Domestic silver prices

As of 1:05 PM on February 16, the price of Kim Phuc Loc 999 silver bars (1 tael) of Saigon Thuong Tin Commercial Joint Stock Bank Gold and Silver Company Limited (Sacombank-SBJ) is listed at the threshold of 3.330 - 3.432 million VND/tael (buying - selling).

The price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Gem Company is listed at the threshold of 2.889 - 2.960 million VND/tael (buying - selling).

The price of silver ingots 2025 Ancarat 999 (1kg) at Ancarat Gem Company is listed at 76.124 - 78.434 million VND/kg (buying - selling).

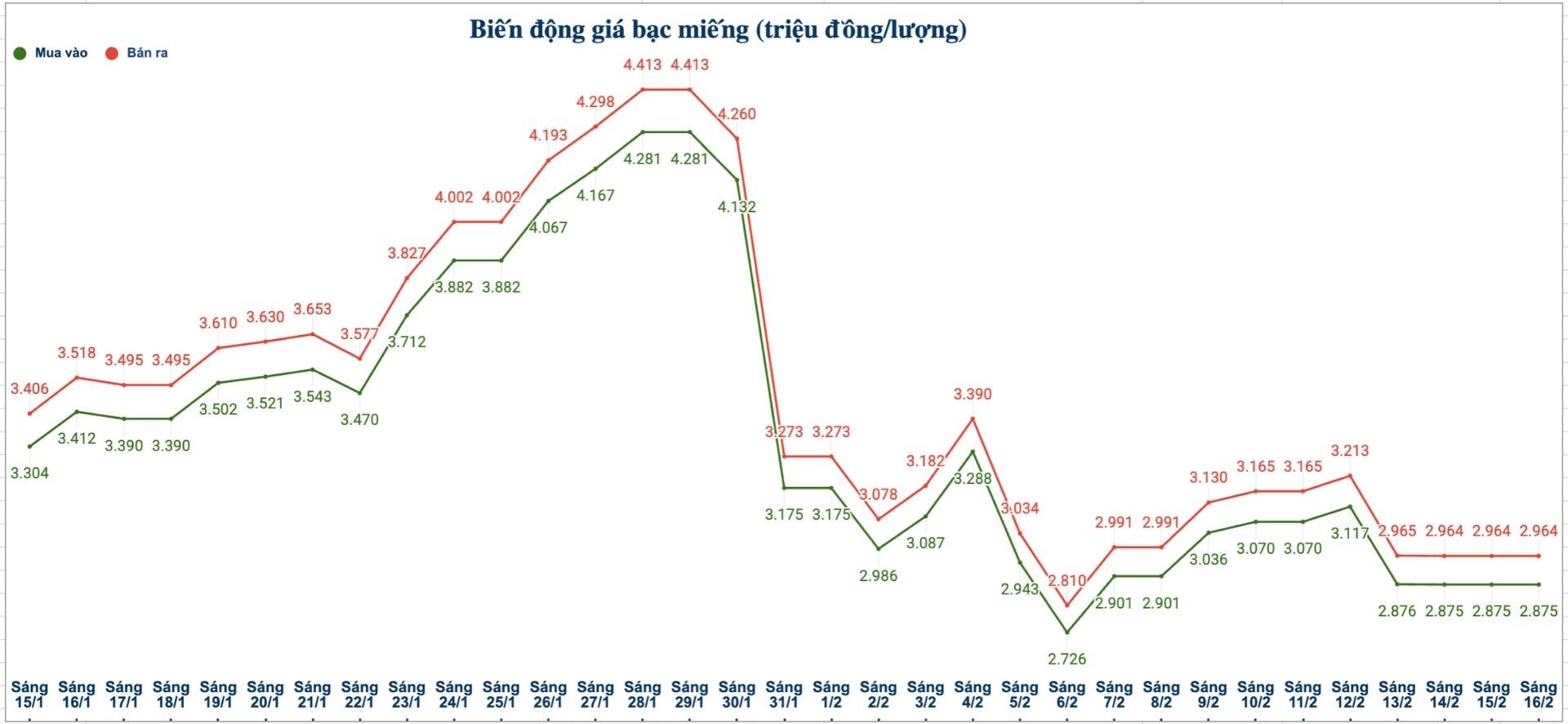

At the same time, the price of 999 silver bars (1 tael) at Phu Quy Jewelry Group was listed at the threshold of 2.875 - 2.964 million VND/tael (buying - selling).

The price of 999 silver ingots (1kg) at Phu Quy Jewelry Group is listed at 76.666 - 79.039 million VND/kg (buying - selling).

