Domestic silver prices

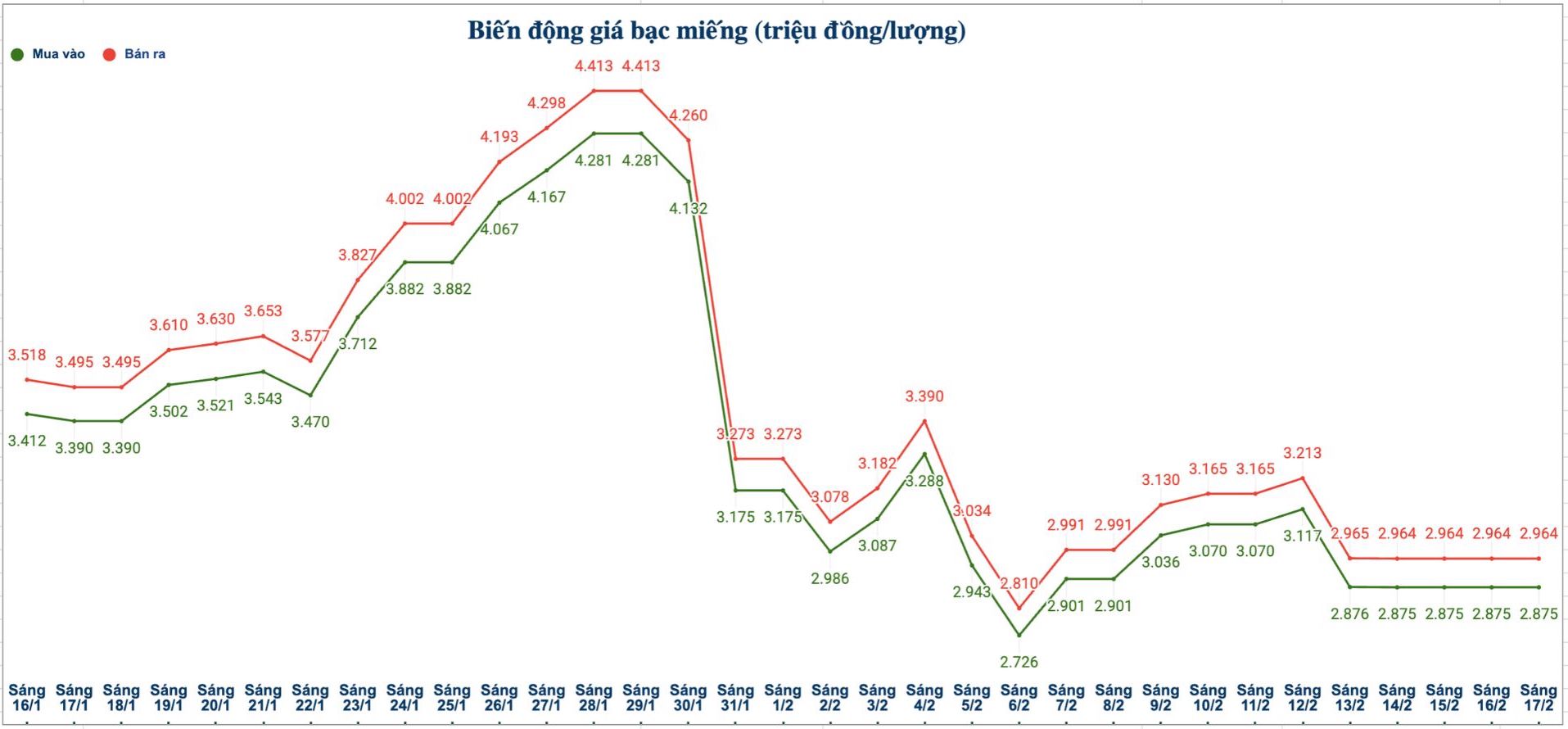

As of 11:05 am on February 17, the price of Kim Phuc Loc 999 silver bars (1 tael) of Saigon Thuong Tin Commercial Joint Stock Bank Gold and Silver Company Limited (Sacombank-SBJ) was listed at the threshold of 3.330 - 3.432 million VND/tael (buying - selling).

The price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Gem Company is listed at the threshold of 2.889 - 2.960 million VND/tael (buying - selling).

The price of silver ingots 2025 Ancarat 999 (1kg) at Ancarat Gem Company is listed at 76.124 - 78.434 million VND/kg (buying - selling).

At the same time, the price of 999 silver bars (1 tael) at Phu Quy Jewelry Group was listed at the threshold of 2.875 - 2.964 million VND/tael (buying - selling).

The price of 999 silver ingots (1kg) at Phu Quy Jewelry Group is listed at 76.666 - 79.039 million VND/kg (buying - selling).

