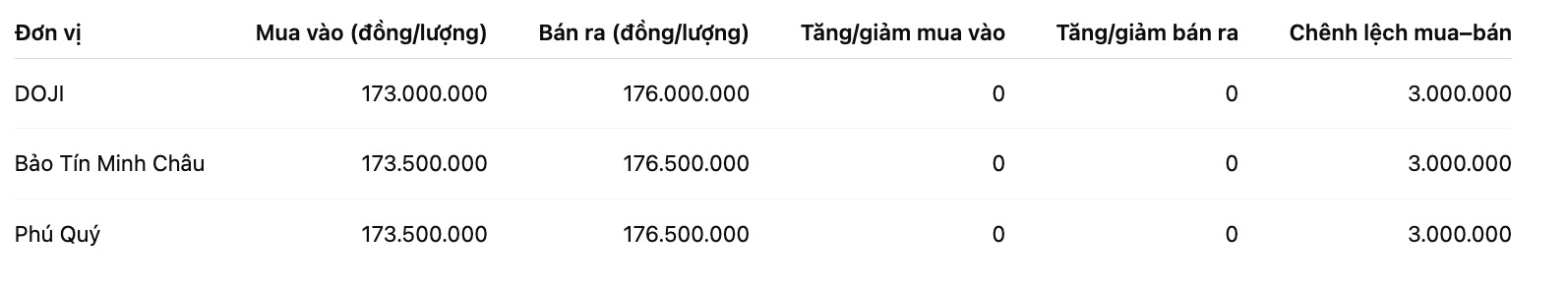

9999 gold ring price

As of 6:00 AM, DOJI Group listed the price of gold rings at the threshold of 173-176 million VND/tael (buying - selling), going sideways in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 173.5-176.5 million VND/tael (buying - selling), going sideways in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at the threshold of 173.5-176.5 million VND/tael (buying - selling), going sideways in both directions. The buying - selling difference is at 3 million VND/tael.

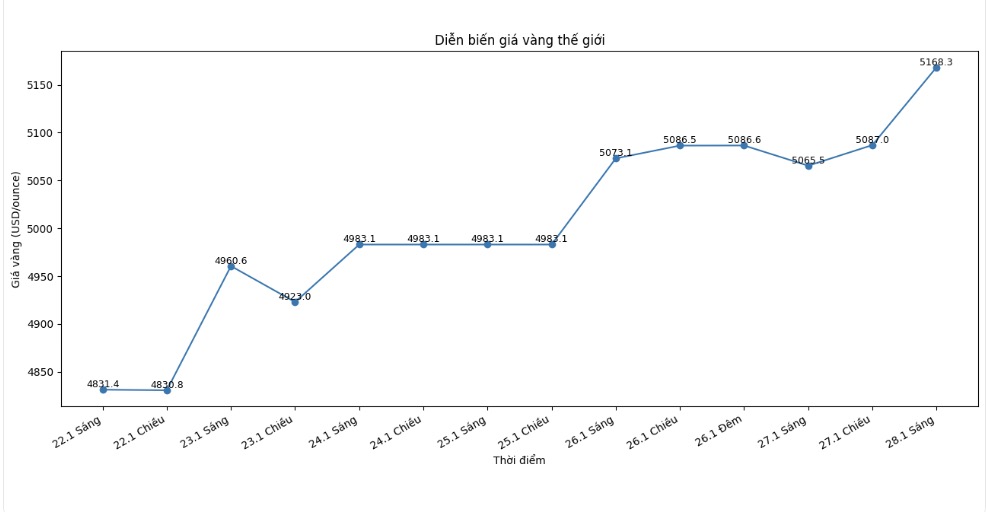

World gold price

At 6:33 am, the world gold price was listed around the threshold of 5,166.3 USD/ounce, up 81.7 USD.

Gold price forecast

The strong developments of gold prices in recent times are reinforcing expectations that this precious metal still has room to increase in the medium and long term, despite short-term corrections that may appear when the price has reached a record high.

According to assessments by many international financial institutions, the most important driving force for gold today no longer comes from the simple interest rate cycle, but lies in the shift in global investment capital flows. Societe Generale Bank (SocGen) recently raised its gold price forecast for 2026 to 6,000 USD/ounce, saying that this is still just a cautious scenario in the context that cash flow into gold investment funds is increasingly having a greater impact on price fluctuations.

Figures show that the amount of capital poured into gold ETF funds has continuously increased sharply from the end of 2025 to now, making the sensitivity of gold prices to cash flow significantly higher than in the previous period. This explains why in just a few months, gold prices have accelerated much faster than previous upward cycles.

From another perspective, the trend of gradually reducing dependence on the USD is also becoming an important catalyst for gold's upward momentum. Mr. Vincent Mortier – Investment Director of Amundi – said that policy instability in the US, prolonged budget deficits, and rising geopolitical tensions are prompting investors to seek high-defense alternative assets. “In the long term, gold remains an effective tool to preserve purchasing power amid rising monetary risks” - Mr. Mortier emphasized.

In addition, geopolitical and trade factors continue to cast a shadow over global economic prospects. The tough moves on tariffs and unpredictable foreign policy from the US are increasing the level of "risk compensation" in gold prices.

According to Mr. Tim Waterer - chief market analyst at KCM Trade - the current chaotic policy environment is unintentionally strengthening the shelter role of gold, helping this precious metal maintain its priority position in the portfolio of investors.

However, experts also note that central banks slowing down buying when prices rise too high may cause gold to fluctuate more strongly in the short term. However, overall, investment capital and defensive sentiment are still the main pillars supporting the upward trend of gold prices in the coming time.

It's a bit of a bit of a bit of a bit of a bit of a bit.

Gold price data is compared to the previous day.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...