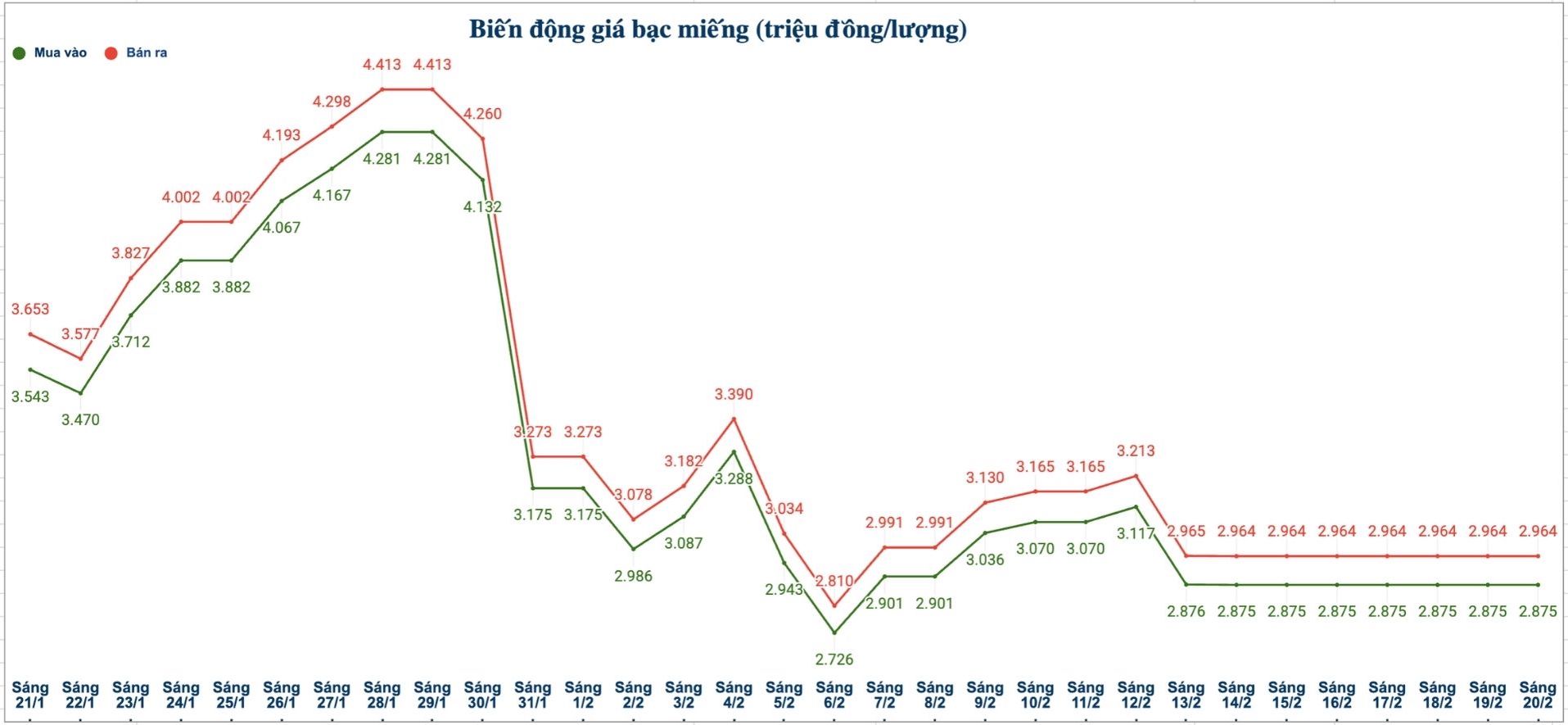

Domestic silver prices

As of 2:40 PM on February 20th, the price of Kim Phuc Loc 999 silver bars (1 tael) of Saigon Thuong Tin Commercial Joint Stock Bank Gold and Silver Company Limited (Sacombank-SBJ) was listed at the threshold of 3.330 - 3.432 million VND/tael (buying - selling).

The price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Gem Company is listed at the threshold of 2.889 - 2.960 million VND/tael (buying - selling).

The price of silver ingots 2025 Ancarat 999 (1kg) at Ancarat Gem Company is listed at 76.124 - 78.434 million VND/kg (buying - selling).

At the same time, the price of 999 silver bars (1 tael) at Phu Quy Jewelry Group was listed at the threshold of 2.875 - 2.964 million VND/tael (buying - selling).

The price of 999 silver ingots (1kg) at Phu Quy Jewelry Group is listed at 76.666 - 79.039 million VND/kg (buying - selling).

