In particular, regarding how to calculate policy benefits, Article 7 of the Circular provides instructions on how to calculate policy benefits for cases of work at agencies and units that are not directly affected by the reorganization of the apparatus but must streamline the payroll, restructure, and improve the quality of the team.

1. The subsidy regime for the number of years of early retirement and the subsidy regime according to the working period with compulsory social insurance (SI) contributions:

In case of those who are 2 years to 5 years old and have reached the age limit according to the instructions in Point a, b, Clause 5, Article 5 of this Circular, the instructions in Point b, c, Clause 1, Article 6 of this Circular shall apply:

Allowance for the number of years of early retirement:

Subsidy level for the number of years of early retirement = Current monthly salary x 5 x number of years of early retirement.

Allowances according to the working period with compulsory social insurance contributions:

- Receive pension according to the percentage corresponding to the working period with social insurance contributions according to the provisions of the law on social insurance and will not have the pension percentage deducted due to early retirement compared to the prescribed age.

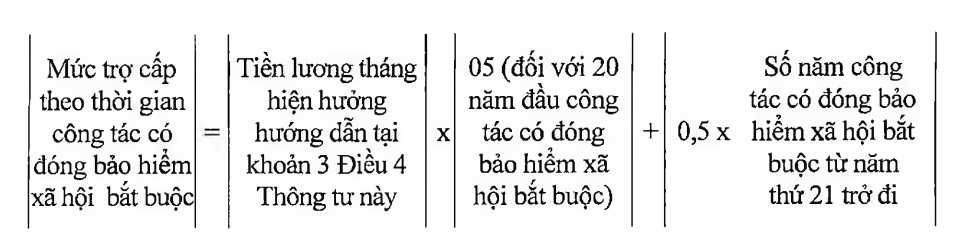

- Receive a subsidy of 5 months of current salary for the first 20 years of work with compulsory social insurance contributions. From the 21st year onwards, for each year of work with compulsory social insurance contributions, a subsidy of 0.5 months of current salary will be granted.

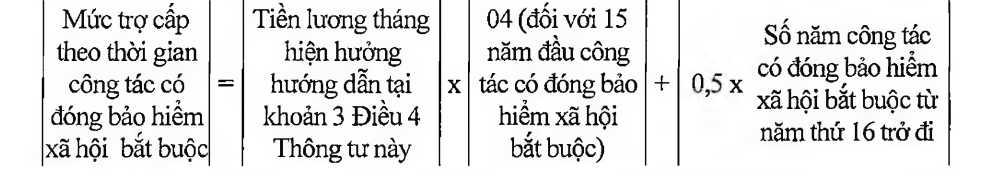

- In case of full 15 years or more, pay compulsory social insurance and subject to pensions in accordance with the law on social insurance at the time of retirement before the age, the 4 -month salary is entitled to the first 15 years of work; From the 16th year onwards, every year the work has compulsory social insurance premium is allowed to provide 0.5 months of salary.

2. One-time pension benefits for the number of months of early retirement are implemented according to Clause 2, Article 7 as follows:

- Retire and receive a monthly pension for the period from March 15, 2025 to March 14, 2026 (receiving policies and regimes for the first 12 months):

One-time pension allowance = Current monthly salary x 1.0 x number of months of early retirement.

- Retire and receive a monthly pension from March 15, 2026 onwards (receiving policies and regimes from the 13th month onwards):

One-time pension allowance = Current monthly salary x 0.5 x number of months of early retirement.

Circular No. 19 of the Ministry of National Defense gives a specific example, comrade Tran Van Long (born in May 1971, enlisted in February 1990), Colonel, position of Assistant worked at Department A, General Staff Agency.

According to current regulations, by the end of May 2029, comrade Long will be 58 years old, the highest age limit according to the rank of Colonel.

Assuming that Comrade Long's agency is not subject to merger or dissolution, but must streamline the payroll, restructure, and improve the quality of the team; In May 2025, the competent authority decided to retire early, with a retirement period of 12 months, from June 1, 2025 to May 31, 2026, receiving a monthly pension from June 1, 2026.

In case, comrade Long who has retired before the above time will enjoy the policies and regimes of the retiree from the 13th month onwards (from March 15, 2025).

Comrade Long wishes to retire before retirement without waiting for retirement and retire with a monthly pension from January 1, 2026, and be resolved by competent authorities to retire early;

Accordingly, Comrade Long is eligible for the policies and regimes of the retiree for the first 12 months from March 15, 2025 (the number of months of early retirement is 41 months; the number of years of early retirement is 3 years and 5 months; the working period with compulsory social insurance payment is 35 years and 11 months, completed 36 years according to the instructions in Clause 4, Article 5 of this Circular).