Accordingly, Article 6 of Circular No. 19/2025/TT-BQP of the Ministry of Defense guides the implementation of policies and regimes for subjects under the management of the Ministry of Defense, stating how to calculate policies in case of working at agencies and units subject to the direct impact of the organizational structure.

These cases include the subjects specified in Clauses 1, 2, 3, 4 and Clause 5, Article 2 of this Circular eligible for retirement before the age due to organizational structure entitled to policies and regimes prescribed in Article 7 of Decree No. 178/2024/ND-CP, amended and supplemented with a number of points in Clause 6, Article 1 of Decree No. 67/2025/ND-CP; Including the 1 -time retirement benefit regime for the number of months of early break, the allowance for the number of years of early break and allowance over time with the compulsory payment of social insurance (social insurance).

The regime with the case of age is from full 2 years to 5 years to the age as instructed at Point a, Point b, Clause 5, Article 5 of this Circular is guided in accordance with Clause 1, Article 6 as follows:

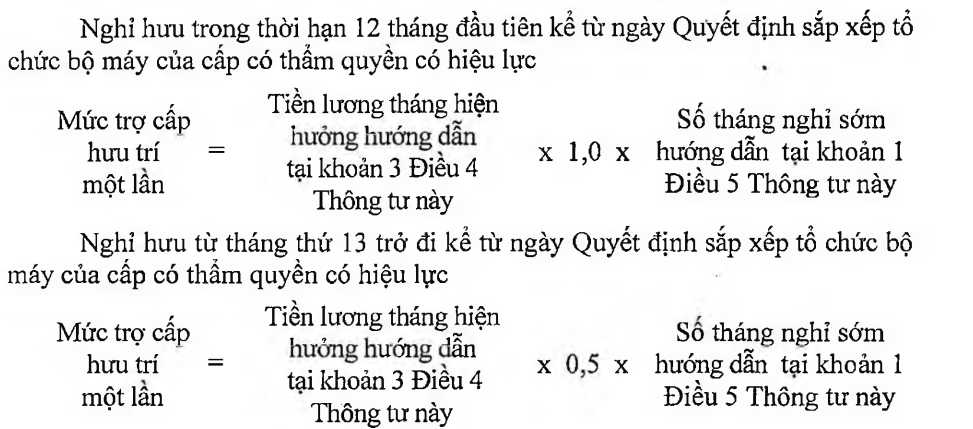

Retirement allowance 1 time for early vacation:

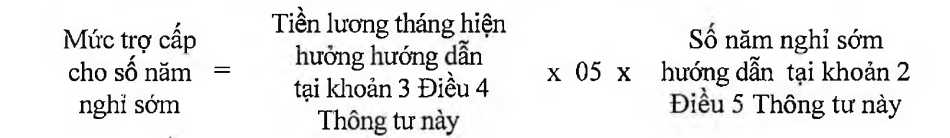

The allowance for the number of years of vacation early is as follows:

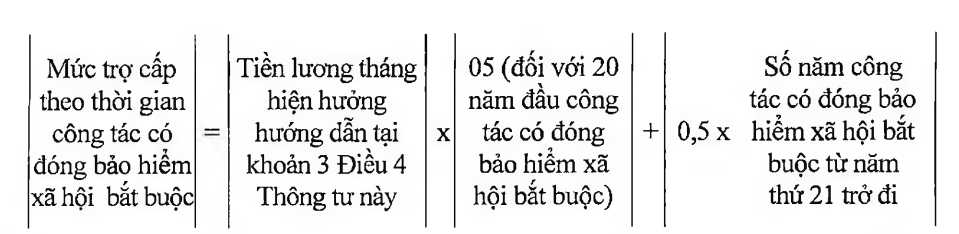

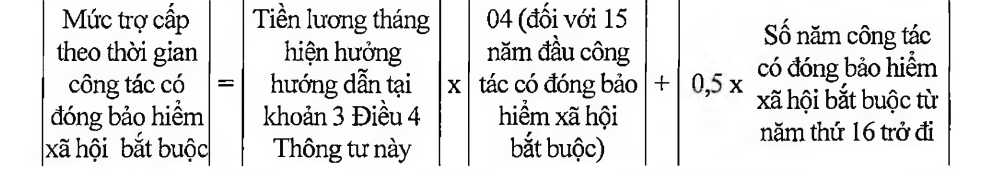

Periods by time working with compulsory social insurance to implement as follows:

- Be entitled to pension at the percentage corresponding to the working time of paying social insurance in accordance with the law on social insurance and not deducted percentage of pension percentage due to the retirement before the prescribed age.

- Being allowed for 5 months of salary currently entitled to the first 20 years of work with compulsory social insurance. From the 21st year onwards, every year the work has compulsory social insurance premium is allowed to provide 0.5 months of salary.

- In case of full 15 years or more, pay compulsory social insurance and subject to pensions in accordance with the law on social insurance at the time of retirement before the age of age, the allowance will be allowed to be allowed to receive 04 months for the first 15 years of work; From the 16th year onwards, every year the work has compulsory social insurance premium is allowed to provide 0.5 months of salary.

Circular 19 of the Ministry of Defense specifies: Mr. Tran Van Long (born in May 5.1971, enlisted in February 1990), the rank of Colonel, the position of assistant work at Department A, the General Staff Agency.

According to current regulations, by the end of May 5.2029 Comrade Long was 58 years old, the highest age expired according to the rank of colonel. In March 2025, Mr. Long's unit merged with other units; Comrade Long was decided to retire before his age (without retirement), enjoying pensions from 1.6.2025 (full 54 years old).

Comrade Long is in the case of retirement within the first 12 months from the date of the merger decision of the competent authority; The retirement period before the age is 4 years (48 months) and 35 years 4 months of working with compulsory social insurance (rounded 35.5 years under the guidance in Clause 4, Article 5 of this Circular).

Suppose the salary is currently enjoyed before the retirement time (May 5, 2025) of Mr. Long's 30 million VND:

Retirement allowance 1 time for early leave is: 30,000,000 VND x 1.0 months x 48 months of retirement before age = 1,440,000,000 VND;

The one -time subsidy for the number of early breaks is: 30,000,000 VND x 5 months x 4 years of retirement before age = 600,000,000 VND.

The one -time allowance for the number of years of work with compulsory social insurance is: 30,000,000 VND x {5 months + (0.5 x 15.5 years)} = 382,500,000 VND.

In this case, the Ministry of Defense said that the total amount of comrade Long's benefit was 2,422,500,000 VND.