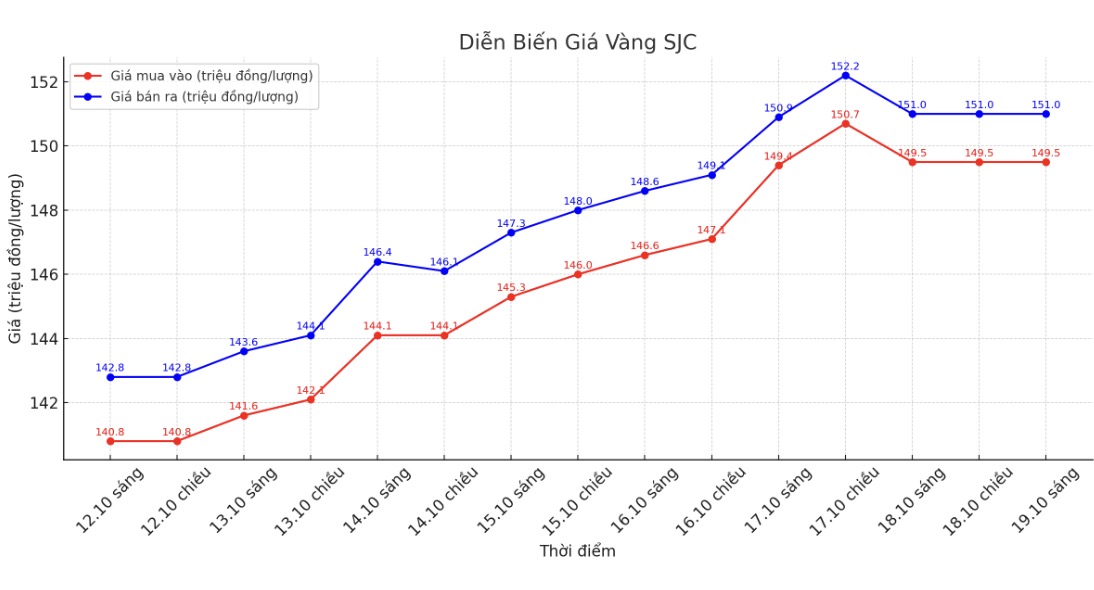

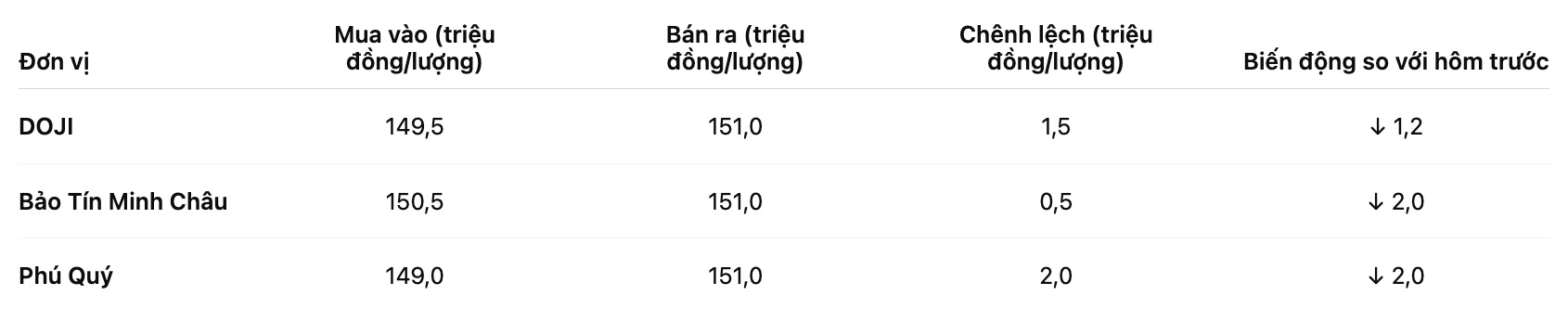

SJC gold bar price

As of 6:00 a.m., the price of SJC gold bars was listed by DOJI Group at 149.5-151 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 1.5 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 150.5-151 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 500,000 VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 149-151 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2 million VND/tael.

