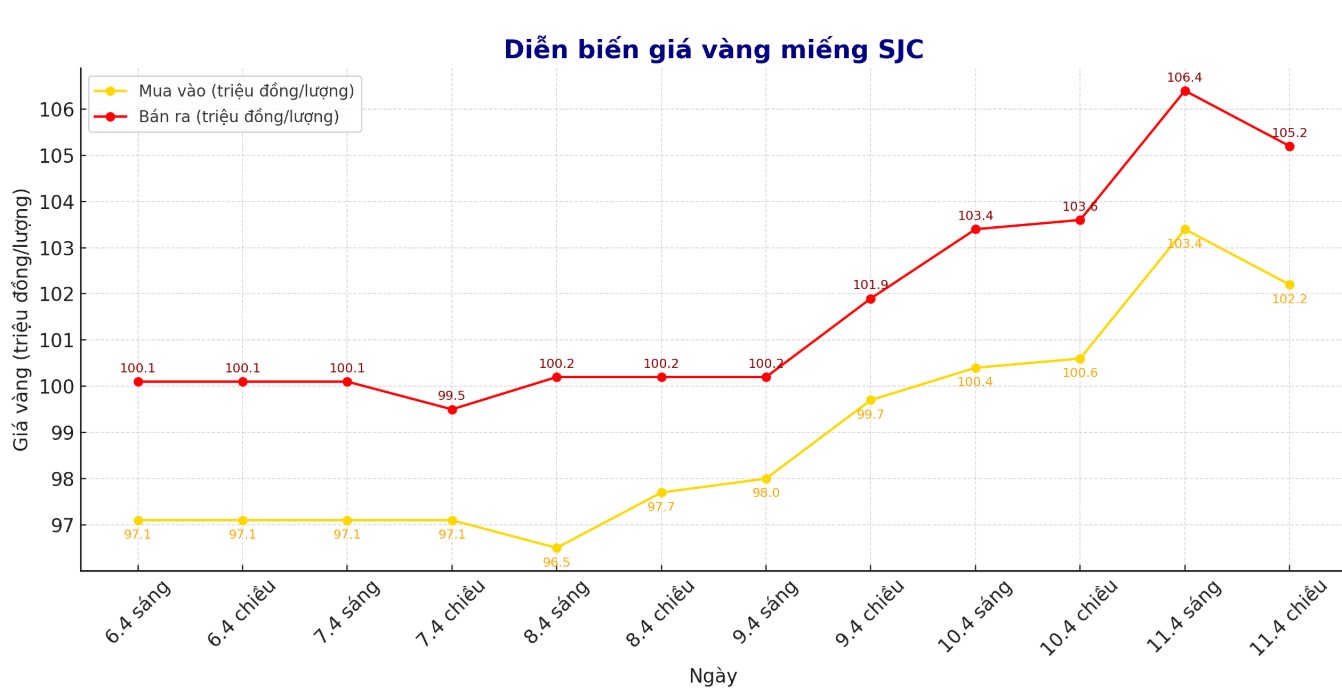

Updated SJC gold price

As of 6:00 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND102.2-105.2 million/tael (buy in - sell out); an increase of VND1.6 million/tael for both buying and selling. The difference between buying and selling prices is at 3 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 102.2-105.2 million VND/tael (buy - sell); an increase of 1.6 million VND/tael for both buying and selling. The difference between buying and selling prices is at 3 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 102.2-105.2 million VND/tael (buy - sell); increased by 1.6 million VND/tael for both buying and selling. The difference between buying and selling prices is at 3 million VND/tael.

