Domestic silver prices

As of 10:05 AM on February 5th, the price of silver bars 2024 Ancarat 999 (1 tael) at Ancarat Gem Company was listed at the threshold of 2.878 - 2.949 million VND/tael (buying - selling); down 411,000 VND/tael on the buying side and down 421,000 VND/tael on the selling side compared to yesterday morning.

The price of silver ingots 2025 Ancarat 999 (1kg) at Ancarat Gem Company is listed at 75,830 - 78,140 million VND/kg (buying - selling); down 10.896 million VND/kg on the buying side and down 11.226 million VND/kg on the selling side compared to yesterday morning.

The price of Kim Phuc Loc 999 silver bars (1 tael) of Saigon Thuong Tin Commercial Joint Stock Company Limited (Sacombank-SBJ) is listed at 3.432 - 3.540 million VND/tael (buying - selling); down 51,000 VND/tael on the buying side and down 60,000 VND/tael on the selling side compared to yesterday morning.

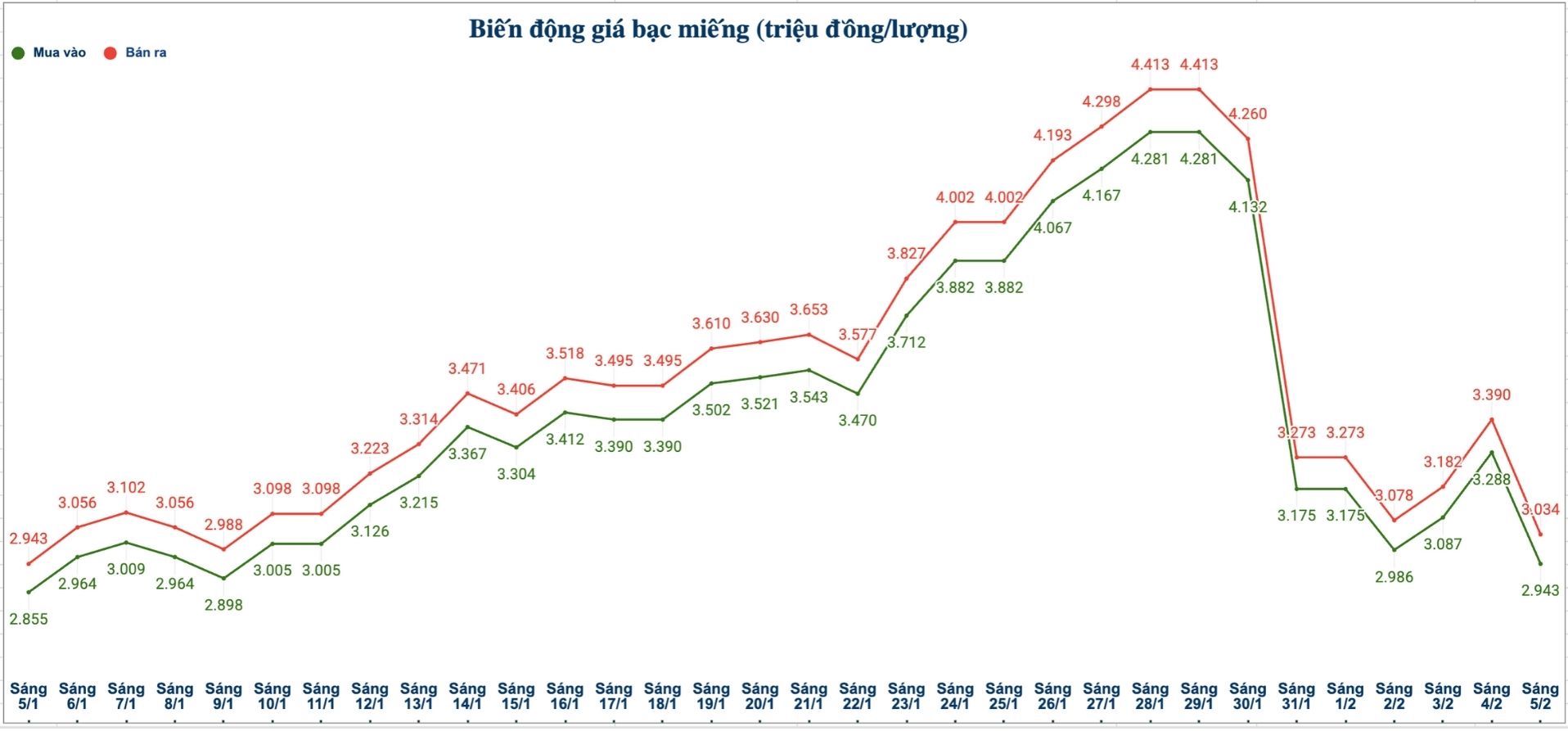

At the same time, the price of 999 silver bars (1 tael) at Phu Quy Jewelry Group was listed at the threshold of 2.943 - 3.034 million VND/tael (buying - selling); down 340,000 VND/tael on the buying side and down 350,000 VND/tael on the selling side compared to yesterday morning.

The price of 999 silver ingots (1kg) at Phu Quy Jewelry Group is listed at 78.479 - 80.906 million VND/kg (buying - selling); down 9.2 million VND/kg on the buying side and down 9.493 million VND/kg on the selling side compared to yesterday morning.

