Domestic silver prices

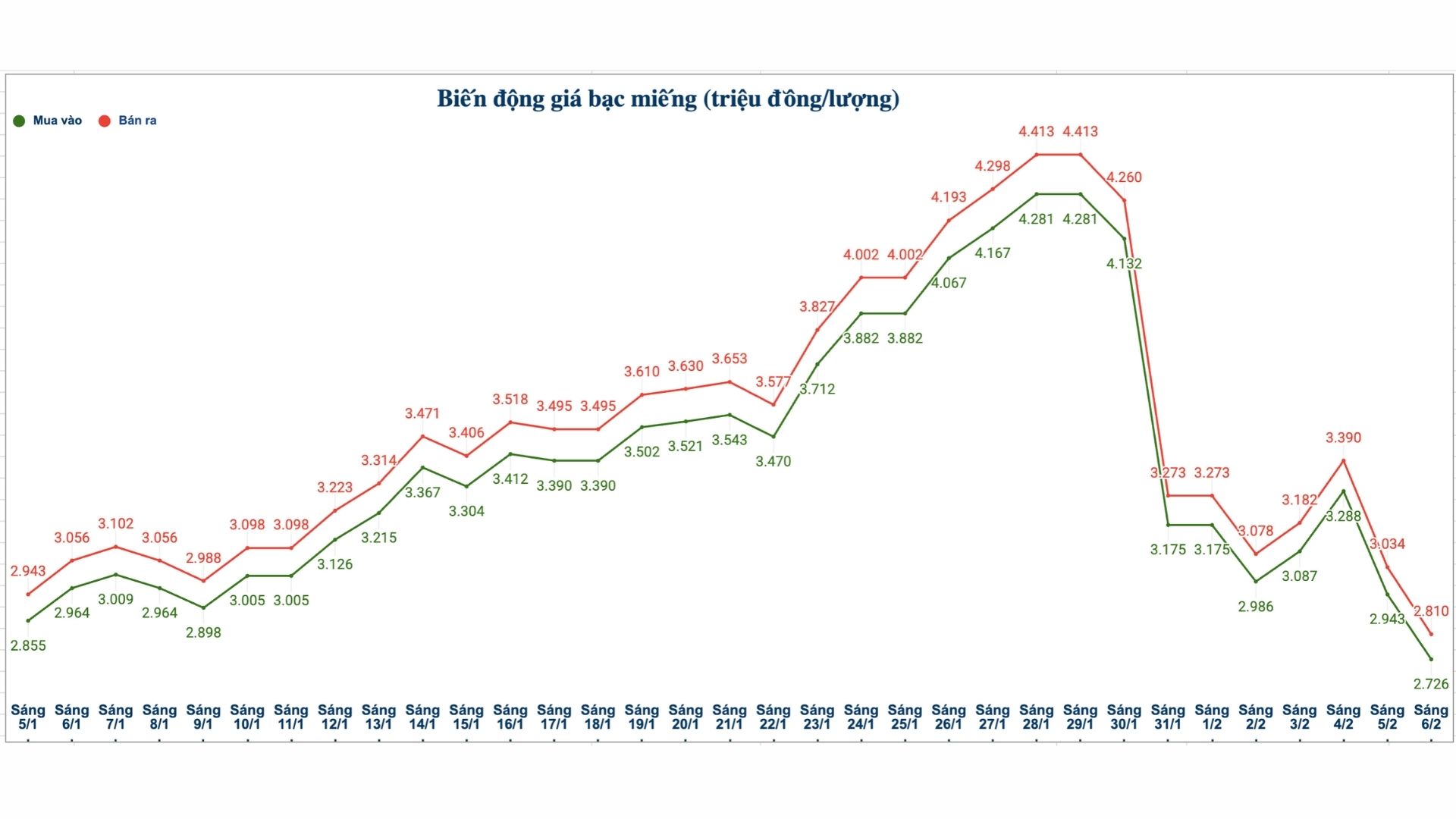

As of 9:35 am on February 6, the price of Kim Phuc Loc 999 silver bars (1 tael) of Saigon Thuong Tin Commercial Joint Stock Bank (Sacombank-SBJ) listed at the threshold of 3.102 - 3.210 million VND/tael (buying - selling); down 330,000 VND/tael in both buying and selling directions compared to yesterday morning.

At the same time, the price of 999 silver bars (1 tael) at Phu Quy Jewelry Group was listed at the threshold of 2.726 - 2.81 million VND/tael (buying - selling); down 217,000 VND/tael on the buying side and down 224,000 VND/tael on the selling side compared to yesterday morning.

The price of 999 silver ingots (1kg) at Phu Quy Jewelry Group is listed at 72.693 - 74.933 million VND/kg (buying - selling); down 5.786 million VND/kg on the buying side and down 5.973 million VND/kg on the selling side compared to yesterday morning.

