Gold prices today (4.8) have recovered after hitting a nearly 4-week low in the trading session on April 7. Spot gold prices rose 0.5% to $2,996.6 an ounce as of 3:40 a.m. on April 8, GMT.

Previously, world gold prices on April 7 fell to their lowest level since March 13 due to concerns about an increase in the global trade war between the US and major trading partners.

US President Donald Trump increased his threat to impose tariffs on China on April 7 while the European Union drafted a plan to impose tariffs in retaliation against the US, raising concerns about a prolonged trade war that could plunge the global economy into recession.

"The escalation of trade wars could trigger a global recession, which could boost demand for safe havens. Despite declines in previous sessions, gold remains strong and will continue to increase in price trends," said Jigar Trivedi, senior analyst at Reliance Securities.

President Donald Trump said he would not consider suspending tariffs to facilitate negotiations with trade partners, but noted that he would participate in discussions on tariffs with China, Japan and other relevant countries.

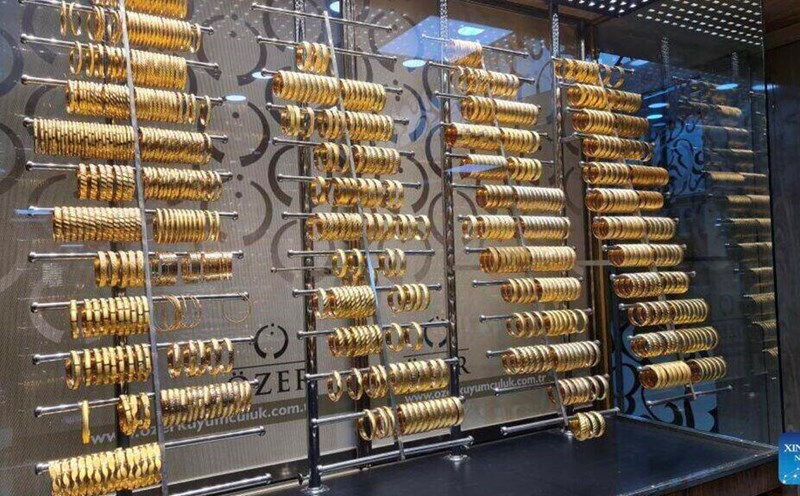

Gold is often considered a safe investment channel during times of political and financial instability. Gold prices hit an all-time high of $3,167.57/ounce on April 3.

Reuters pointed out that the market will closely monitor the minutes of the latest policy meeting of the US Federal Reserve (Fed) scheduled to be released on April 9, local time.

Traders are also waiting for data from the US Consumer Price Index due on April 10 and the Producer Price Index on April 11 to signal US interest rates amid escalating global trade war and concerns about economic recession.

Current contract data shows that the Fed will cut interest rates by about 93 basis points from now until December 2025.