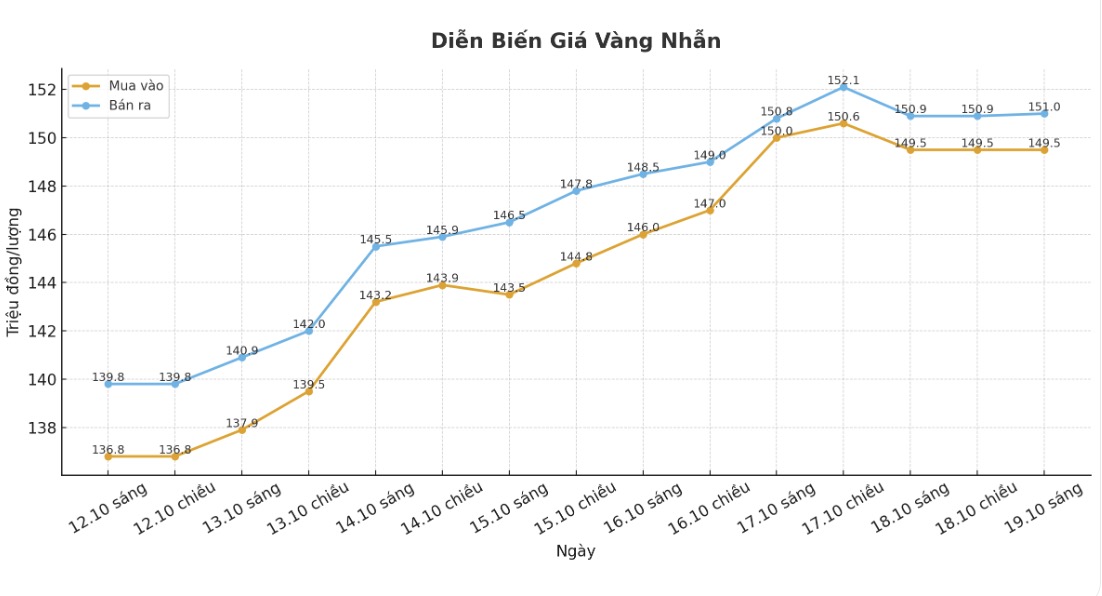

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 149.5-150.9 million VND/tael (buy in - sell out). The difference between buying and selling is 1.4 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 155.5-158.5 million VND/tael (buy in - sell out). The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 148-151 million VND/tael (buy in - sell out). The difference between buying and selling is 3 million VND/tael.

The buying - selling distance is still high, posing a potential risk to investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

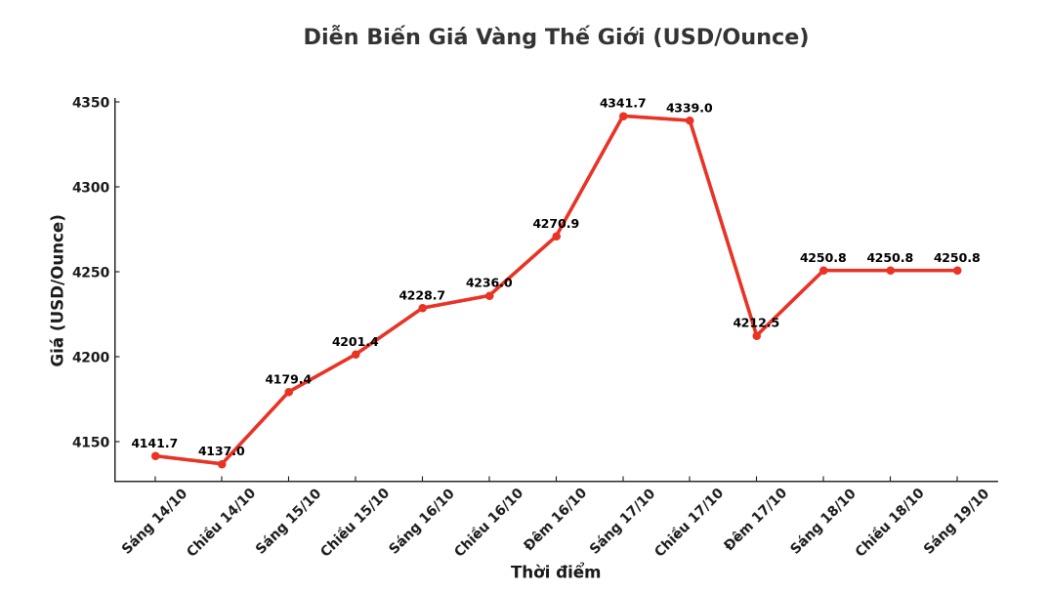

World gold price

Recorded at 6:00 (Vietnam time), the world spot gold price was listed at 4,250.8 USD/ounce.

