Nam A Bank has just announced the issuance of a deposit certificate for the 5th period, lasting until February 28, 2026. Nam A Bank aims to raise VND 2,000 billion for a 6-month and 9-month term, with a face value of VND 10 million/certificate.

The issuance interest rate is 6.8%/year for a 6-month term and 6.9%/year for a 9-month term. This is the deposit interest rate at the end of the deposit certificate.

Compared to the interest rate for mobilizing deposit certificates in the 4th round, mobilization period from November 4, 2025 to February 4, 2026, the interest rate for the 5th round has increased by 0.3%/year.

Previously, in October, Nam A Bank announced the issuance of the second VND deposit certificate in 2025 with a total scale of 1,000 billion VND, the issuance period is from October 20, 2025 to January 20, 2026, for customers who buy a minimum of 100 million VND.

The product has terms of 6, 9, 12, 15 and 18 months, with interest paid at the end of the term; in which the 6-month term interest rate is 6%/year (monthly interest rate 5.92%/year); 9-month term 6.3%/year (monthly interest rate 6.17%/year); 12-month term 6.4%/year (monthly interest rate 6.21%/year); 15-month term 6.5%/year (monthly interest rate 6.26%/year); and 18-month term reaches 6.7%/year (month interest rate 6.4%/year).

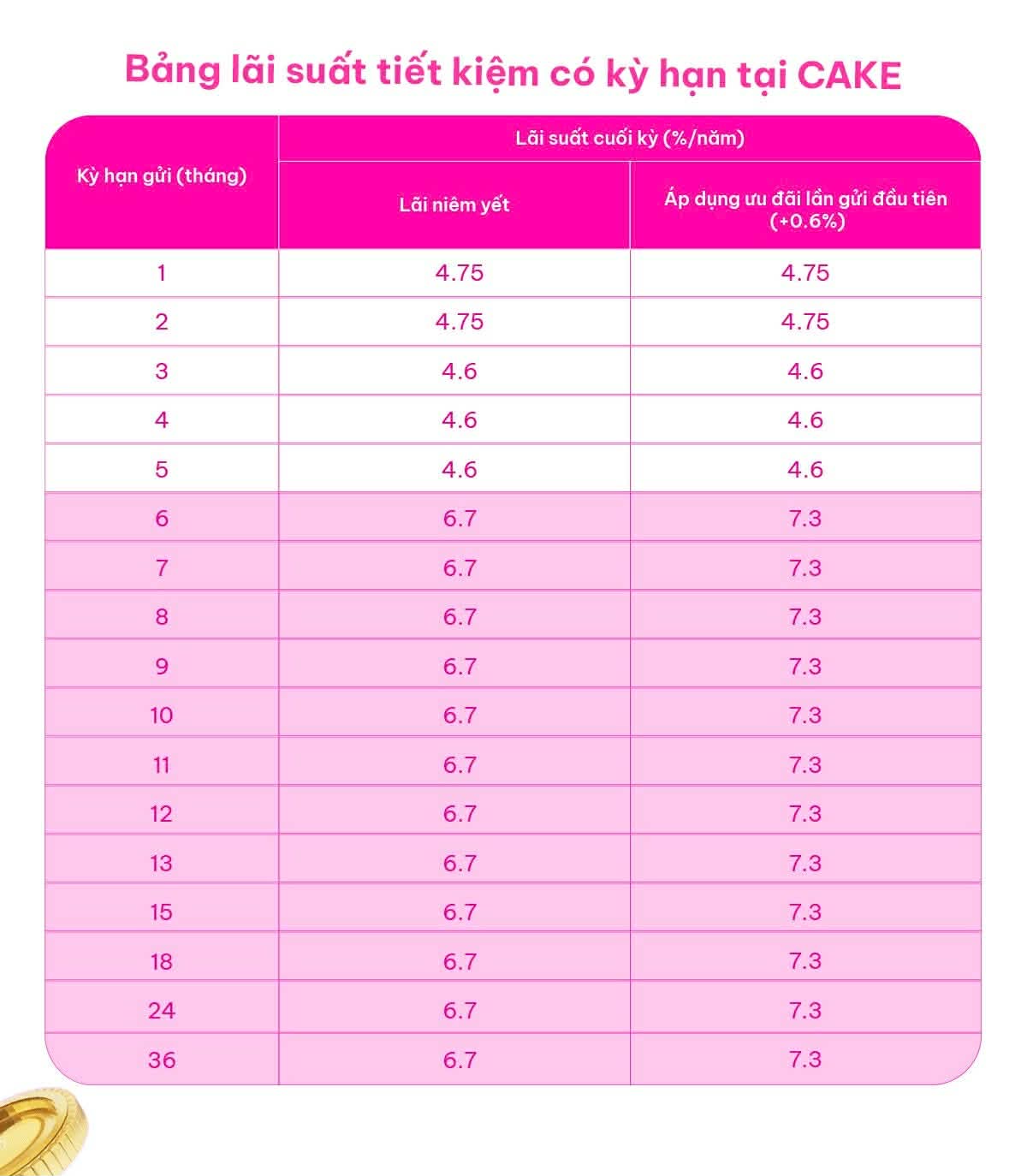

Recently, Cake by VPBank continued to adjust deposit interest rates up sharply. Accordingly, the bank adjusted the interest rates for terms from 6-36 months to increase by 0.2%/year, bringing the interest rates for all terms to 6.7%/year, which is also the highest interest rate on the market today.

Notably, the bank also applies a preferential policy, plus up to 0.6%/year interest rate for customers making first-time deposits. Thus, the highest interest rate that customers can receive at Cake by VPBank is up to 7.3%/year for terms from 6-36 months.

At Viet A Bank, the highest interest rate is up to 6.8%/year for Dac Tai Savings products, 18-month term, counter transactions, interest paid at the end of the term, requiring a minimum deposit of 100 million VND. The bank applies 6%/year for 6-month term; 6.1%/year for 7-month term; 6.5%/year for 12-month term; 6.6%/year for 13-month term; and 6.7%/year for 15-month term.

For MBV, this bank increased deposit interest rates from 0.1% to 0.2%/year, to 5.7%/year; the 1236 month term increased from 0.1% to 0.2%/year, to 6%/year. Along with increasing deposit interest rates, MBV announced an interest rate promotion program with an additional interest rate of up to 0.7%/year for savings deposits. Therefore, the highest deposit interest rate at this bank can be up to 6.7%/year, not just 6%/year as listed.

Bac A Bank after a sharp increase in interest rates for customers depositing under 1 billion VND is listing 6.3%/year for 12-month terms; 6.4%/year for 1315 month terms and 6.5%/year for 1836 month terms. For deposits of VND1 billion or more, the highest interest rate is 6.7%/year applied to a term of 1836 months.

In the group of banks with special interest rates with large conditions, the highest level ranges from 69%/year. PVcomBank applies an interest rate of 9%/year for a term of 1213 months but requires a minimum balance of VND 2,000 billion. HDBank offers 8.1%/year for 13-month terms and 7.7%/year for 12-month terms for customers with a minimum of VND500 billion. Vikki Bank applies an interest rate of 7.5%/year for a term of 13 months with a minimum amount of 999 billion VND.

IVB listed 6.15%/year for a 36-month term with a deposit of VND1,500 billion; ACB applied 6%/year for a 13-month term when customers have a balance of VND200 billion or more.

At LPBank, deposits from VND 300 billion are entitled to an interest rate of 6.5%/year when receiving interest at the end of the term; receive monthly interest of 6.3%/year and receive interest at the beginning of the term of 6.07%/year.