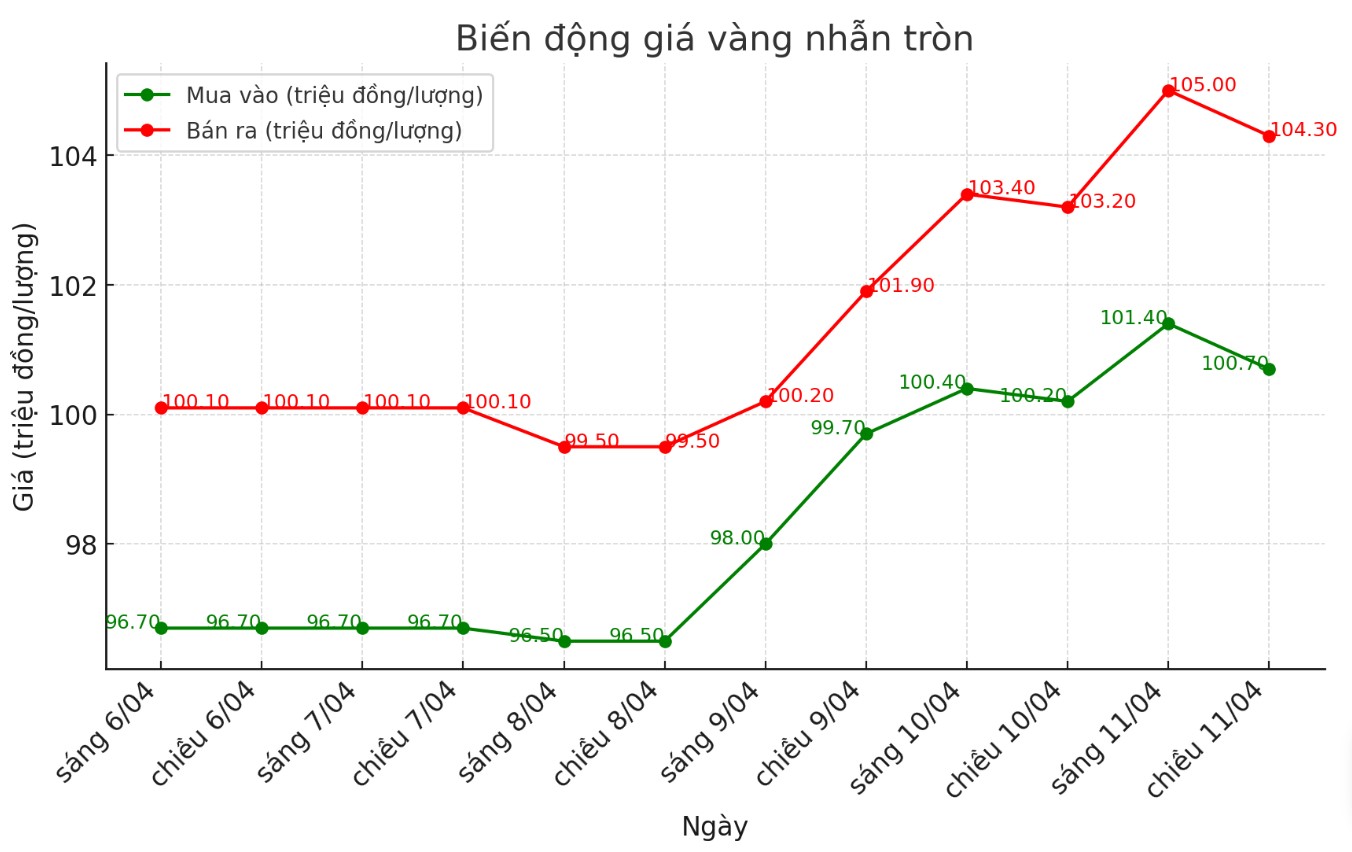

9999 round gold ring price

As of 5:00 p.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 100.7-104.3 million VND/tael (buy - sell); an increase of 500,000 VND/tael for buying and an increase of 1.1 million VND/tael for selling compared to early in the morning. The difference between buying and selling prices is at 3.6 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 100.9-104.5 million VND/tael (buy - sell); an increase of 200,000 VND/tael for buying and an increase of 800,000 VND/tael for selling compared to early in the morning. The difference between buying and selling prices is at 3.6 million VND/tael.

