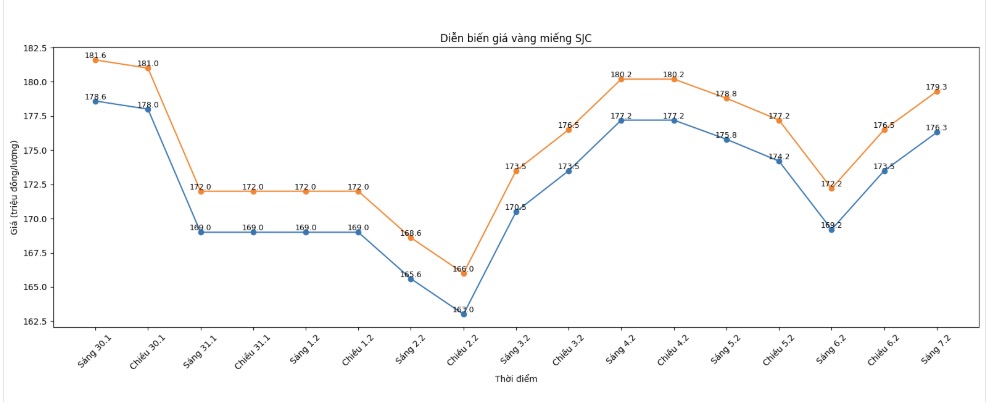

SJC gold bar price

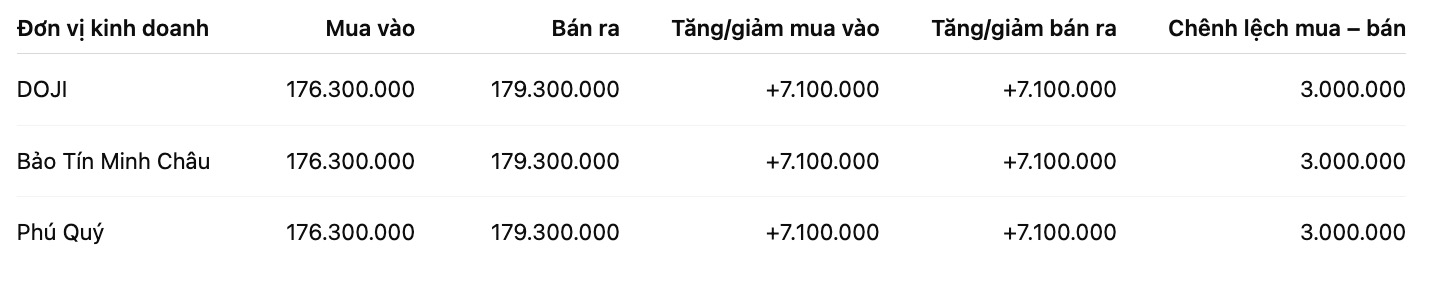

As of 9:00 AM, SJC gold bar prices were listed by DOJI Group at 176.3-179.3 million VND/tael (buying - selling), an increase of 7.1 million VND/tael in both buying and selling directions. The difference between buying and selling prices is at the threshold of 3 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 176.3-179.3 million VND/tael (buying - selling), an increase of 7.1 million VND/tael in both buying and selling directions. The difference between buying and selling prices is at the threshold of 3 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at 176.3-179.3 million VND/tael (buying - selling), an increase of 7.1 million VND/tael in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

