Domestic silver prices

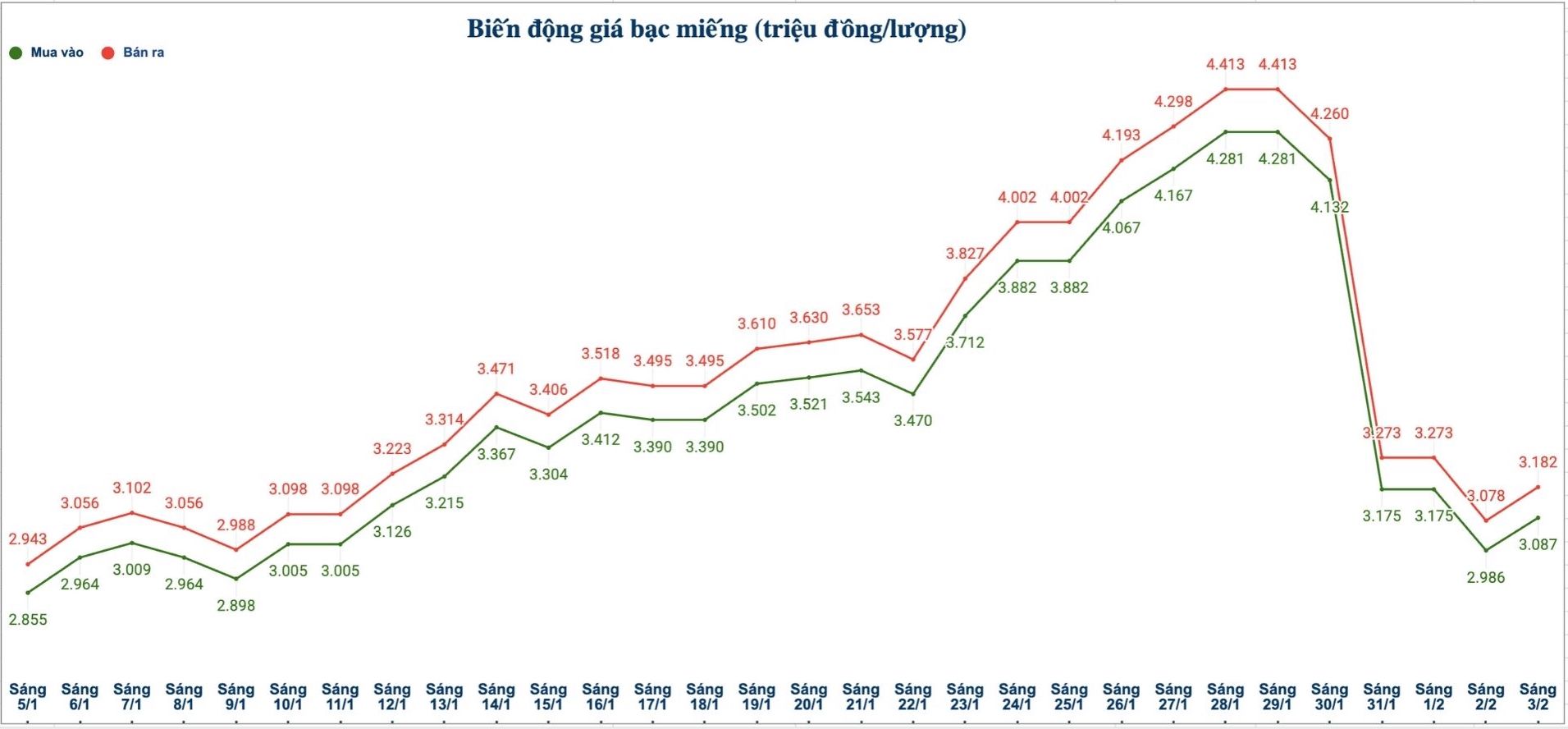

As of 10:15 am on February 3, the price of silver bars 2024 Ancarat 999 (1 tael) at Ancarat Gem Company was listed at 3.084 - 3.160 million VND/tael (buying - selling); an increase of 99,000 VND/tael on the buying side and an increase of 102,000 VND/tael on the selling side compared to yesterday morning.

The price of silver ingots 2025 Ancarat 999 (1kg) at Ancarat Gem Company is listed at the threshold of 81.296 - 83.766 million VND/kg (buying - selling); an increase of 2.64 million VND/kg on the buying side and an increase of 2.72 million VND/kg on the selling side compared to yesterday morning.

The price of Kim Phuc Loc 999 silver bars (1 tael) of Saigon Thuong Tin Commercial Joint Stock Company Limited (Sacombank-SBJ) is listed at the threshold of 3.288 - 3.405 million VND/tael (buying - selling).

At the same time, the price of 999 silver bars (1 tael) at Phu Quy Jewelry Group was listed at the threshold of 3.087 - 3.182 million VND/tael (buying - selling); an increase of 101,000 VND/tael on the buying side and an increase of 104,000 VND/tael on the selling side compared to yesterday morning.

The price of 999 silver ingots (1kg) at Phu Quy Jewelry Group is listed at 82.319 - 84.853 million VND/kg (buying - selling); an increase of 2.693 million VND/kg on the buying side and an increase of 2.774 million VND/kg on the selling side compared to yesterday morning.

