By the end of the third quarter of 2025, SSI is about to complete the annual plan

SSI Securities Joint Stock Company (HOSE: SSI) has just released its separate financial statements for the third quarter of 2025 with total recorded revenue of VND 4,115 billion and pre-tax profit (PIT) of VND 1,782 billion. SSI estimates that the third quarter consolidation revenue will reach VND 4,208 billion and the LNTT will reach VND 1,825 billion. Accumulated in the first 9 months of the year, the Company achieved VND 9,433 billion in revenue and VND 4.070 billion in LNTT, completing 97 and 96% of the plan to submit to the General Meeting of Shareholders in 2025 for approval.

As of September 30, 2025, the total assets of the parent company reached VND 99,678 billion, equity reached VND 30,312 billion, up 37.4% and 16.7% respectively compared to the end of 2024.

With the scale of assets and equity increasing sharply, SSI continues to maintain high operational efficiency, when the accumulated profit rate on equity (ROE) in the last 4 quarters reached 12.7% and the profit rate on total assets (ROA) reached 4.1%.

Stock services continue to lead in revenue

According to the report, the securities services segment continues to contribute a large proportion to total revenue, reaching more than VND 1,950 billion, accounting for 47% of the entire system. In particular, revenue from brokerage, notary, investment consulting and other services reached VND944 billion, up 83% over the previous quarter.

Market liquidity at the Ho Chi Minh City Stock Exchange (HOSE) in the third quarter reached VND39,566 billion, up to 79.6% compared to the second quarter, creating favorable conditions for brokerage activities of securities companies. SSI's stock brokerage, fund certificate and securities market share at HOSE in the third quarter reached 11.82%, up 0.97 percentage points compared to the previous quarter, continuing to maintain its position in the group of two leading companies in the market.

SSI said that to achieve this result, the company has implemented many programs to attract investors.

For individual customers, SSI has implemented the program " Opening a "Real fortune" account for investors to open new and create stock transactions or borrow deposits, contributing to attracting a large number of new customers in the context of a vibrant market.

For institutional customers, the company proactively improves the quality of technology infrastructure and transaction systems, regularly updating information and investment ideas to domestic and foreign organizations. Improving connectivity and supporting professional investors has helped SSI expand its market share in the institutional customer segment.

margin investment and lending activities increase sharply

Deposit lending and advance payment activities continued to grow strongly, with revenue of nearly VND 1,006 billion, up 21% over the previous quarter. Outstanding loans to margin and deposits reached more than VND39,231 billion, up to 50.6%. SSI also expands promotional programs to support customers, such as raising the loan limit from 5 billion to 10 billion VND for the T7 program, applying a preferential margin interest rate of only 9% for first-time customers.

Flexible policies help investors take advantage of financial leverage more effectively, in line with strong market developments in the third quarter.

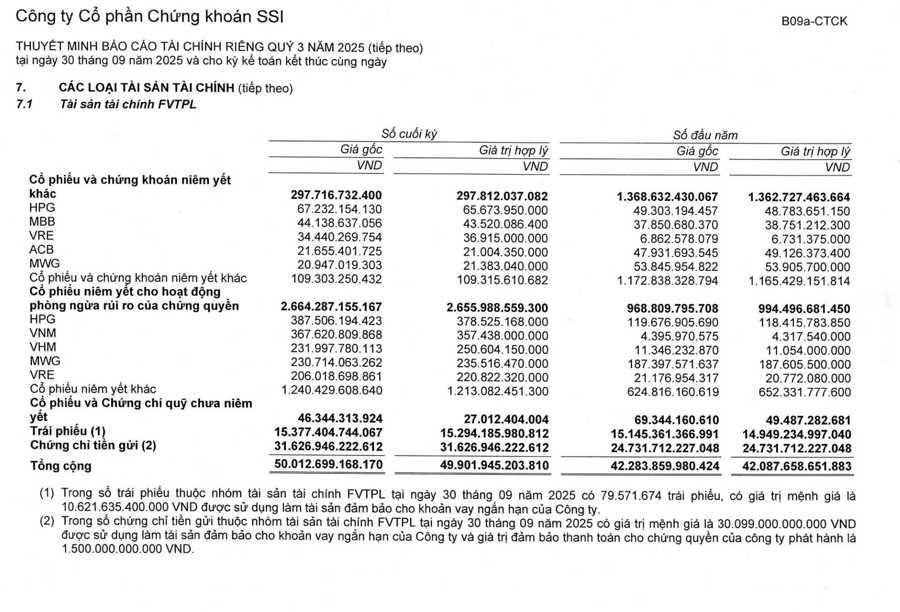

SSI's investment activities also recorded positive results with revenue of VND2,025 billion, up 42% over the previous quarter and contributing 49.2% of total operating revenue. The investment portfolio is expanded in both scale and quality, focusing on assets with fixed incomes issued by credit institutions, contributing to stabilizing revenue and balancing risks.

The financial capital and business segment recorded revenue of VND 135 billion, down slightly compared to the second quarter. This is a traditional business segment, affected by the scale of total assets, relationships with financial institutions and interest rate fluctuations in the market.

In the Investment Banking Services and other activities segment, SSI recorded revenue of VND 6 billion. In the third quarter, the company participated in consulting and distributing for a number of large capital mobilization transactions in the market. SSI leaders said that with a favorable market context and more vibrant investment flows in the last months of the year, the company expects to continue to record more successful deals, consolidating its position as one of the leading securities institutions in Vietnam.