Domestic coffee prices

On October 23, coffee prices in key Central Highlands regions increased sharply by VND 2,800/kg, bringing the average price in the whole region to VND 118,300/kg.

The increase occurred throughout the region, approaching the threshold of 119,000 VND/kg:

Dak Lak increased the most VND 2,900/kg to VND 118,500/kg.

Dak Nong (old) increased by VND 2,800/kg to VND 118,500/kg.

Gia Lai increased VND 2,800/kg to VND 118,000/kg.

Lam Dong increased by VND 2,100/kg to VND 117,000/kg.

This strong rally has completely erased concerns about abundant supply, showing that the market is absolutely focused on risks.

World coffee prices

The international coffee market witnessed an extremely strong price increase.

Robusta ( London): Exploding, up to $119/ton (over 2.5%), closing at $4,739/ton. This price has surpassed the threshold of 4,700 USD/ton, continuing the historic increase.

Arabica (New York): Continued to climb sharply, increasing by 7.30 US cents/lb (nearly 1.8%), closing at 420.85 US cents/lb.

The synchronization in the increase, especially Robusta, has increased beyond the important mark, which is the main driving force for domestic prices.

Assessment and forecast

Today's skyrocketing price increase is the result of strong control from policy factors and long-term supply risks, overwhelming other downward pressures.

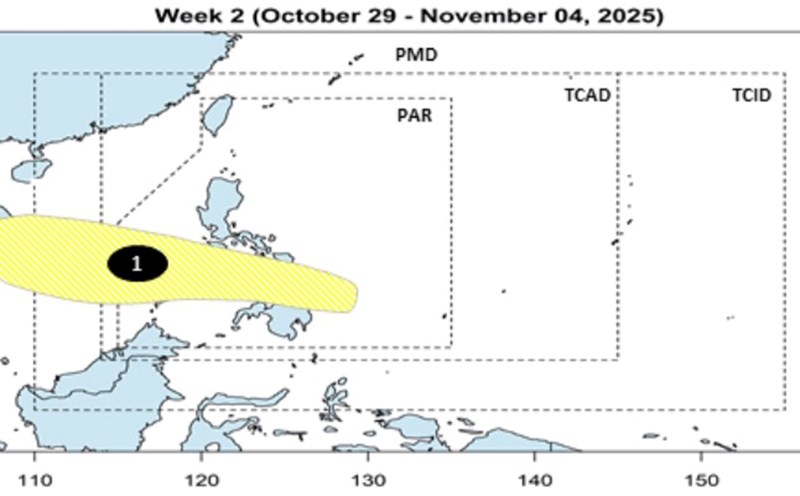

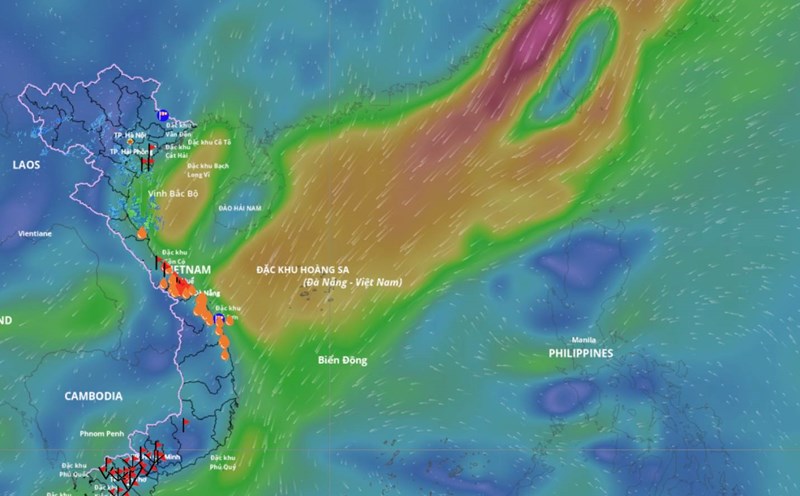

The latest price increase comes from tropical storm Fengshen. The Vietnam Meteorological Agency warns that heavy rains from storms can cause flash floods and landslides, damage coffee in the Central Highlands, and promote purchases for prevention.

In addition, trade policy risks remain the focus, with concerns about new tariffs on Colombia still in place. Most importantly, the inventory crisis is still serious. Arabica inventories on the ICE have fallen to a 19-month low, and Robusta inventories have hit a 3-month low. This situation is further aggravated by the 50% tax still in place on Brazil. Long-term forecasts from NOAA (La Niña) and Volcafe ( Arabica deficit of 8.5 million bags) continue to support prices.

The downward pressure still exists but is overwhelmed. That is, the drought has eased in Brazil with more than half of the rainfall received. In addition, the supply of Vietnam's Robusta is still forecast to grow strongly by 6.9% in the 2025/26 crop year, also putting pressure on the market.

The short-term trend forecast is skyrocketing. With today's boom, the market has regained confidence and is trying to establish a new price level. Domestic prices are likely to continue to test the historical peak of VND122,000/kg in the near future, dominated by natural disaster risks and trade policies.