Reducing tax rates to some levels, but keeping the highest rate at 35%

The Ministry of Finance has just reported the content of receiving and explaining the opinions of National Assembly deputies and the review of the Economic and Financial Committee on the draft Law on Personal Income Tax (amended).

Many opinions say that the progressive tax rate is somewhat unreasonable when the gap between levels is large. Levels 1, 2 and 3 are up to 10% apart, causing taxpayers at these two levels to be under higher pressure than the current one, while this group accounts for a large proportion. In contrast, the difference between grades 4 and 5 is only 5%. Some opinions suggested narrowing the tax rate, stopping at only 25% or 30%; some opinions suggested the highest rate of 45% such as China, Korea, Japan, France, Australia.

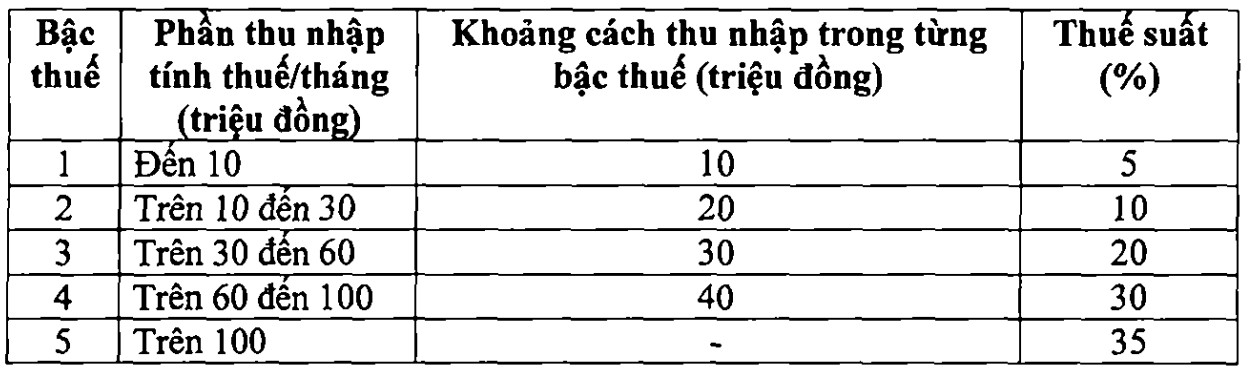

In response to comments, the Government has revised the tax table in the draft in the direction of reducing the tax rate by 15% and 25% to 10% and 20%, creating more uniformity between levels. With this plan, all taxpayers have their obligations reduced compared to the current one; at the same time, overcoming the situation of sharp increases at some levels.

Regarding the highest tax rate of 35% for income from wages and wages, the Ministry of Finance believes that this rate is reasonable, equivalent to the general level of many ASEAN countries (Thailand, Indonesia, Philippines with 35%; China - 45%). The Ministry said that lowering the rate to 35% to 30% could be considered a tax reduction policy for the rich.