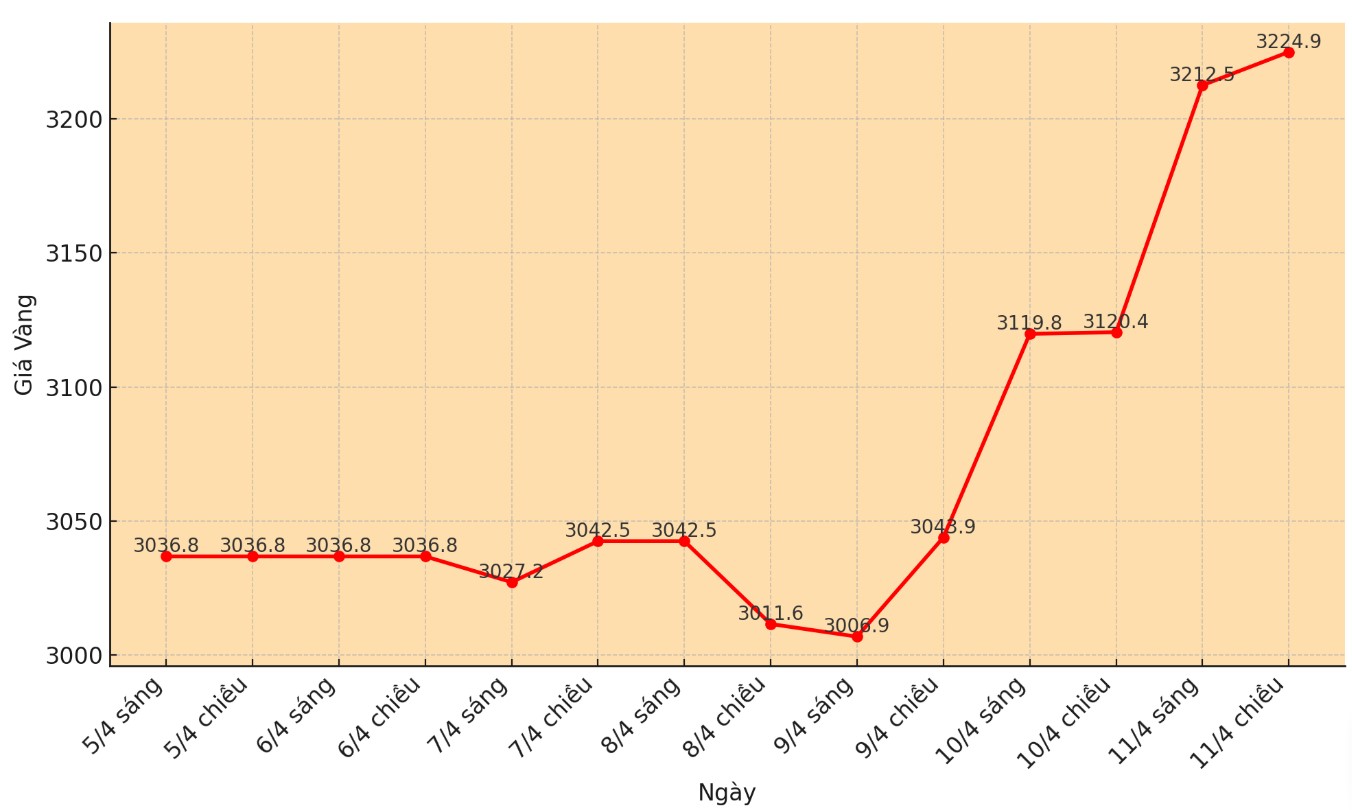

World gold price

As of 5:00 p.m., the world gold price was listed at 3,224.9 USD/ounce, up 104.5 USD.

Gold price forecast

According to Reuters, gold prices increased by nearly 2% and exceeded the important threshold of 3,200 USD/ounce in the trading session on Friday, as concerns about an increased economic recession amid the escalating US-China trade war and a weakening USD.

According to Kitco, gold has become attractive due to strong safe-haven demand. The US stock market is fluctuating, concerns about the US-China trade war, as well as the US inflation report cooling down, are prompting precious metals traders this weekend.

There are also concerns about the stability of the US bond market.

World gold prices increased sharply after the number of weekly US jobless claims decreased, while the CPI decreased more than expected.

The number of Americans filing for new unemployment benefits is lower than economists predicted. The number of initial jobless claims to states in the week ended April 5 was 223,00, according to the US Department of Labor on Thursday.

This figure is lower than expected, as experts predict it will be 226,000. Last week's figure was revised down to 219,000.

According to the US Bureau of Labor Statistics on Thursday (local time), the country's consumer price index (CPI) fell 0.1% last month, after rising 0.2% in February. This inflation data is lower than expected, as economists expect the CPI to increase by 0.1%.

The report said that overall inflation in the past 12 months increased by 2.4%, down sharply from 2.9% in February. Economic experts have forecast annual inflation to increase by 2.5%.

Since last year, gold prices have maintained a strong increase, setting many record peaks and increasing nearly 21% this year, thanks to the demand for shelter, buying from central banks and the flow of money into gold ETFs.

We believe gold could increase further in a positive scenario, targeting $3,400 to $3,500 an ounce in the next few months, UBS expert Giovanni Staunovo predicted.

Note: The article data compares with the same time of the previous trading session.

See more news related to gold prices HERE...