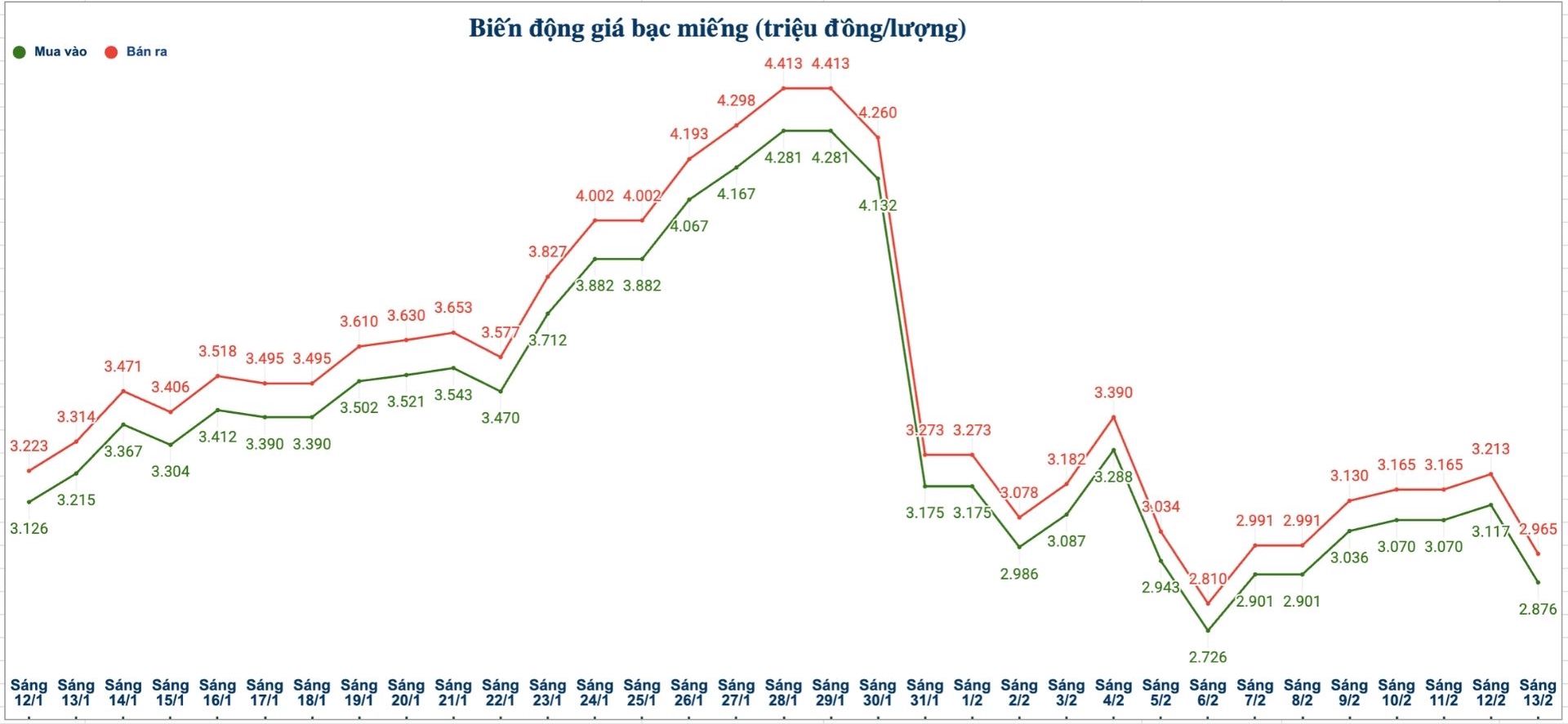

Domestic silver prices

As of 9:30 am on February 14, the price of silver bars 2024 Ancarat 999 (1 tael) at Ancarat Gem Company was listed at the threshold of 2.889 - 2.960 million VND/tael (buying - selling); an increase of 13,000 VND/tael in both directions compared to yesterday morning.

The price of silver ingots 2025 Ancarat 999 (1kg) at Ancarat Gem Company is listed at 76.124 - 78.434 million VND/kg (buying - selling); an increase of 338,000 VND/kg on the buying side and an increase of 348,000 VND/kg on the selling side compared to yesterday morning.

The price of Kim Phuc Loc 999 silver bars (1 tael) of Saigon Thuong Tin Commercial Joint Stock Company Limited (Sacombank-SBJ) is listed at the threshold of 3.330 - 3.432 million VND/tael (buying - selling); an increase of 51,000 VND/tael in both directions compared to yesterday morning.

At the same time, the price of 999 silver bars (1 tael) at Phu Quy Jewelry Group was listed at the threshold of 2.875 - 2.964 million VND/tael (buying - selling).

The price of 999 silver ingots (1kg) at Phu Quy Jewelry Group is listed at 76.666 - 79.039 million VND/kg (buying - selling).

