With the desire to increase safe and profitable investment opportunities for customers, and at the same time to improve financial capacity, increase medium and long-term capital sources to supply capital to the economy, Saigon - Hanoi Bank (SHB) will issue 5,000 billion VND, of which the first offering is 2,500 billion VND.

Bank bonds are still the main group leading the market.

In the recently released bond market report, analysts from MBS Research assessed that corporate bond issuance activities will be more active in the fourth quarter of 2024, when businesses' capital needs recover and the need to expand production and business actively follows the economic recovery.

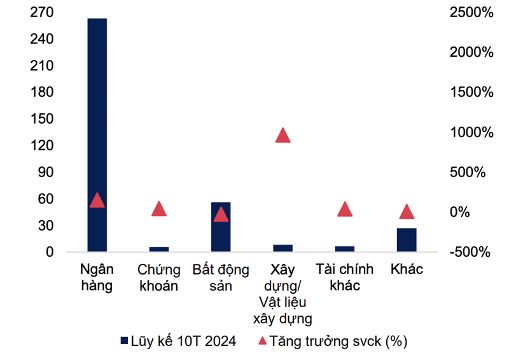

Accumulated from the beginning of the year to October 2024, banking is the industry group with the highest issuance value with about 263,000 billion VND, accounting for 72%. Compared to the same period last year, the bond issuance value of the banking group has increased by 154%.

MBS experts said that banks will continue to increase bond issuance to supplement capital to meet lending needs. In the first 10 months of 2024, system-wide credit increased by 10.08%, higher than the 7.4% in the same period last year. Credit is forecast to continue to accelerate in the remaining 2 months of the year thanks to the strong recovery of production, export and services.

Banking and Finance Expert – Associate Professor, Dr. Dinh Trong Thinh mentioned that recently the bond market has become more vibrant, mainly bonds issued by commercial banks.

“Bonds are issued by banks to supplement medium and long-term capital. Therefore, this is a safe investment channel, controlled by state management agencies. The payment of principal and interest is guaranteed as when customers deposit savings,” this expert assessed.

SHB increases investment opportunities for customers

With the desire to increase safe and profitable investment opportunities for customers, and at the same time to improve financial capacity, increase medium and long-term capital sources to supply capital to the economy, Saigon - Hanoi Bank (SHB) will issue 5,000 billion VND.

In the first phase, the Bank will offer VND 2,500 billion in bonds and accept registrations to buy from December 26, 2024 to February 28, 2025. The bonds issued in the first phase will be implemented in accordance with Resolution 21/2024/NQ-HDQT on the implementation of the plan to issue SHB bonds to the public.

By November 30, 2024, SHB's total assets will be VND 708 trillion, with outstanding credit balances of nearly VND 522 trillion, up 18%. Safety, liquidity, and risk management indicators will comply with and be better than the regulations of the State Bank of Vietnam. SHB will apply Basel III standards in liquidity risk management from 2023, with a capital adequacy ratio of 12%. SHB's charter capital will be VND 36,629 billion, maintaining its position in the TOP 5 largest private commercial banks in Vietnam.

SHB is determined to develop sustainably, safely and effectively, continuously improving its management capacity according to international standards and modern models, contributing to maintaining sustainable stability for the banking industry. In addition, the Bank continues to strictly control credit quality, promote debt settlement and overdue debt collection, accompany customers to overcome difficulties and gradually recover.

According to banking and finance expert - Associate Professor, Dr. Dinh Trong Thinh, SHB is in the TOP 5 largest private commercial banks, always highly appreciated and ranked by domestic and foreign credit organizations for its reputation in risk management.

SHB has been approved by the relevant authorities to issue bonds to the market with a total value of VND5,000 billion in two tranches, affirming the Bank’s reputation and financial capacity in the market. Thereby, investors have more options for safe and effective profit channels.

In the strong and comprehensive transformation strategy 2024-2028, SHB continuously promotes innovation - creativity, technology application, applying new initiatives internally and bringing customers convenient and modern products, services and solutions.

This is one of the factors that helps the CIR index to be optimized at 24.68% - the lowest in the industry thanks to promoting digitalization and applying technology to operating processes to optimize operating costs.

SHB sets a strategic goal of becoming the TOP 1 Bank in terms of efficiency; the most favorite Digital Bank; the best Retail Bank and at the same time the TOP Bank providing capital, financial products and services to strategic private and state corporate customers, with a supply chain, value chain, ecosystem, and green development.

Originating from the Heart, SHB always accompanies, creates and spreads good values to people, community and society, joining the country in entering a new era.