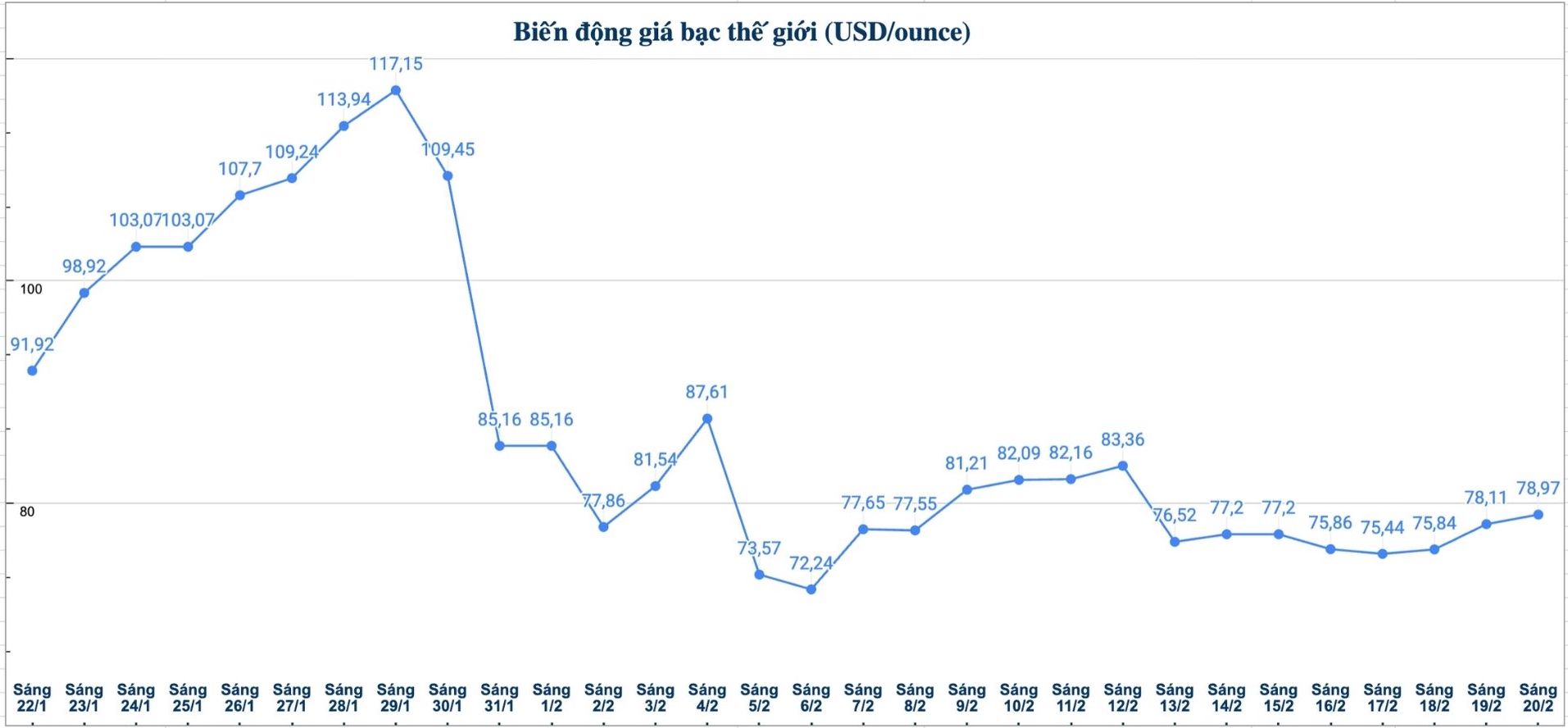

World silver price

On the world market, as of 2:40 PM on February 20 (Vietnam time), the world silver price was listed at 78.97 USD/ounce; up 0.86 USD compared to yesterday morning.

Causes and forecasts

Spot silver prices edged up slightly in Friday's trading session, but the increase was unsustainable, showing that selling pressure is still silently appearing in the market.

According to precious metals analyst James Hyerczyk of FX Empire, the upward momentum quickly cooled down after the minutes of the meeting of the US Federal Reserve (Fed) sent a tough signal on monetary policy. The prolonged tightening stance has narrowed the upward outlook for silver, especially as the USD continues to maintain its strength and the upcoming PCE inflation data may create more volatility.

James Hyerczyk said that the downward outlook for silver could be triggered if macroeconomic factors move in a negative direction. The US PCE index report, if it shows that inflation cools down slowly or sends a negative signal, could strengthen the US Federal Reserve (Fed)'s tightening stance.

At the same time, if the USD continues to strengthen, silver - which is valued in USD - will become more expensive for international investors, thereby weakening the demand for holding this precious metal," he said.

Notably, the expert believes that the Lunar New Year holiday in many Asian markets causes liquidity to decline. In thin trading conditions, prices may fluctuate more strongly than usual. Cash flow from this region recently tends to lean towards buying, increasing the unpredictability for short-term developments.

In the context that the Fed maintains a tough stance, the USD is high and geopolitical risks are still latent, investors need to be cautious in the face of both up and down scenarios in the near future," James Hyerczyk said.

See more news related to silver prices HERE...