World silver price

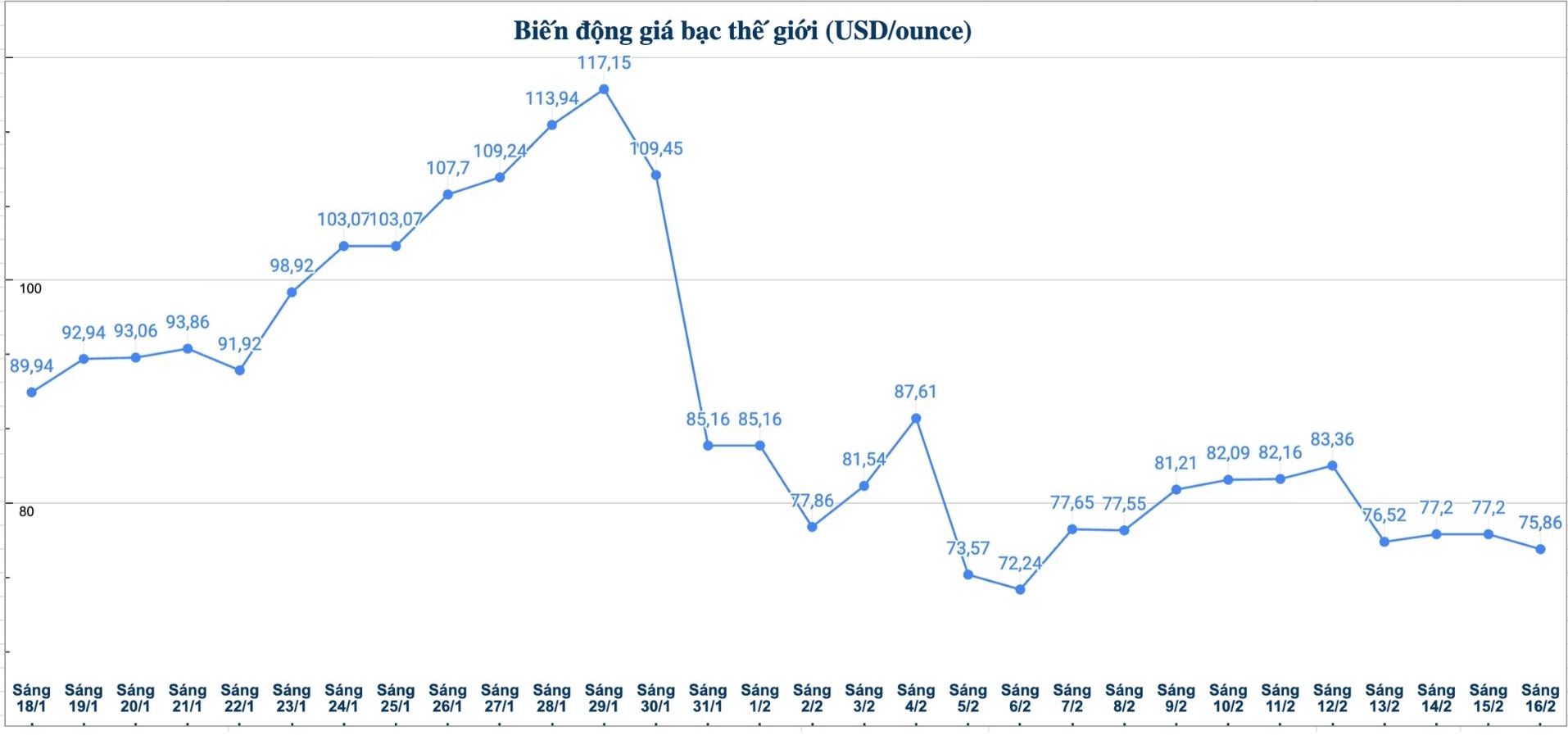

On the world market, as of 12:50 PM on February 16 (Vietnam time), the world silver price was listed at 75.86 USD/ounce; down 1.34 USD compared to yesterday morning.

Causes and forecasts

According to The Economic Times, gold and silver prices on the international market are forecast to continue to fluctuate sharply after the Presidents' Day holiday in the US (Presidents' Day), as investors are waiting for more clear signals from the US Federal Reserve (Fed) as well as important economic data to be released soon.

In the first trading session of the week, silver prices recorded a slight decrease, showing that market sentiment is still quite cautious. However, experts believe that this is only a short-term fluctuation and the upcoming trend still largely depends on economic information.

An analysis group at The Economic Times believes that investors are focusing on a series of important US data such as the PCE inflation index, GDP growth, the jobs report as well as the minutes of the Federal Open Market Committee (FOMC) meeting. These factors will help the market better assess the possibility of the Fed adjusting interest rates in the near future. The US interest rate policy has a direct impact on the price of precious metals, because high interest rates often reduce the attractiveness of gold and silver - non-interest assets.

Mr. Pranav Mer - commodity research expert at JM Financial Services - said that gold and silver prices are likely to fluctuate within a certain range in the short term.

However, the market may see strong ups and downs due to reactions to economic data and Fed officials' statements," he said.

Pranav Mer added that, in general, after the Presidents' Day holiday, the gold and silver markets are forecast to continue to fluctuate strongly and have not yet formed a clear trend.

Price movements in the coming time will mainly depend on US economic data and the monetary policy orientation of the Fed" - the expert said.

See more news related to silver prices HERE...