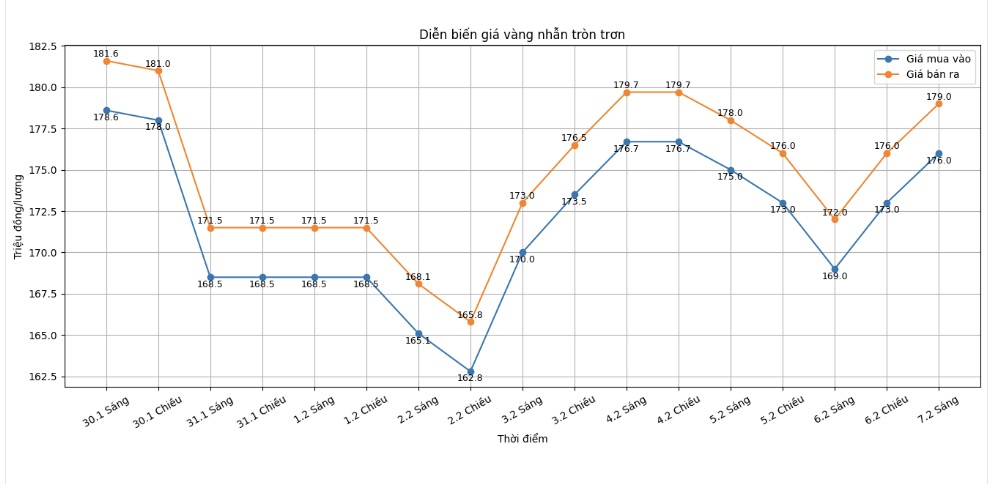

9999 gold ring price

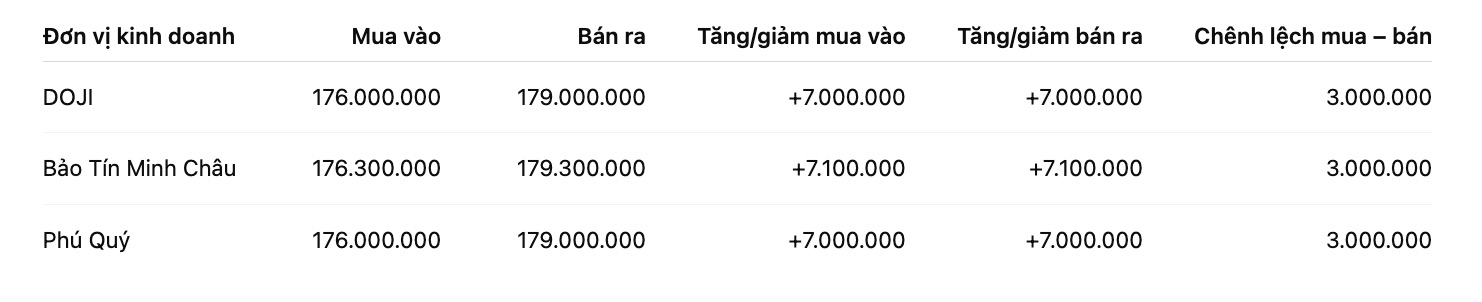

As of 9:00 AM, DOJI Group listed the price of gold rings at 176-179 million VND/tael (buying - selling), an increase of 7 million VND/tael in both directions compared to the previous day. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 176.3-179.3 million VND/tael (buying - selling), an increase of 7.1 million VND/tael in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

Phu Quy Gold and Gems Group listed the price of gold rings at 176-179 million VND/tael (buying - selling), an increase of 7 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Currently, the buying - selling price difference of gold is at a very high level, around 2 to 3 million VND/tael, posing a risk of losses for investors.

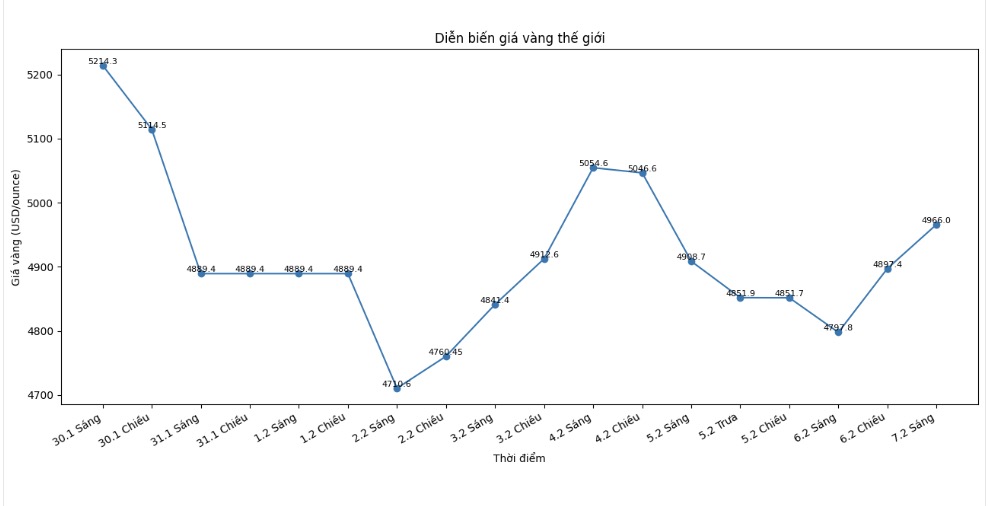

World gold price

At 9:08 am, world gold prices were listed around the threshold of 4,966 USD/ounce, a sharp increase of 168.2 USD compared to the previous day.

Gold price forecast

After a strong fluctuation in recent sessions, world gold prices are showing signs of stabilizing again as important support and resistance zones are gradually being established. Although it has not been able to successfully conquer the psychological milestone of 5,000 USD/ounce, the recovery of this precious metal shows that the long-term upward trend has not been broken.

In the past week, gold prices rebounded significantly after falling deeper to the lowest level since the beginning of January. Bottom-fishing buying appeared strongly around the 4,400 USD/ounce area, helping prices quickly recover, bringing gold closer to the 5,000 USD/ounce threshold. However, profit-taking pressure and the improvement of the US stock market have made gold not strong enough to break through this resistance zone.

Technical indicators show that the upward trend structure of gold is still maintained. Notably, the price continues to fluctuate above important support zones, reflecting the market's fairly good resistance even after strong correction sessions. The short-term trading range is gradually narrowing, with the near support zone being defined around the 4,650 USD/ounce mark, while the immediate resistance level is still the 5,000 USD/ounce area.

From a macroeconomic perspective, the upward momentum of the USD index in recent times has somewhat put pressure on gold prices. In addition, the return of money to the US stock market has also caused the demand for safe-haven assets to decline in the short term. However, geopolitical factors still contain many unpredictable risks, thereby continuing to play an important supporting role for gold prices.

Regarding the medium-term outlook, experts from the Royal Bank of Canada (CIBC) remain optimistic about this precious metal. In a report released in early February, CIBC strongly raised its forecast for the average gold price in 2026 to 6,000 USD/ounce, significantly higher than previous forecasts. The bank believes that the weakening trend of the USD, along with prolonged geopolitical instability and expectations of loose monetary policy, will continue to strengthen the role of gold in the global investment portfolio.

According to CIBC, although the market may still experience short-term corrections, gold is likely to form a new higher price level in the coming period, as structural supporting forces have not changed.

Gold price data is compared to the previous day.

See more news related to gold prices HERE...