Domestic silver prices

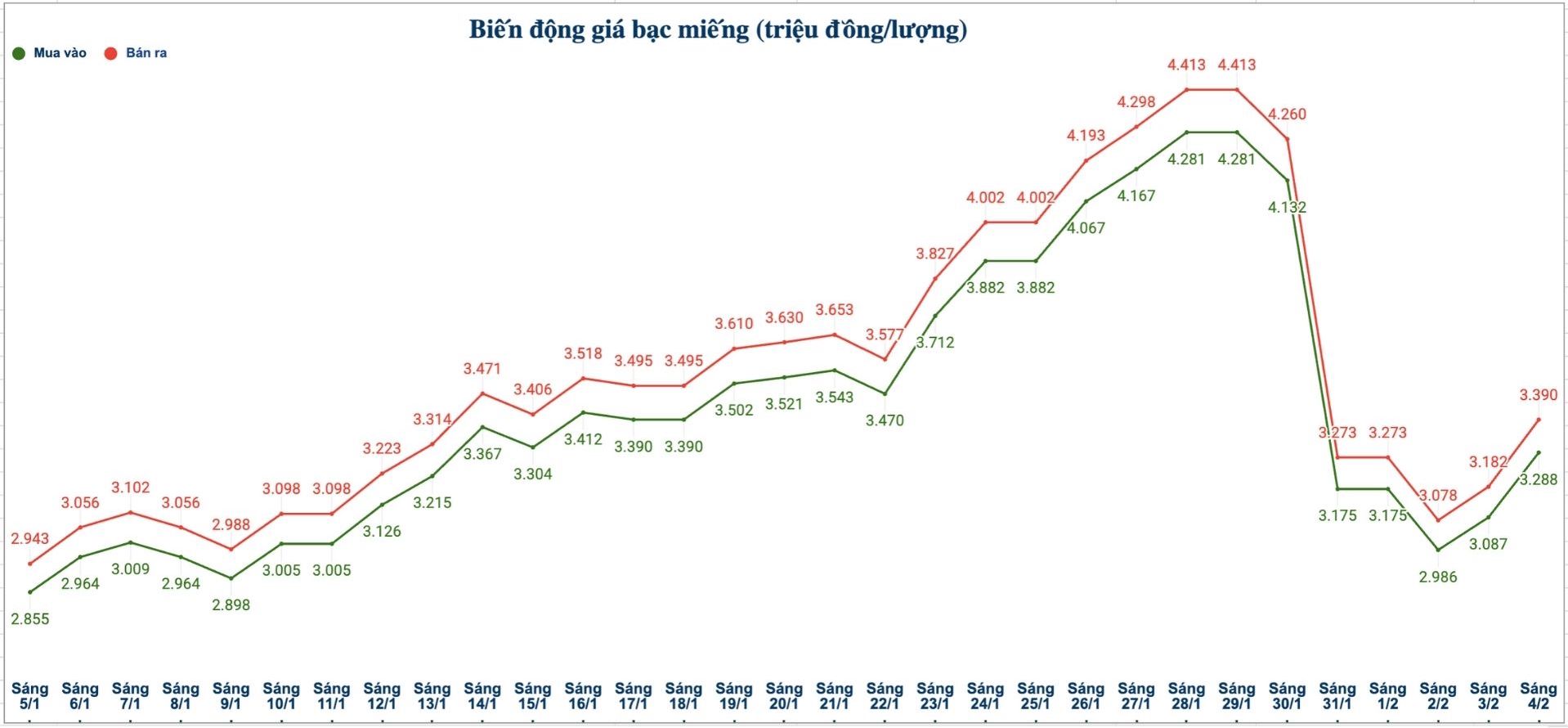

As of 10:05 AM on February 4th, the price of Kim Phuc Loc 999 silver bars (1 tael) of Saigon Thuong Tin Commercial Joint Stock Company Limited (Sacombank-SBJ) was listed at the threshold of 3.483 - 3.600 million VND/tael (buying - selling); an increase of 195,000 VND/tael in both directions compared to yesterday morning.

At the same time, the price of 999 silver bars (1 tael) at Phu Quy Jewelry Group was listed at the threshold of 3.288 - 3.390 million VND/tael (buying - selling); an increase of 201,000 VND/tael on the buying side and an increase of 208,000 VND/tael on the selling side compared to yesterday morning.

The price of 999 silver ingots (1kg) at Phu Quy Jewelry Group is listed at 87.679 - 90.399 million VND/kg (buying - selling); an increase of 5.36 million VND/kg on the buying side and an increase of 5.546 million VND/kg on the selling side compared to yesterday morning.

