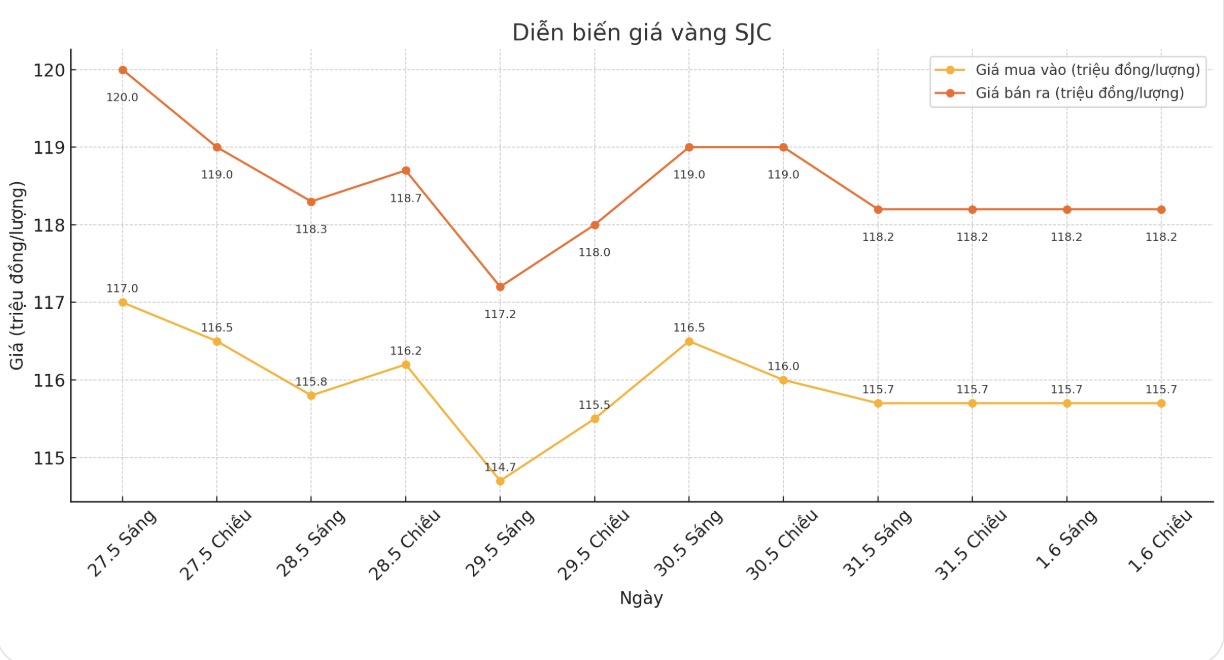

SJC gold bar price

At the end of the trading session of the week, DOJI Group listed the price of SJC gold at 115.7/18.2 million VND/tael (buy in - sell out).

Compared to the closing price of last week's trading session (May 25, 2025), the price of SJC gold bars at DOJI decreased by 3.3 million VND/tael for buying and decreased by 2.8 million VND/tael for selling.

The difference between the buying and selling prices of SJC gold at DOJI Group is at 2.5 million VND/tael.

Meanwhile, Saigon Jewelry Company SJC listed the price of SJC gold at 115.7/18.2 million VND/tael (buy in - sell out).

Compared to the closing price of last week's trading session (May 25, 2025), the price of SJC gold bars at Saigon Jewelry Company SJC decreased by 3.3 million VND/tael for buying and decreased by 2.8 million VND/tael for selling.

The difference between the buying and selling prices of SJC gold at Saigon Jewelry Company SJC is at 2.5 million VND/tael.

If buying SJC gold at DOJI Group and Saigon Jewelry Company SJC in the session of May 25 and selling it in today's session (January 16), gold buyers at DOJI Group and Saigon Jewelry Company SJC will both lose 5.3 million VND/tael.