World silver price

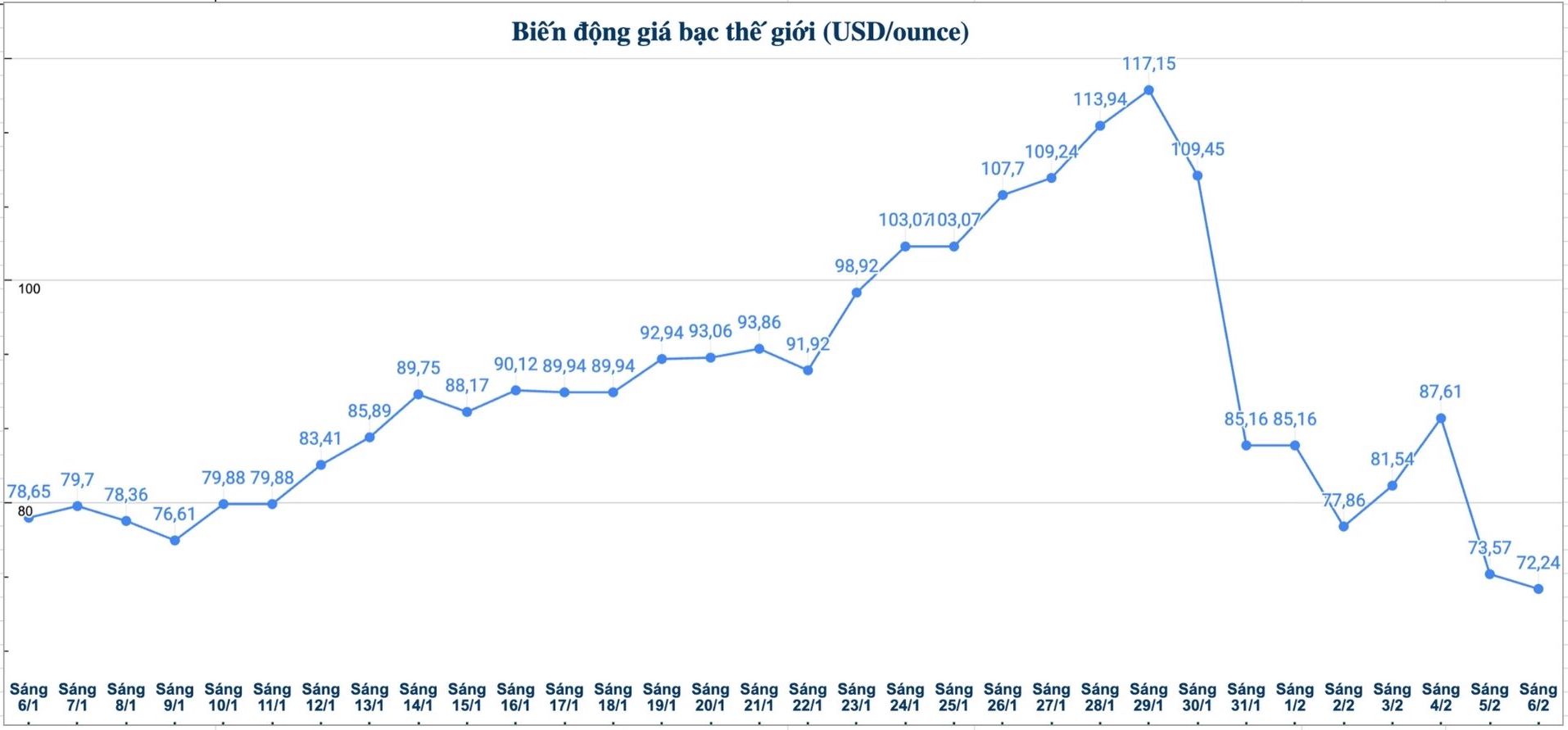

On the world market, as of 9:35 am on February 6 (Vietnam time), the world silver price was listed at 72.24 USD/ounce; down 1.33 USD compared to yesterday morning.

Causes and forecasts

In Friday's trading session, spot silver prices fell sharply, continuing the downward trend of the previous week after two days of temporary stagnation. According to precious metals analyst James Hyerczyk of FX Empire, the main reason is believed to be the weakening of the gold market.

Previously, in Wednesday's session, silver showed signs of being weaker than gold when it could not keep up with the recovery momentum of this precious metal in the technical correction zone from 96.49 - 102.43 USD/ounce," he said.

In addition to the weakening of gold, James Hyerczyk believes that the sell-off also stems from the strengthening of the USD and reduced global geopolitical tensions, weakening the safe haven role of precious metals. In addition, low market liquidity also makes price fluctuations stronger and more difficult to control.

In addition, boredom is spreading to the long-term investor group. After a long period of persistently holding positions when prices increased, many people are no longer patient enough and accept selling, in the context that the market has not found a stable price. Some price levels being mentioned include the peak on December 5, 2025 at 59.34 USD/ounce and the psychological threshold of 50 USD/ounce" - James Hyerczyk said.

In the context of too much selling pressure and a lack of strong enough buying power, James Hyerczyk believes that the short-term outlook for silver is still leaning towards deep decline risk.

See more news related to silver prices HERE...