World silver price

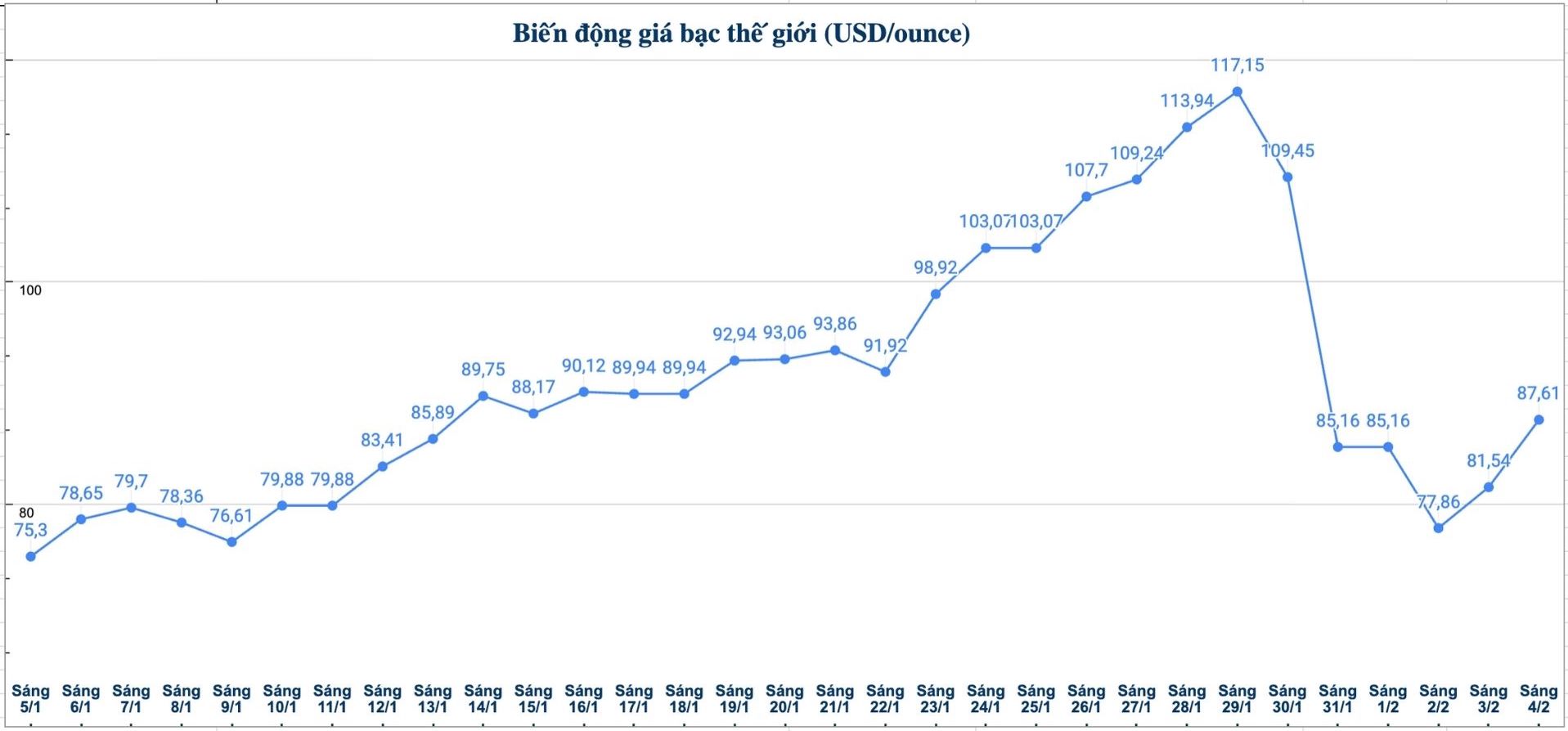

On the world market, as of 10:00 AM on February 4th (Vietnam time), the world silver price was listed at 87.61 USD/ounce; up 6.07 USD compared to yesterday morning.

Causes and forecasts

Silver prices are still in the process of finding a new bottom after a sharp drop in the last trading session last week. Although the price has shown signs of stabilizing again, precious metals analyst Christopher Lewis at FX Empire believes that investors still need to be cautious in the context that the market still has many unpredictable fluctuations.

Christopher Lewis said that in the first trading session of Tuesday, silver prices rose slightly when the 80 USD/ounce zone - playing an important support threshold - "A part of traders see short-term corrections as buying opportunities, in the context that this precious metal is trying to return to the 100 USD/ounce mark" - he said.

However, Christopher Lewis warns that a slow, stable recovery process will be healthier than previous impulsive surges. "The risk of silver prices having to retest lower support zones, even around the 50 USD/ounce mark, is still present and is a factor causing the market to maintain a cautious mentality," the expert said.

According to Christopher Lewis, silver prices are still likely to fall below 70 USD/ounce and return to test the 50 USD/ounce zone - a price that has played a role as a resistance level for decades. Previously, the market had surpassed the 50 USD/ounce mark without experiencing a significant correction, so many investors are closely monitoring the possibility of prices returning to this zone to strengthen the growth foundation.

The volatile trading session last Friday has made market sentiment more cautious, and investors will need time to regain confidence. In that context, investors should manage risks tightly, set reasonable cut-loss levels and not pour too much capital into one position, to avoid losses when the market suddenly fluctuates sharply" - Christopher Lewis said.

Although there are still many unstable factors, Christopher Lewis believes that more stable developments in recent sessions are considered an initial positive signal, opening up expectations for a more sustainable recovery process of silver prices in the near future.

See more news related to silver prices HERE...