World silver price

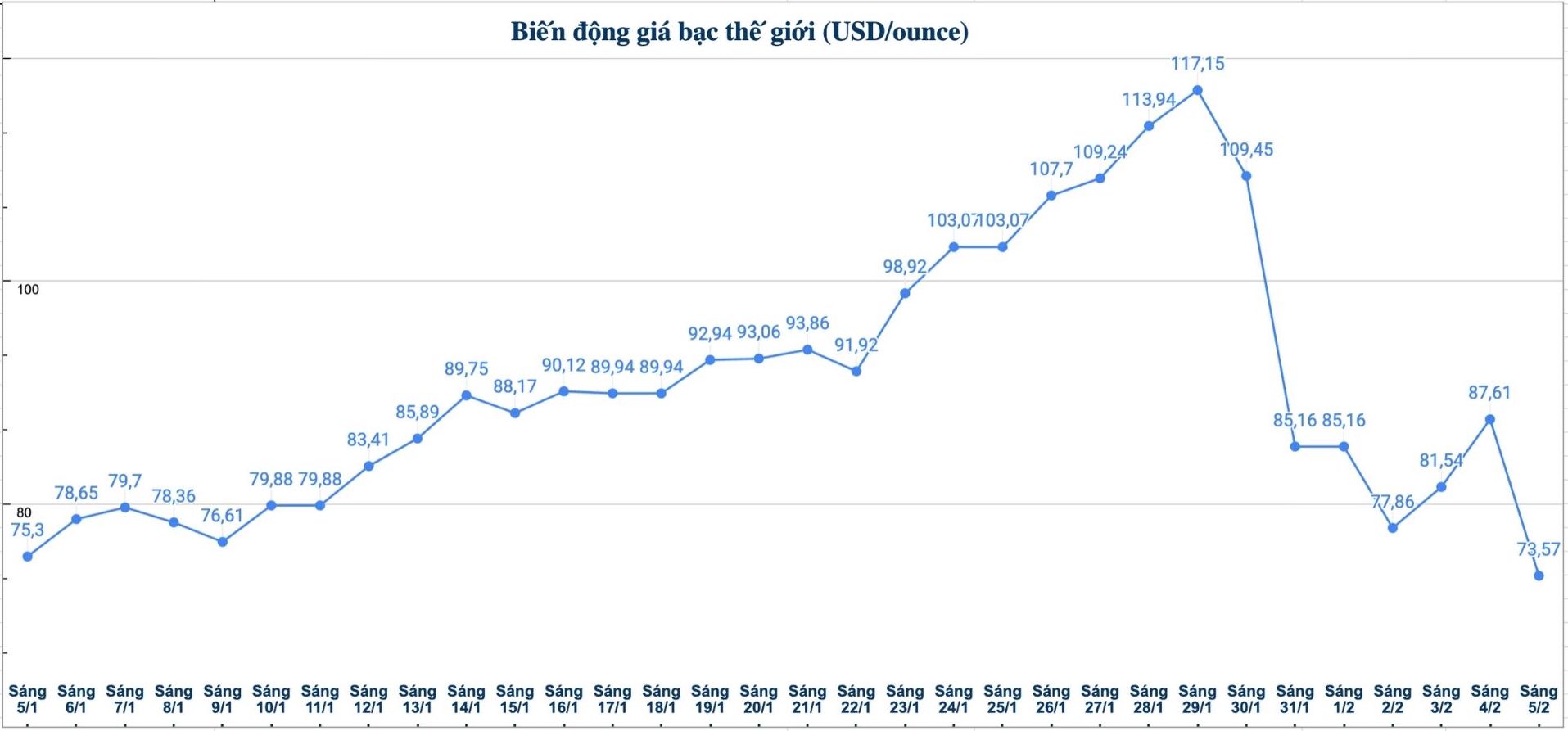

On the world market, as of 10:00 AM on February 5th (Vietnam time), the world silver price was listed at 73.57 USD/ounce; down 14.04 USD compared to yesterday morning.

Causes and forecasts

Unlike silver, gold is currently still supported by stable buying power from central banks, helping prices maintain a more solid foundation. Meanwhile, silver mainly attracts speculative cash flow thanks to its low price and fast profitability, but is also therefore easily under strong selling pressure when market sentiment changes.

According to precious metals analyst James Hyerczyk of FX Empire, this characteristic makes silver prices often fluctuate strongly, increasing rapidly during euphoric periods but also falling deeply when the market enters a correction phase, especially causing risks for investors using high leverage.

Mr. Hyerczyk said that in the recent adjustment, both gold and silver retreated to important price zones to seek support. Silver prices at one point fell to a low of 71.31 USD/ounce before recovering slightly, while the price range from about 74 to 84 USD/ounce is considered a noteworthy support area in the context that the short-term trend is still under downward pressure.

According to this expert, although gold and silver often fluctuate in the same direction, the amplitude and speed of increase and decrease of the two metals are different. In the current conditions, the expectation that silver prices will soon return to the peak of 121.67 USD/ounce is not really consistent with market developments.

Sharing the same cautious view, precious metals analyst Christopher Lewis at FX Empire said that the strong increase in silver in the past time was heavily speculative and far exceeded actual physical demand, thereby increasing the possibility of the market entering a correction phase.

However, Mr. Lewis believes that the long-term outlook for silver has not been completely denied.

This precious metal still has room to increase in price in the future, but it is difficult to maintain the hot growth rate as in the past period, and the current adjustment process is considered necessary for the market to re-establish a more reasonable price level" - Christopher Lewis assessed.

See more news related to silver prices HERE...