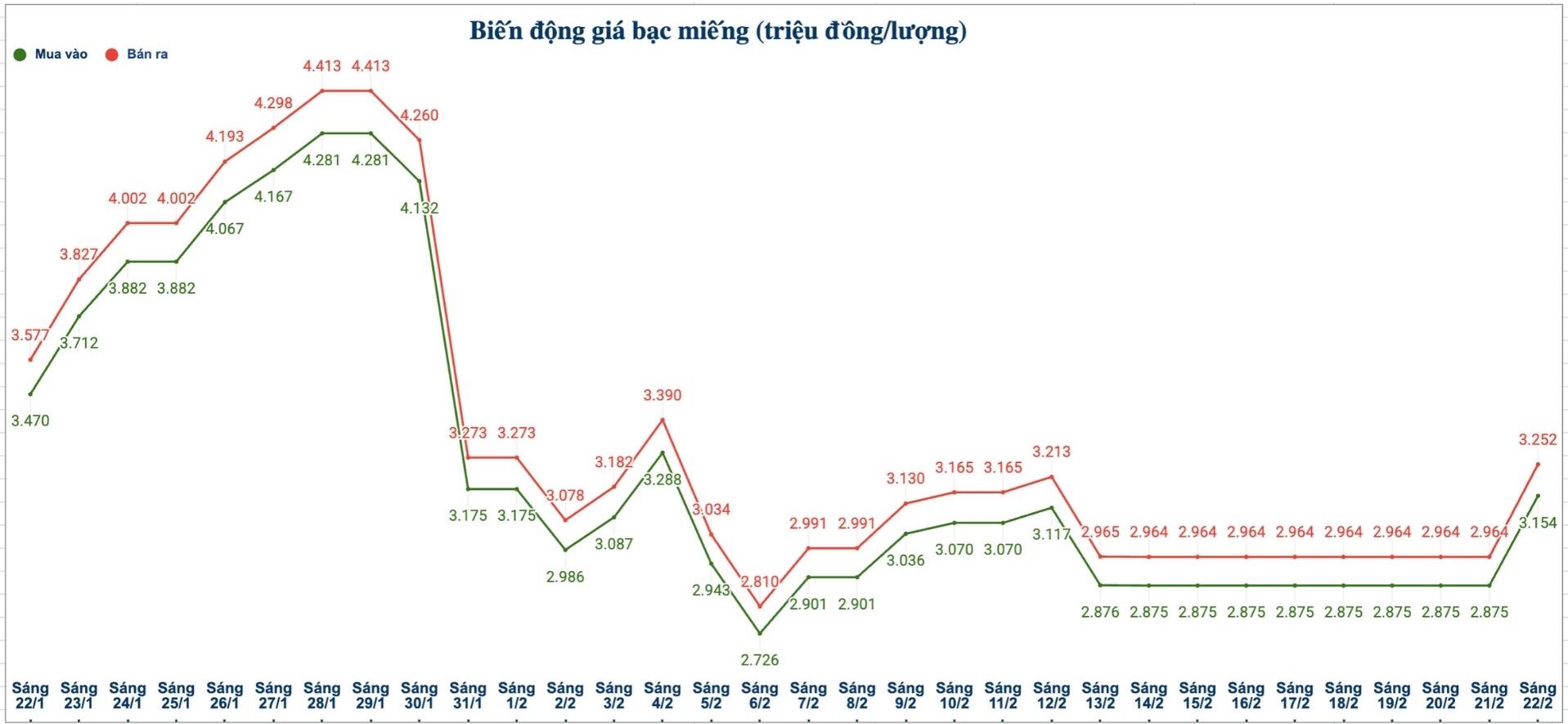

Domestic silver prices

As of 10:20 am on February 22, the price of Kim Phuc Loc 999 silver bars (1 tael) of Saigon Thuong Tin Commercial Joint Stock Bank Gold and Silver Company Limited (Sacombank-SBJ) is listed at the threshold of 3.330 - 3.432 million VND/tael (buying - selling).

The price of silver bars 2024 Ancarat 999 (1 tael) at Ancarat Gem Company is listed at 3.149 - 3.226 million VND/tael (buying - selling); an increase of 260,000 VND/tael on the buying side and an increase of 266,000 VND/tael on the selling side compared to yesterday morning.

The price of silver ingots 2025 Ancarat 999 (1kg) at Ancarat Gem Company is listed at 83.006 - 85.526 million VND/kg (buying - selling); an increase of 6.882 million VND/kg on the buying side and an increase of 7.092 million VND/kg on the selling side compared to yesterday morning.

At the same time, the price of 999 silver bars (1 tael) at Phu Quy Jewelry Group was listed at 3.154 - 3.252 million VND/tael (buying - selling); an increase of 279,000 VND/tael on the buying side and an increase of 288,000 VND/tael on the selling side compared to yesterday morning.

The price of 999 silver ingots (1kg) at Phu Quy Jewelry Group is listed at 84.106 - 86.719 million VND/kg (buying - selling); an increase of 7.44 million VND/kg on the buying side and an increase of 7.68 million VND/kg on the selling side compared to yesterday morning.

