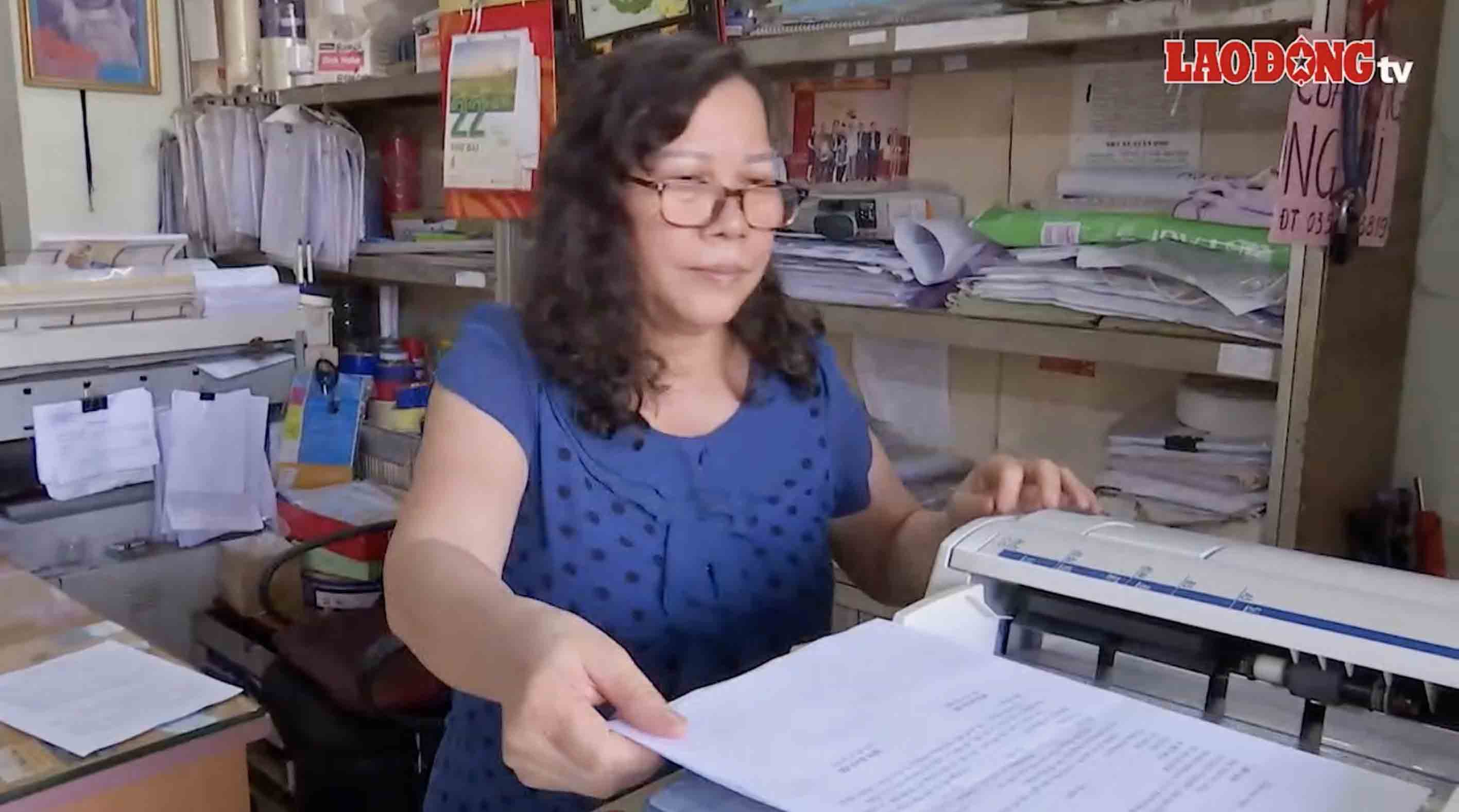

Ms. Nguyen An Thuy (Y La ward, Tuyen Quang province) has had a small stationery store that has been in operation for many years. Mainly selling pens and notebooks to primary school students, Ms. Thuy's total revenue is less than 30 million VND/month, calculated for the whole year at about more than 300 million VND.

"Recently, through the newspaper, I learned that the taxable revenue for business households has been adjusted to VND500 million or more. I find it reasonable, because small stores like mine have very low yearly revenue, doing business so they don't have to work for hire," said Ms. Thuy.

As for Mr. Le Manh Cuong - the owner of a breakfast restaurant in Minh Xuan ward, Tuyen Quang province, every day, Mr. Cuong sells about 100 bowls of pho, with a revenue of about 3.5 million VND, equivalent to 105 million VND/month and more than 1.26 billion VND/year. However, the actual interest rate is not worth much.

"I have to rent a flat surface for 15 million VND/month, 2 domestic workers, each person earns 4 million VND/month, and the input materials are quite expensive. The interest rate is less than 15 million VND per month.

Meanwhile, I still have to raise young children, old mothers, and the cost of living has also increased. If the tax is calculated at the threshold of 500 million VND, most businesses like me will have to pay taxes, it is really difficult. I think, we need to calculate profits to be true to the nature of business, Mr. Cuong suggested.

In the latest document sent to the Prime Minister, Deputy Prime Minister Ho Duc Phoc reported on the reception and explanation of the opinions of the delegates on the draft Law on Personal Income Tax (amended), the Ministry of Finance proposed to increase the taxable revenue threshold for households and individuals doing business to 500 million VND.

According to the Ministry of Finance, applying this revenue level, there will be about 2.3 million business households (out of a total of 2.54 million business households, as of October 2025) that do not have to pay taxes. This is considered a step in line with practical management and helps reduce tax obligations for the majority of small business households.

However, with the majority of business households, especially traditional business households, still feel dissatisfied. Because in the past, traditional small-scale business in the form of having stores and offices has not been effective.

Business has been fiercely competited by e-commerce and changing consumer habits. While the price of premises and input materials has continuously increased, profits have decreased, and tax payment has become a burden.

According to Ms. Nguyen Thi Cuc - Chairwoman of the Vietnam Tax Consulting Association, it is reasonable to adjust the taxable revenue threshold to 1 billion VND and accurately reflect the current income level.

"If the revenue is 1 billion VND per year, the profit will be about 16%, equivalent to 160 million VND, or about 13.3 million VND per month. This level is equivalent to the income of a public employee who is currently applying a family deduction of VND 15.5 million, said Ms. Cuc.

In reality, there are still cases of huge gaps between declared revenue and real revenue. Recently, in Tuyen Quang province, the police have just prosecuted a case of online clothing sales with a revenue of nearly 51 billion VND but only declared nearly 400 million VND. In Hanoi, a case has just been prosecuted for declaring 155 million VND while the real revenue is up to 100 billion VND.

Therefore, many experts believe that the policy-making agency needs to set a sufficient threshold to encourage businesses to declare correctly, instead of deliberately declare low. Thus, there is a basis to build a reasonable and fair tax exemption level.