Domestic silver prices

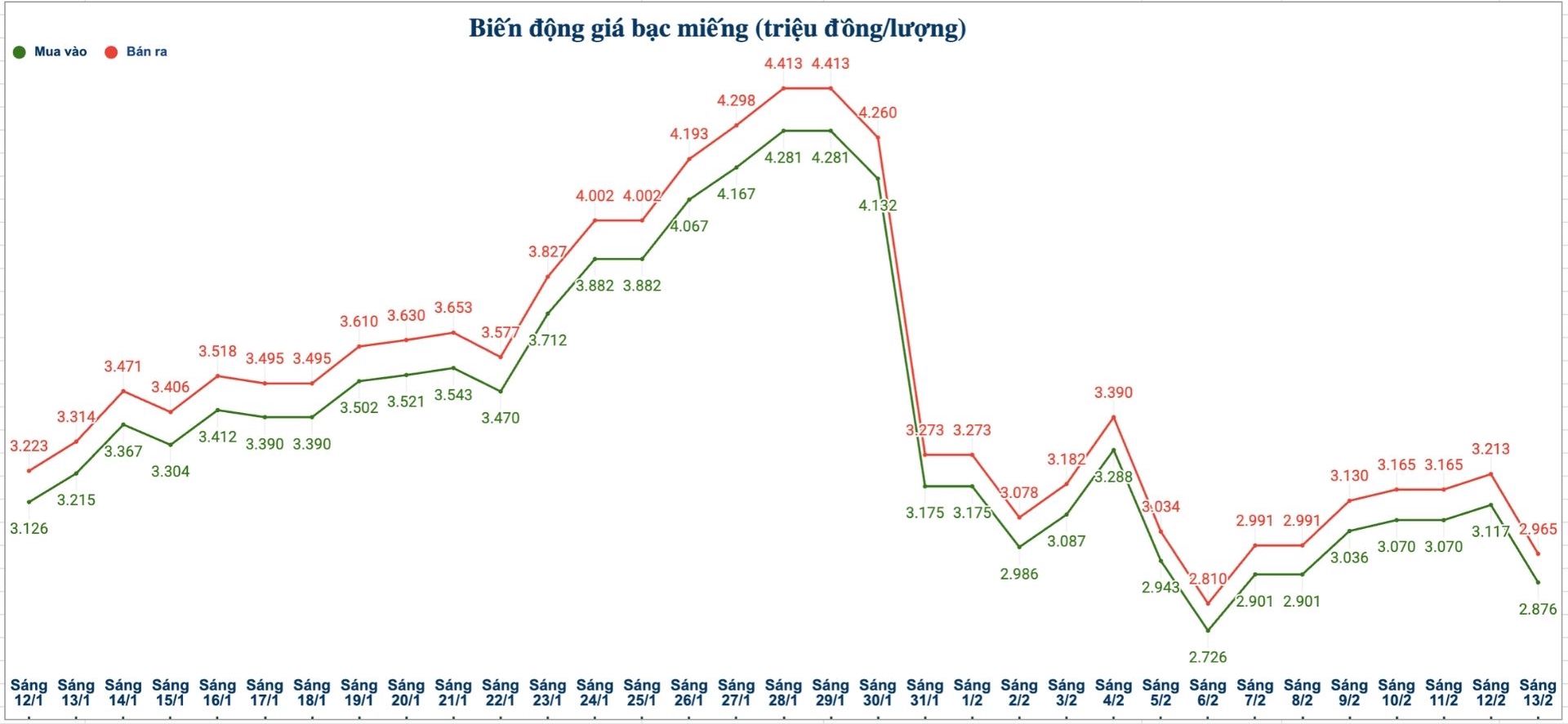

As of 9:35 am on February 13, the price of silver bars 2024 Ancarat 999 (1 tael) at Ancarat Gem Company was listed at the threshold of 2.876 - 2.947 million VND/tael (buying - selling); down 232,000 VND/tael on the buying side and down 237,000 VND/tael on the selling side compared to yesterday morning.

The price of silver ingots 2025 Ancarat 999 (1kg) at Ancarat Gem Company is listed at 75.786 - 78.086 million VND/kg (buying - selling); down 6.13 million VND/kg on the buying side and down 6.32 million VND/kg on the selling side compared to yesterday morning.

The price of Kim Phuc Loc 999 silver bars (1 tael) of Saigon Thuong Tin Commercial Joint Stock Company Limited (Sacombank-SBJ) is listed at the threshold of 3.279 - 3.381 million VND/tael (buying - selling); down 144,000 VND/tael on the buying side and down 150,000 VND/tael on the selling side compared to yesterday morning.

At the same time, the price of 999 silver bars (1 tael) at Phu Quy Jewelry Group was listed at the threshold of 2.876 - 2.965 million VND/tael (buying - selling); down 241,000 VND/tael on the buying side and down 248,000 VND/tael on the selling side compared to yesterday morning.

The price of 999 silver ingots (1kg) at Phu Quy Jewelry Group is listed at 76.693 - 79.066 million VND/kg (buying - selling); down 6.426 million VND/kg on the buying side and down 6.613 million VND/kg on the selling side compared to yesterday morning.

