Domestic silver price

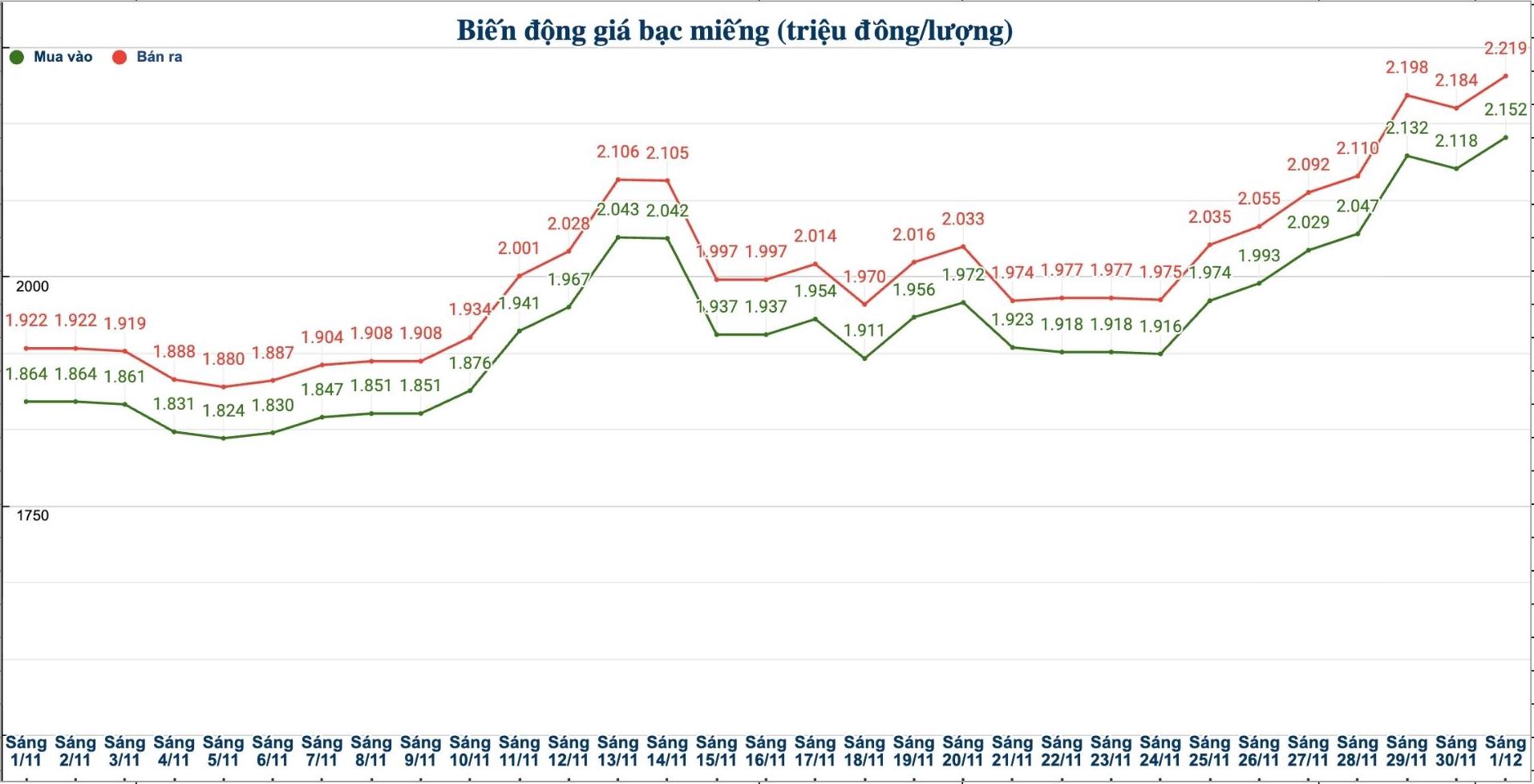

As of 10:15 on December 1, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at VND 2.157 - VND 2.207 million/tael (buy - sell); an increase of VND 43,000/tael in both directions compared to yesterday morning.

The price of 999 Ancarat 999 (1kg) at Ancarat Petrochemical Company was listed at 56.634 - 58.354 million VND/kg (buy - sell); an increase of 1.118 million VND/kg for buying and an increase of 1.148 million VND/kg for selling compared to yesterday morning.

The price of 999 gold bars of Saigon Thuong Tin Bank Gold and Gemstone One Member Co., Ltd. (Sacombank-SBJ) was listed at VND2.094 - VND2.145 million/tael (buy - sell); an increase of VND90,000/tael in both directions compared to yesterday morning.

At the same time, the price of 999 999 coins (1 tael) at Phu Quy Jewelry Group was listed at VND 2.152 - 2.219 million/tael (buy - sell); an increase of VND 34,000/tael for buying and an increase of VND 35,000/tael for selling compared to yesterday morning.

The price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 57.386 - 59.173 million VND/kg (buy - sell); an increase of 907,000 VND/kg for buying and an increase of 934,000 VND/kg for selling compared to yesterday morning.

