Domestic pepper prices: Deep decrease

As of 11:30 today (December 1), domestic pepper prices reversed and decreased, trading between 148,500 - 150,000 VND/kg, an average decrease of 1,200 VND/kg compared to last week depending on the region.

Key regions simultaneously fell 1,000 VND/kg after a series of high prices. The price list on the market in key areas is as follows:

Dak Lak and Lam Dong have put the market at around 150,000 VND/kg.

Gia Lai recorded the deepest decrease of VND 2,000/kg, listed at VND 148,500/kg.

Dong Nai and Ho Chi Minh City set the mark of 149,000 VND/kg, down 1,000 VND/kg.

World pepper prices: Maintain the increase

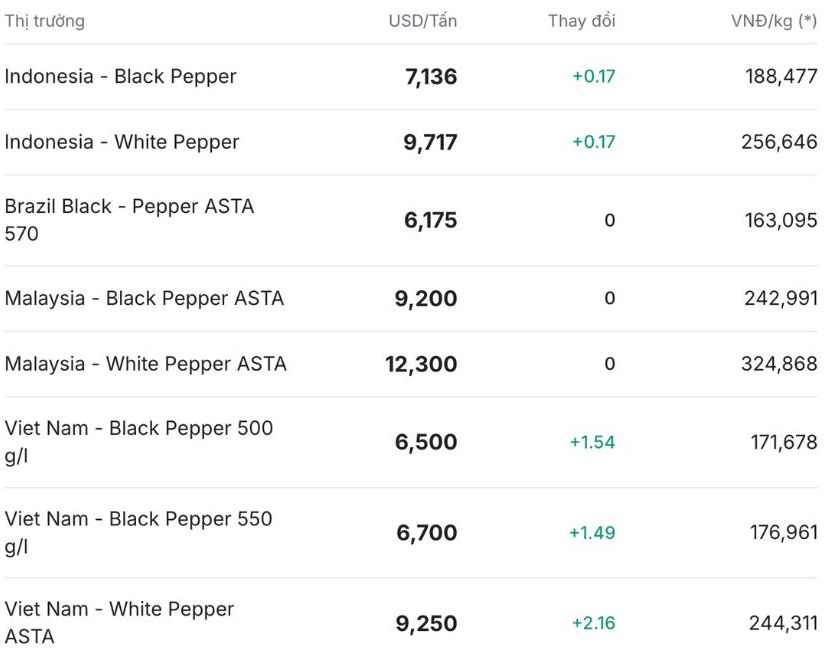

In the world market, pepper prices continue to fluctuate after a series of unchanged days in different regions. The Indonesian exchange - one of the busiest markets continues to increase prices. Currently, these two items are traded between 7,136 - 9,717 USD/ton (equivalent to 188,477 VND/kg - 256,646 VND/kg).

On the other hand, the Brazilian market has maintained a stable streak, currently holding at 6,175 USD/ton (about 163,095 VND/kg). Meanwhile, black and white pepper remained unchanged, trading at 12,300 USD/ton and 9,200 USD/ton.

Notably, in the Vietnamese pepper export market, the price of 500 g/l and 550 g/l black pepper increased by 1.54%-1.49%, anchored at 6,500 - 6,700 USD/ton. ASTA white pepper prices increased by 2.16% in the same direction, currently standing at 9,250 USD/ton (equivalent to 244,311 VND/kg).

Assessment and forecast

According to the latest report from Nedspice, global pepper output has decreased by more than 30% over the past 7 years, down to 430,000 tons. While Brazil's growing area continues to expand, other major producing countries such as Vietnam, India and Indonesia have reported lower output, reflecting tight supply in key producing countries.

Global demand this year has been slow, with the strongest decrease of about 30% coming from the US, the world's largest pepper importer. Vietnam's total exports decreased by 6% in the first 10 months of the year. Nedspice believes that countervailing tariff exemptions could help US demand recover.