World silver price

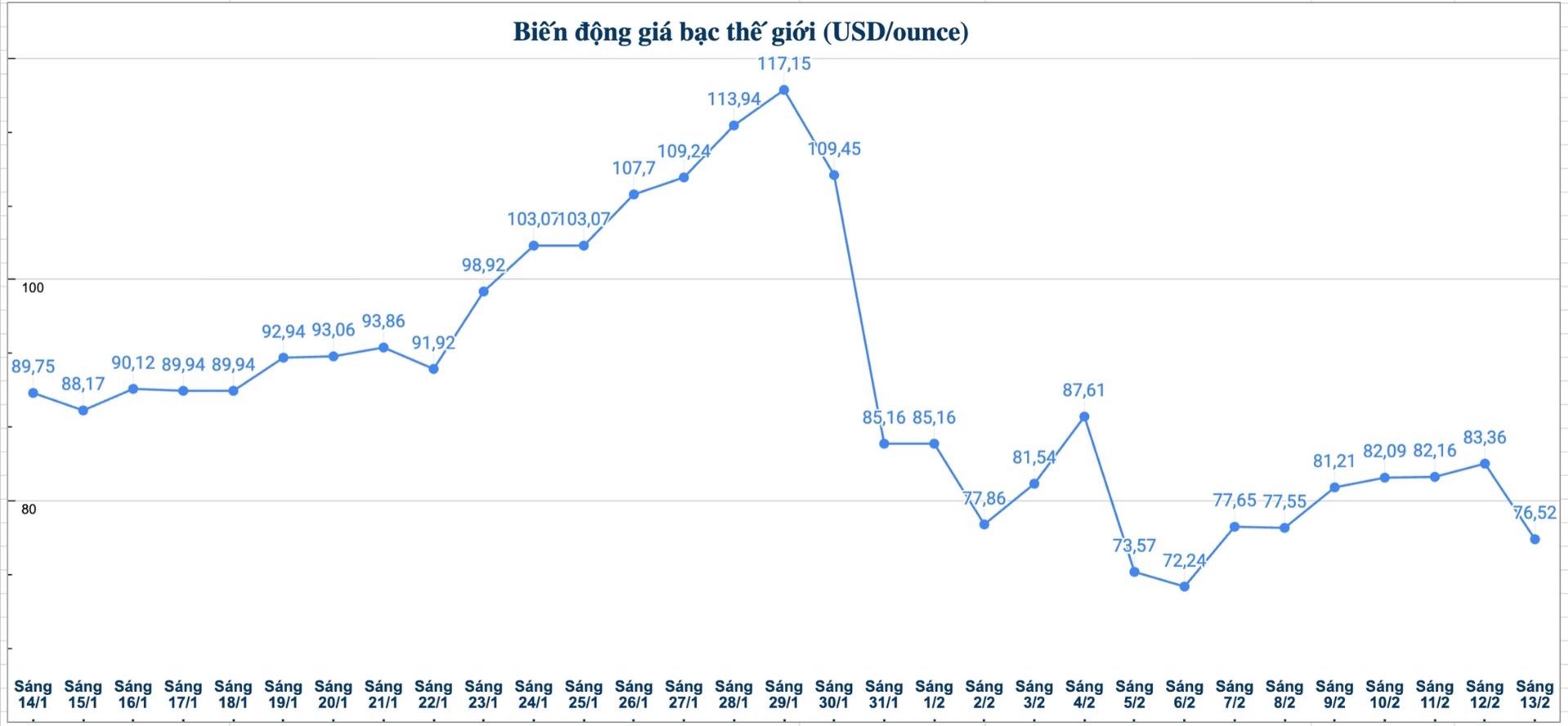

On the world market, as of 9:35 am on February 13 (Vietnam time), the world silver price was listed at 76.52 USD/ounce; down 6.84 USD compared to yesterday morning.

Causes and forecasts

Silver prices fell as investors continued to assess the impact of the US jobs report. Data shows that the labor market is more positive than expected, thereby raising an important question: How will the US Federal Reserve (Fed) use this information to decide when to cut interest rates next.

According to precious metals analyst James Hyerczyk of FX Empire, traders are currently focusing more on the consumer price index (CPI) report expected to be released on Friday, a factor that could cause silver prices to escape the narrow fluctuation zone that has lasted for a long time.

According to the expert, the longer the price is "anchored" in a narrow range, the stronger the impact of new information - especially inflation data - will be on the short-term trend.

If inflation is higher than forecast, the possibility of the Fed delaying interest rate cuts will increase, putting downward pressure on silver prices.

Conversely, if inflation cools down significantly, the expectation of monetary policy easing may be strengthened, paving the way for silver prices to recover to the resistance zone of 92.20 - 92.87 USD/ounce" - James Hyerczyk said.

Regarding monetary policy, James Hyerczyk believes that the market is currently particularly sensitive to the expectation of the Fed's interest rate cut. If economic data supports the possibility of interest rate cuts in March, silver prices may benefit. Conversely, if the cut time is pushed back to September, this precious metal is at risk of returning to the bottom of the trading band.

Besides the Fed's policy, demand from China is also an unpredictable variable. If investment and consumption demand for precious metals in the world's second largest economy accelerates, silver prices may be supported in the medium and long term.

In the long term, buying power from central banks is still a factor supporting silver prices. However, in the short term, the price trend is likely to become clearer only when uncertainties related to Fed policy are gradually relieved" - James Hyerczyk said.

See more news related to silver prices HERE...