Gold price forecast

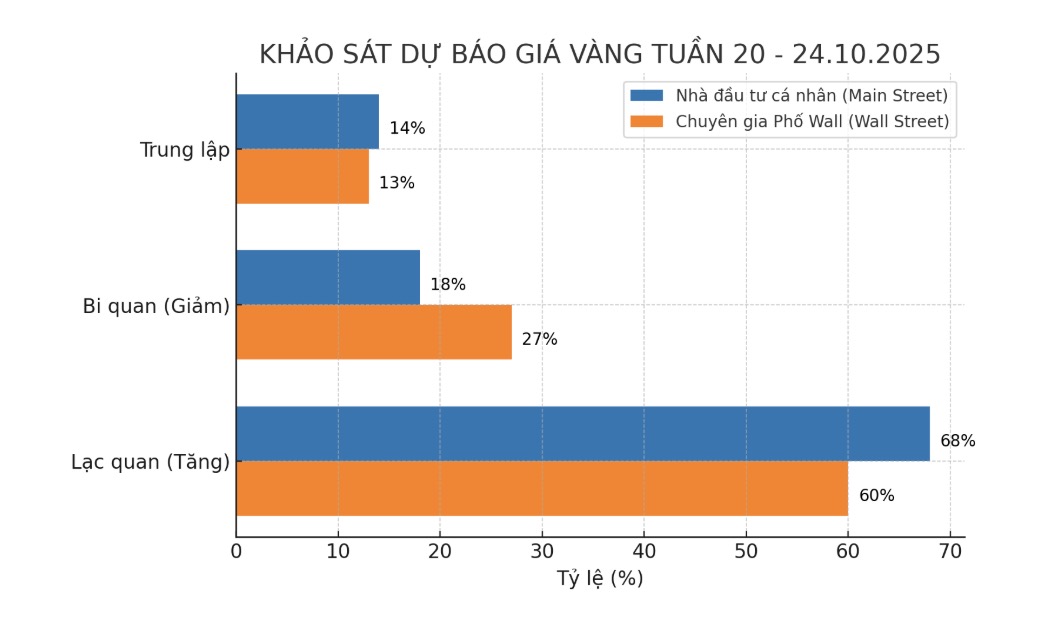

After many consecutive weeks of optimism, the latest survey results show that the Western market sentiment suddenly Differentiated significantly, as gold prices have just experienced a series of strong increases and then adjusted shortly at the end of the week.

This week, 15 analysts participated in the survey. Wall Street analysts have somewhat eased their expectations for price increases. Of these, 9 people (equivalent to 60%) predicted gold prices would increase this week, 4 people (27%) expected prices to decrease, and the remaining 2 people (13%) expected gold prices to remain flat.

Jim Wyckoff - senior analyst at Kitco - predicted that gold prices will " decrease slightly or remain flat". He said the market needs a technical adjustment after the recent strong increase.

Mr. Alex Kuptsikevich - senior analyst at FxPro - said that after more than two consecutive months of increase, gold prices are likely to decrease next week.

The record rally of over $4,200 an ounce comes from a wave of disbelief in the currency. Governments are struggling with budget deficits, huge public debt and central banks are being required to cut or keep interest rates low.

Investors have therefore lost faith in bonds and currencies, looking to precious metals. Gold has been rising for nine consecutive weeks something that has only happened five times since the 1970s, he said.

Mr. James Stanley - senior strategist at Forex.com - predicted that gold prices may increase in the short term: "There is a clear correction before the market closes at the end of the week, I think that will help relieve most of the profit-taking pressure. I expect the support zone to appear soon early next week.

The current rally is so strong that the only doubt is that it is happening too fast, he added. Therefore, I still maintain a positive view until there are clearer signs of reversal".

Economic data to watch this week

As the US government remains closed, markets are forced to rely on private sector data, including home sales reports and weekly manufacturing data.

However, the market will still receive some official inflation figures, as the US Bureau of Labor Statistics (BLS) has summoned a limited number of employees to release the September CPI report.

The move is aimed at helping the US government calculate the annual cost of living adjustment for social security pensioners before November 1.

The US home sales data for September is scheduled to be released on Thursday, while the September CPI report will be released on Friday, followed by the S&P preliminary PMI.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...