World silver price

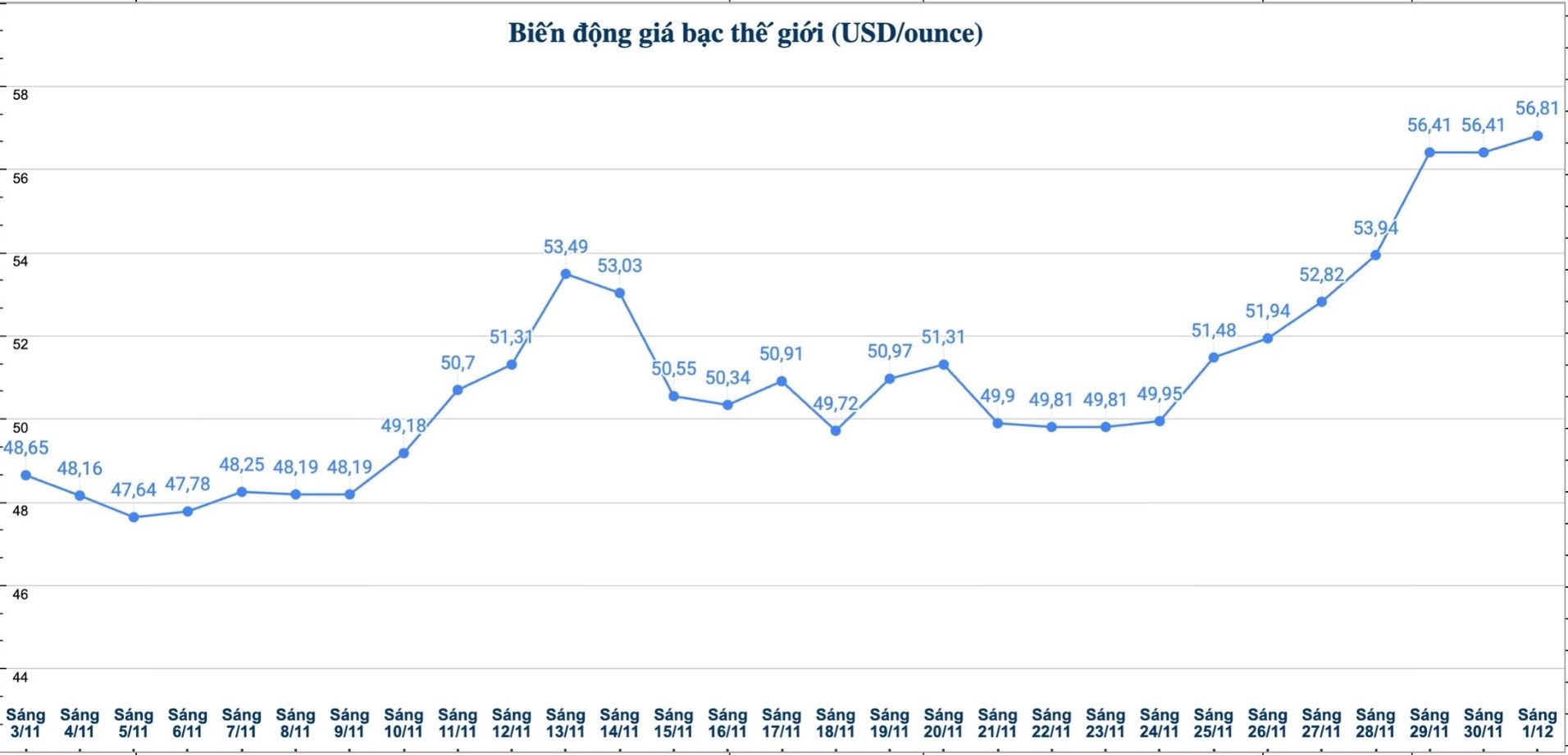

On the world market, as of 10:25 a.m. on December 1 (Vietnam time), the world silver price was listed at 56.81 USD/ounce; up 0.4 USD compared to yesterday morning.

Causes and predictions

Silver prices surpassed the old record of 54.49 USD/ounce in October and recorded the strongest week of increase since May 2024.

According to precious metals analyst James Hyerczyk at FX Empire, the strong increase reflects a market where all factors converge: industrial demand continues to escalate, supply shortages for many consecutive years and expectations that the US Federal Reserve (Fed) will cut interest rates in December.

"The strongest driver of this rally comes from expectations of a Fed rate cut soon. Officials such as Christopher Waller and John Williams also signaled a dovish stance. For a non-yielding asset like silver, lower interest rates mean lower opportunity costs, and the flow of money into metals becomes more reasonable," said James Hyerczyk.

On supply-demand, James Hyerczyk said the market has been short of a total of about 678 million ounces over the past four years. Looking ahead, silver is both a precious metal and an industrial commodity, causing strong price fluctuations, but it is this dual role that supports the uptrend.

"As long as solar energy continues to expand, electric vehicles continue to develop and the supply continues to be limited, silver prices still have a solid foundation.

In the short term, the December Fed meeting and upcoming economic data will play a decisive role: if the Fed cuts and signals moderation, silver prices may continue to rise; if the Fed keeps interest rates unchanged, the increase may slow down but it will be difficult to change the supply-demand structure that has been formed for many years" - James Hyerczyk commented.

See more news related to silver prices HERE...