Business results for the third and fourth quarters of the third quarter

According to the Consolidated Financial Statements (BCTC) for the third quarter of 2025 that No Va Real Estate Investment Group Joint Stock Company (Novaland, stock code: NVL) has just announced, after-tax profit after corporate income tax (CIT) recorded a negative profit of VND 1,153.2 billion. This figure is in complete contrast to the profit of VND2,950 billion in the third quarter of 2024.

In the explanatory document, Novaland said that the profit after corporate income tax in the third quarter of 2025 decreased by VND 4,104 billion compared to the same period. Financial revenue in the quarter decreased by VND 3,442 billion and the exchange rate loss increased by VND 712 billion compared to the same period last year.

Accumulated in the first 9 months of 2025, Novaland recorded a loss after corporate income tax of VND 1,819 billion. Although the results of the third quarter were negative, the 9-month picture showed improvement, when in the same period in 2024, the company lost VND 4,377 billion.

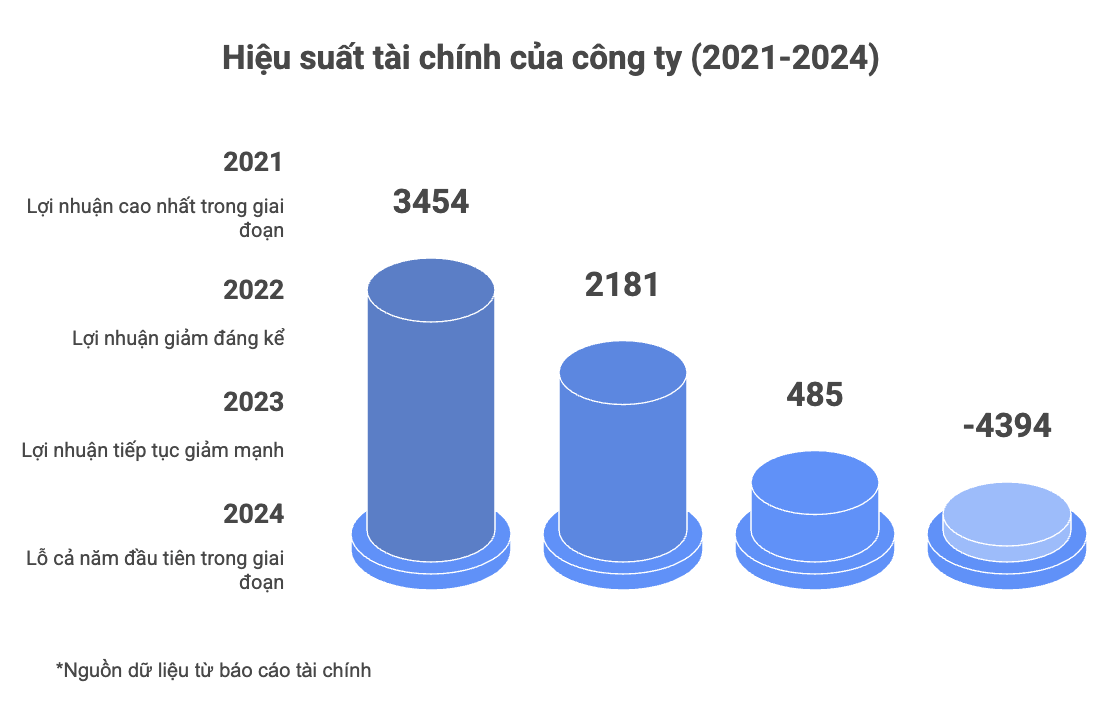

Financial data shows that 2024 is a difficult year for businesses when they recorded a total loss of VND 4,394 billion for the whole year. This is the first time the company has reported a loss for the whole year in the period of 2021-2024, after profits continuously decreased from VND 3,454 billion (2021) to VND 2,181 billion (2022) and VND 485 billion (2023).

Revenue and asset fluctuations

NVL's net revenue in the first 9 months of 2025 reached approximately VND 5,398 billion. This figure comes after a period of strong fluctuations. Historical data shows that Novaland's net revenue peaked at VND14,902 billion in 2021, before falling to VND11,134 billion (in 2022) and falling to VND4,756 billion (in 2023). Revenue in 2024 has recovered, reaching VND 9,073 billion.

Regarding the scale of assets, as of September 30, 2025, Novaland's total assets reached VND 239,574 billion, a slight increase compared to the approximately VND 237,778 billion at the beginning of 2024. This figure has decreased slightly compared to the peak of VND257,734 billion at the end of 2022.

The item with the largest proportion of total assets is inventory, at VND 152,285 billion (as of September 30, 2025), a slight increase compared to VND 146,607 billion at the beginning of the year.

Pressure from short-term debt

In the accounting balance sheet, NVL's payables as of September 30, 2025 are about VND 188,761 billion, down slightly compared to the beginning of the year and down from the peak of VND 212,917 billion at the end of 2022.

However, the pressure of short-term debt is obvious. Data over the years shows that short-term debt has increased continuously, from VND 49,214 billion (end of 2021) to VND 78,174 billion (2022), VND 87,282 billion (2023) and reaching VND 107,222 billion by the end of 2024.

By the end of the third quarter of 2025, short-term debt continued to increase to VND 114,084 billion. However, the loan structure is shifting. Short-term loans decreased from VND 36,978 billion (at the beginning of the year) to VND 31,934 billion. In contrast, long-term loans increased from VND24,587 billion to VND32,349 billion, showing signs of debt restructuring activities in 2025.