Workers reduce motivation to strive

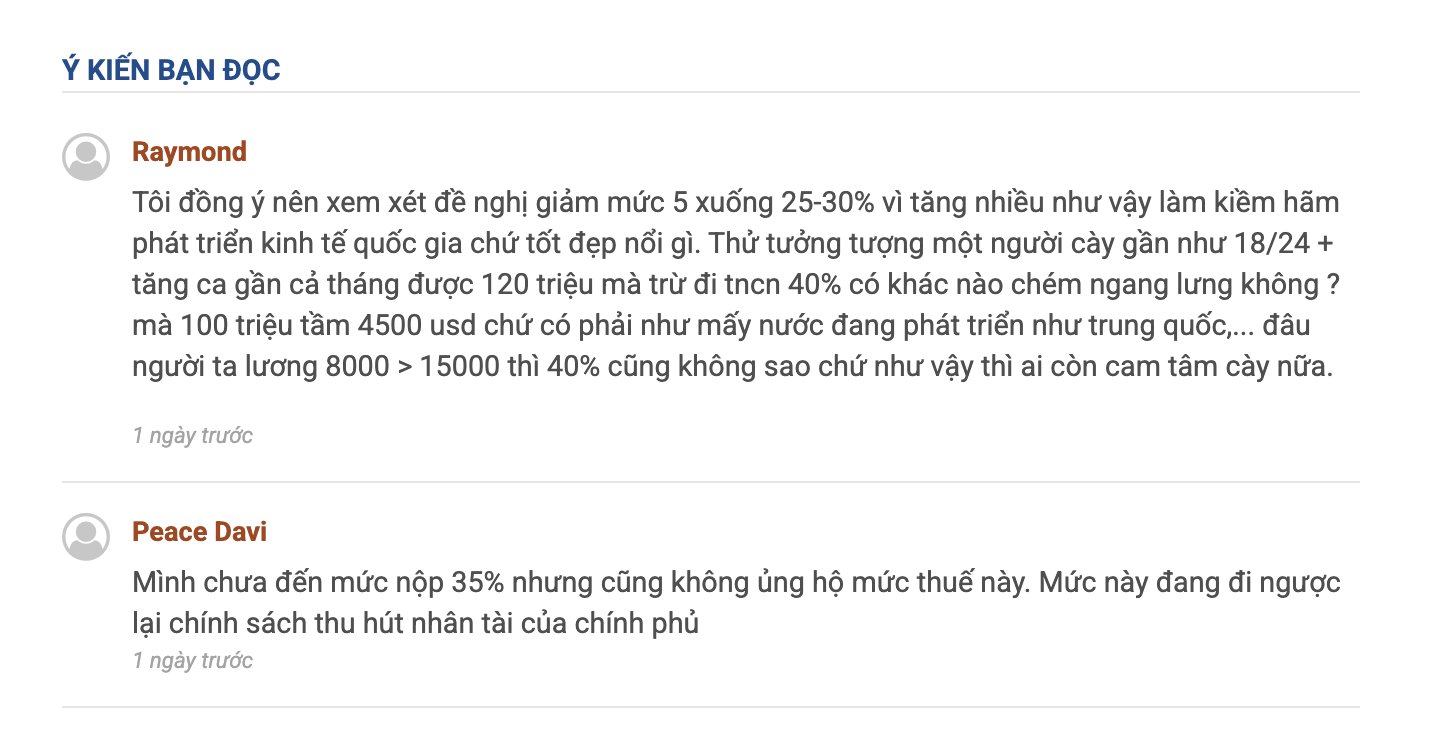

However, keeping the highest tax rate of 35% in the Tax Plan still causes much controversy. In the article: "Income over 100 million VND with tax payment of 35%, the Ministry of Finance gives reasons for not being able to reduce taxes" published on December 2, 2025 in Lao Dong Newspaper, many readers shared their opinions that the current tax rate is not really suitable and needs to be reconsidered.

A reader with the account " Raymond" said that the highest tax rate should be considered for reduction to about 2530%, because the new proposed tax rate is creating great pressure for well-off income workers.

Reader Peace Davi also expressed his disfavor with keeping the tax rate at 35%, saying that this tax rate is not suitable and goes against the Governments policy of attracting talent.

Sharing with Lao Dong, Mr. Nguyen Xuan Hung (39 years old, Cau Giay, Hanoi) said that the highest tax rate of 35% makes many workers working for hire feel pressured and reduce their motivation to strive. He works in the information technology sector, earning 90110 million VND per month thanks to continuous overtime. However, the additional income is easily "jumped" by taxes, causing the actual amount of money received to not be commensurate with the effort spent.

"Working a lot will increase your income, but the tax payment will also increase. In the end, the gap between overtime and no overtime is not too big. This can easily make workers hesitate, especially in industries that require gray matter and very high work intensity, he shared.

Proposed maximum tax rate at 25%

Assessing the tax table according to the new proposal of the Ministry of Finance, many experts believe that maintaining the maximum tax rate of 35% applied to an income of over 100 million VND/month can make workers lack the motivation to increase their income.

Associate Professor, Dr. Phan Huu Nghi - Deputy Director of the Institute of Banking and Finance (National Economics University) said that reducing the tax rate to 5 levels is reasonable but still keeping the highest rate of 35% is not appropriate and can reduce labor motivation.

He proposed to pay the tax as follows: level 1: 010 million VND/month - 5%; level 2: 1030 million VND/month - 10%; level 3: 3070 million VND/month - 15%; level 4: 70150 million VND/month - 20%; level 5: Over 150 million VND/month - 25%.

According to Mr. Nghi's analysis, average income is increasing rapidly, causing many people to fall into a higher tax rate even though real income does not accurately reflect their standard of living. "Income increases by 30%, but if the range is not extended and the tax rate is adjusted accordingly, workers will suffer the loss. In the long term, this affects the mentality of dedication and transparency in tax declaration, he warned.

Sharing the same view, Mr. Le Van Tuan - Director of Keytas Tax Accounting Company Limited assessed that the 35% tax rate is too high compared to the average income in Vietnam at only the current level, while the threshold of 100 million VND is too low.

"The 80 million VND threshold has been applied since 2009 for 16 years. While 80 million VND in 2009 is much larger than 100 million VND today if calculated according to inflation, Mr. Tuan raised the issue.

Therefore, Mr. Tuan suggested that the highest tax rate should be applied at 25%. In case the Ministry of Finance still wants to keep the rate at 35%, it should apply to the income group from about 200 million VND/month to better suit the current income reality.