World silver price

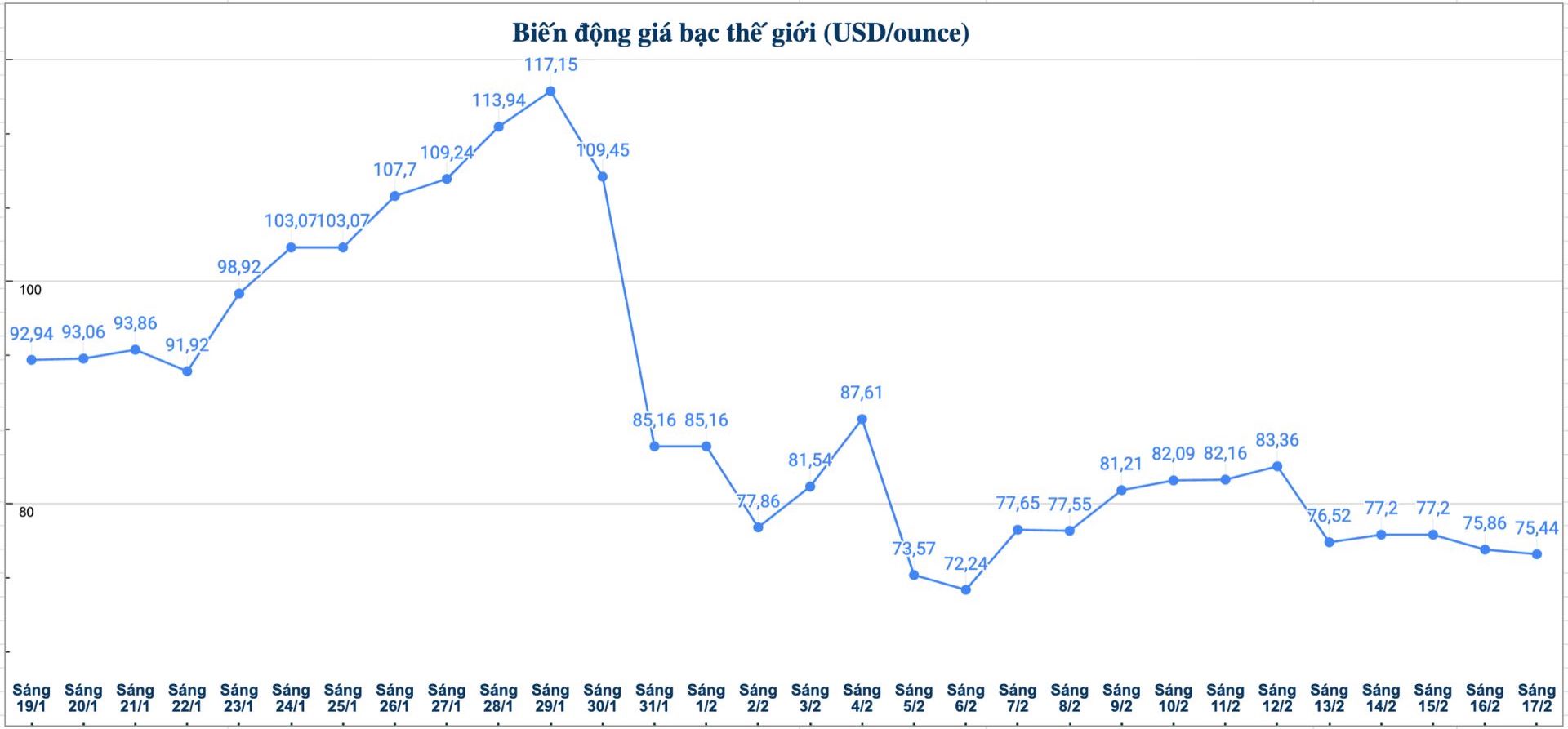

On the world market, as of 11:05 am on February 17 (Vietnam time), the world silver price was listed at 75.44 USD/ounce; down 0.42 USD compared to yesterday morning.

Causes and forecasts

Silver prices are currently trading relatively sluggishly. Last week, investors focused on monitoring the non-farm payrolls report and the US consumer price index (CPI). Although these figures caused 10-year US Treasury bond yields and the USD to weaken, silver prices still could not rebound.

In the opposite direction, the overall CPI is lower than expected, but core inflation still maintains pressure. This contrast makes the policy outlook of the US Federal Reserve (Fed) more unpredictable. That is enough to curb the increase in silver, but not strong enough to create a clear sell-off wave.

The focus of this week will be on the Fed meeting minutes, preliminary GDP and especially the PCE inflation index - a measure that the Fed monitors more closely than the CPI.

Precious metals analyst James Hyerczyk of FX Empire believes that PCE is the factor that could create a turning point for the silver market. If this index exceeds expectations, silver is highly likely to face another sell-off. The market is currently quite "fragile" after a period of excessive speculation, while many speculators are still suffering losses.

Conversely, if the PCE cools down, the positive impact may not be strong enough to quickly reverse the trend. In the scenario of inflation maintaining at a high level, silver prices may even continue to adjust to near the value considered more reasonable - around the threshold of 48.07 USD/ounce" - James Hyerczyk said.

In the context of a clear lack of momentum, James Hyerczyk said that silver is likely to continue to fluctuate widely.

The Fed's upcoming policy decisions and inflation data will be key to orienting the next trend of this precious metal" - James Hyerczyk said.

See more news related to silver prices HERE...