World silver price

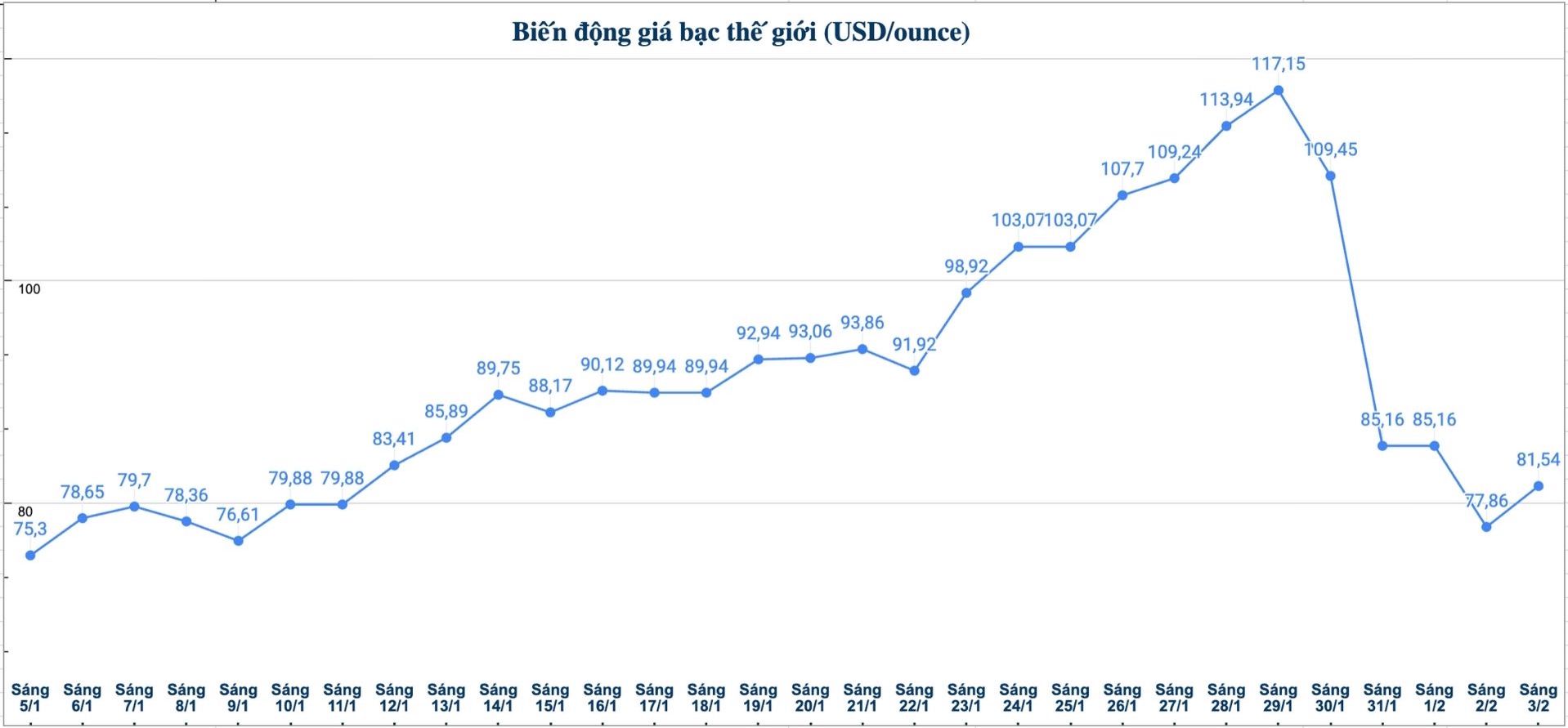

On the world market, as of 10:30 am on February 3rd (Vietnam time), the world silver price was listed at 81.54 USD/ounce; up 3.68 USD compared to yesterday morning.

Causes and forecasts

After a sharp decrease in the first trading session of the week, following a remarkable plunge on Friday, silver prices gradually recovered, helping the market temporarily cool down.

However, according to precious metals analyst Christopher Lewis at FX Empire, the market is still waiting to see if US investors will take advantage of this decline to buy in and push prices back up.

He assessed that the very large falling candlestick appearing in Friday's session is an unusual signal and rarely occurs randomly. Usually, after such sharp declines, the market will tend to continue its downward trend - which was partly shown in the Asian trading session at the beginning of the week.

However, it is not ruled out that silver prices will enter a sideways phase in the short term. If this scenario occurs, this can be seen as a positive signal, because a few accumulation sessions will attract back investors looking for buying opportunities at low prices" - Christopher Lewis said.

In the opposite direction, if silver prices lose the 70 USD/ounce mark, Christopher Lewis believes that the market is likely to have difficulty recovering in the long term.

Over the past time, silver prices have fluctuated very strongly in both ups and downs, showing that investor sentiment is still unstable. Therefore, round price levels, highly psychological - especially about 10 USD each - will play an important role in observing market reactions" - the expert said.

Currently, the 70 USD/ounce zone is considered an important floor level for silver prices. However, whether this support level is maintained or not still needs more time to be verified. Christopher Lewis believes that this is not the right time to risk participating in the silver market. Although the profit potential may be attractive, the accompanying risks are also very large.

Even in the event of silver price recovery, the price increase process is forecast to be slow and with many obstacles. The sharp drop last weekend is said to have caused significant damage to many trading accounts, increasing caution across the market" - Christopher Lewis assessed.

See more news related to silver prices HERE...