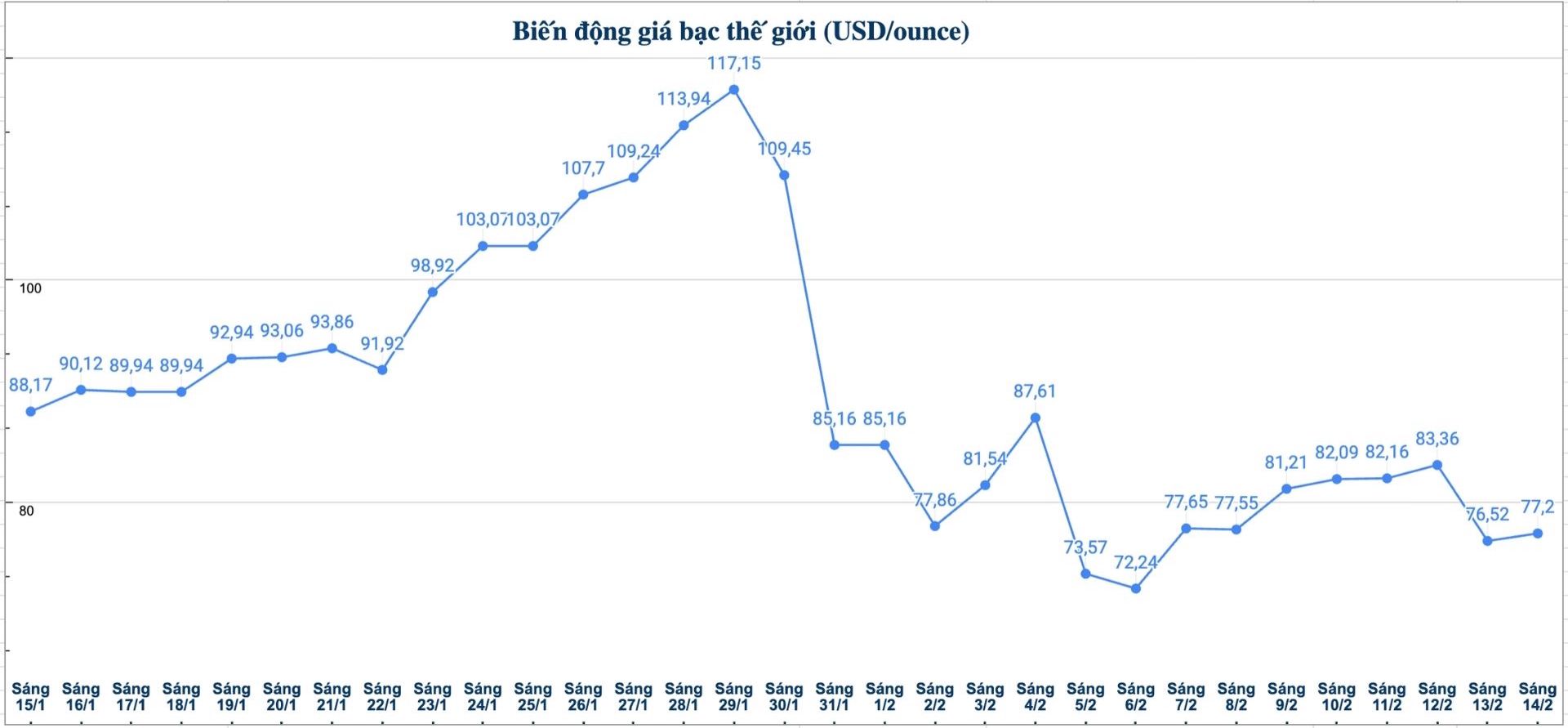

World silver price

On the world market, as of 9:30 AM on February 14 (Vietnam time), the world silver price was listed at 77.2 USD/ounce; up 0.68 USD compared to yesterday morning.

Causes and forecasts

Spot silver prices rose slightly in the last trading session of the week, after the latest US inflation data showed that price pressure is cooling down faster than expected. However, the market's reaction is still quite cautious, showing that investors still have many concerns about the monetary policy orientation of the Federal Reserve (Fed).

According to a US government report, the consumer price index (CPI) in January increased by 2.4% compared to the same period last year, lower than the forecast of 2.5% and down from 2.7% in the previous month. This development reinforces expectations that persistent inflation may be gradually being controlled, thereby opening up the possibility that the Fed considers cutting interest rates in June.

Notably, the current CPI level is equivalent to the time immediately after President Donald Trump announced a large-scale tariff package in April 2025. This surprised investors, because many previous opinions suggested that the prolonged impact of tariffs would cause inflation to remain at a high level for many more months.

After the data was released, US Treasury bond yields simultaneously decreased. However, precious metals analyst James Hyerczyk of FX Empire said that the USD suddenly strengthened, causing the increase of silver to be limited.

This opposite development shows that the market is being affected by more factors than just the inflation and interest rate story alone," he said.

In general, in addition to the technical correction factor after a decrease of more than 30% in the previous two weeks, James Hyerczyk believes that the silver market is shifting to a cautious state and relying more on economic data than short-term speculative sentiment.

In the short term, silver prices may also undergo further adjustments until the Fed's policy orientation becomes clearer. As long as uncertainty about interest rates persists, the precious metals market in general and silver in particular will still trade in a cautious manner, waiting for decisive signals from the US central bank" - James Hyerczyk said.

See more news related to silver prices HERE...