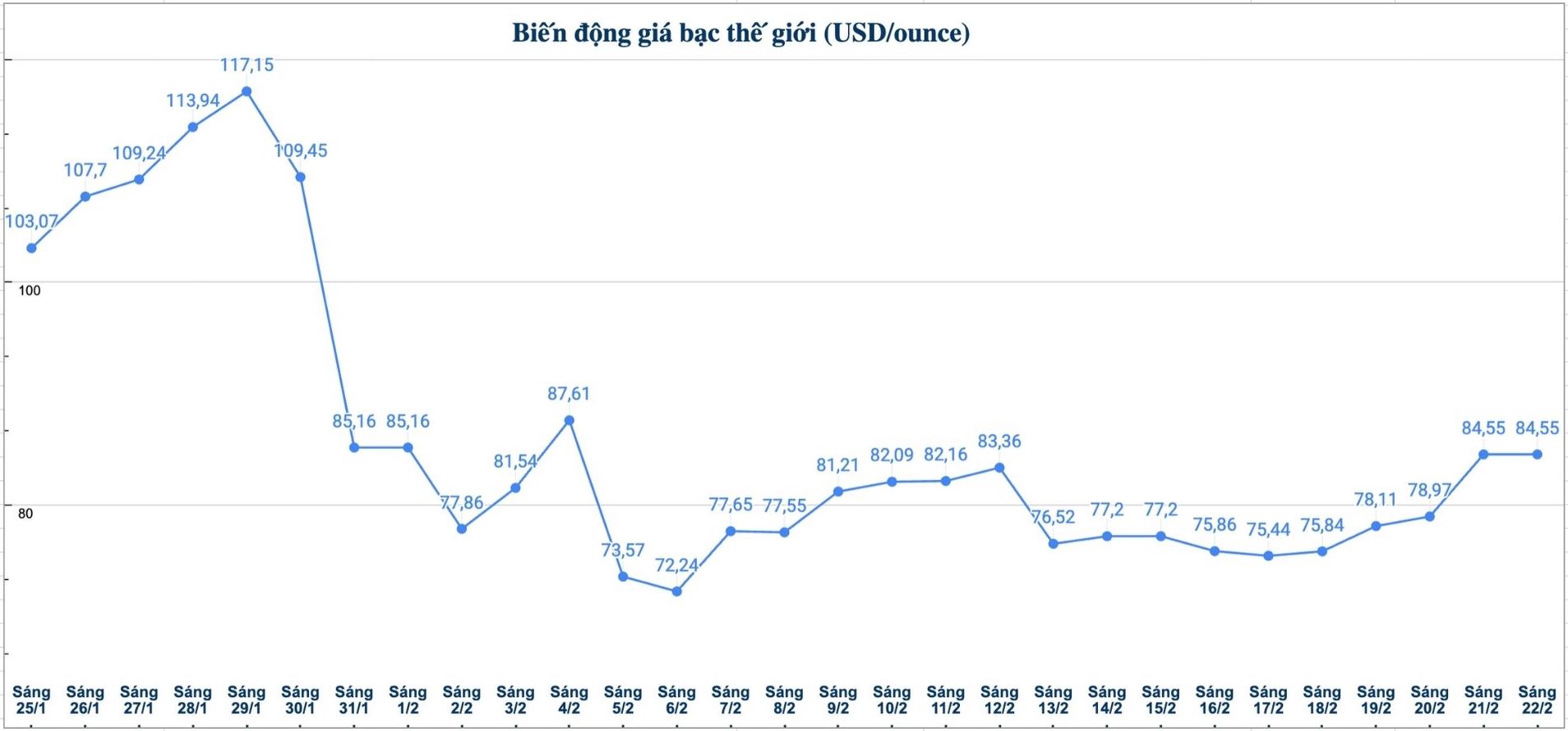

World silver price

On the world market, as of 10:20 am on February 22 (Vietnam time), the world silver price is listed at 84.55 USD/ounce.

Causes and forecasts

Gold prices rose slightly while silver rose sharply in the last trading session of the week, as safe-haven demand increased amid global instability.

According to Kitco News, gold futures for April delivery increased by 43.80 USD, to 5,041.20 USD/ounce, while silver futures for March jumped by 2,631 USD to 80.26 USD/ounce.

According to analyst Jim Wyckoff of Kitco, the tense geopolitical context has prompted cash flow to safe assets.

The USD rose sharply this week as investors reduced expectations about the possibility of the US Federal Reserve (Fed) soon cutting interest rates. The Dollar Index tracking the strength of the greenback is heading for its strongest week of gains in 4 months, as concerns about inflation and positive economic data make the prospect of monetary policy easing less certain," he said.

Jim Wyckoff said that crude oil prices also reacted strongly to the risk of conflict. Nymex oil contracts traded around 66 USD/barrel, maintaining their highest level in 6 months. The market is concerned that if US-Iran tensions escalate, global oil supplies could be disrupted.

On the international financial market, the yield of 10-year US Treasury bonds is currently around 4.1%, while the USD and oil prices remain stable at high levels.

Regarding technical analysis, Jim Wyckoff believes that silver buyers are aiming to close above the strong resistance level of 90 USD/ounce. Conversely, sellers expect prices to retreat below the support level of 63.90 USD/ounce. The nearest resistance levels are 82.50 USD/ounce and 85 USD/ounce respectively, while support is at 77.285 USD/ounce and 75 USD/ounce.

In general, current developments show that precious metals are benefiting from an increasingly risky environment. However, the next direction of gold and silver prices will largely depend on geopolitical developments in the Middle East as well as new signals from the US economy and monetary policy of the Fed" - Jim Wyckoff said.

See more news related to silver prices HERE...