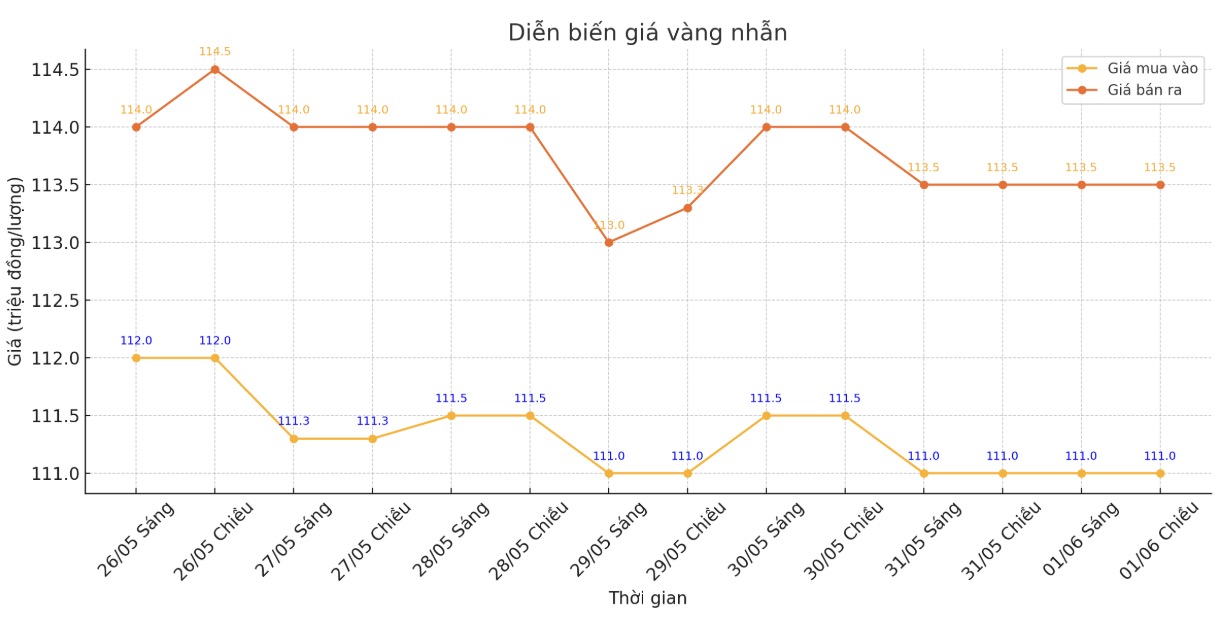

9999 gold ring price

This morning (January 1), the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 111-113.5 million VND/tael (buy - sell); down 2.5 million VND/tael in both directions compared to the closing price of the previous trading session. The difference between buying and selling is at 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 113-116 million VND/tael (buy - sell); down 2.5 million VND/tael in both directions compared to the closing price of the previous trading session. The difference between buying and selling is at 3 million VND/tael.

If buying gold rings in the session of May 25 and selling in today's session (September 1), buyers at DOJI will lose 5 million VND/tael, while buyers at Bao Tin Minh Chau will lose 5.5 million VND/tael.

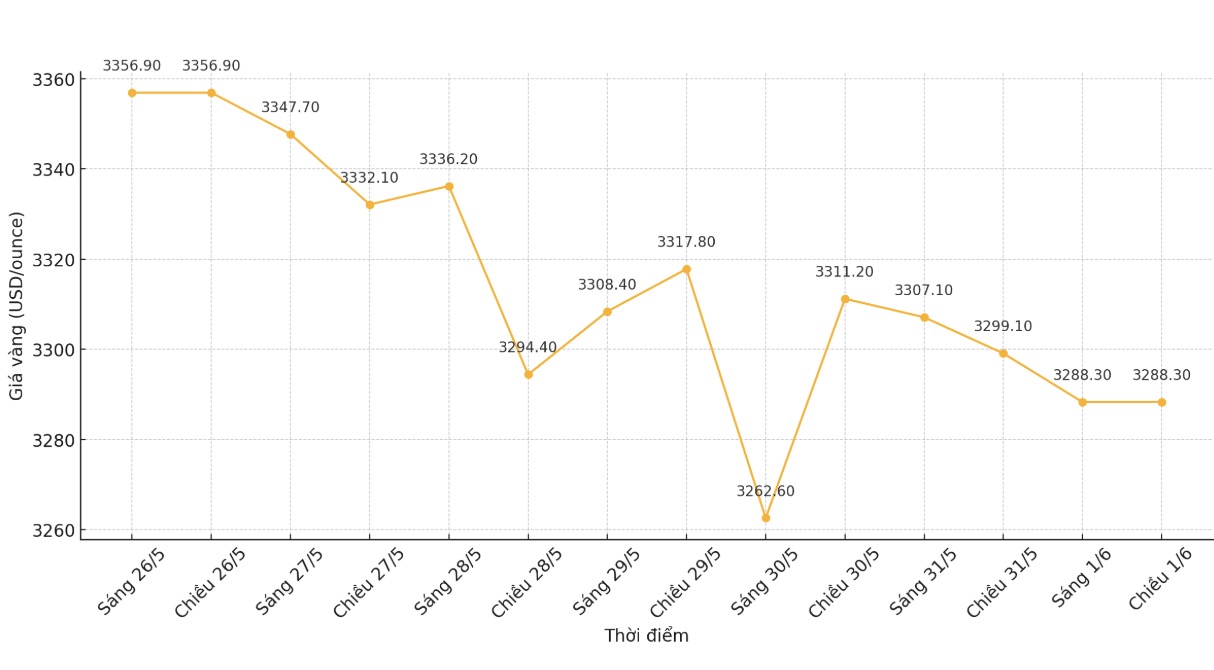

World gold price

At the end of the trading session of the week, the world gold price listed on Kitco was at 3,288.3 USD/ounce, down sharply by 68.6 USD/ounce compared to the closing price of the previous trading session.

Gold price forecast

Gold prices fell last week as conflicting statements and legal judgments related to tariffs made many investors no longer interested in thrilling news, but instead turned to chart and data analysis.

Currently, industry experts and retail traders have a more balanced view on the potential of precious metal prices in the coming time.

Adam Button, head of foreign exchange strategy at Forexlive.com, also said that gold will go up. According to him, new political and trade moves from US President Donald Trump continue to make the market worried, causing gold prices to increase.

Meanwhile, Mr. Adrian Day - Chairman of Adrian Day Asset Management - said that gold prices will fluctuate strongly but it is difficult to decrease deeply because there is always buying pressure when prices decrease.

Gold drivers have been around before Trump, before the war in Ukraine, and they are still in place, he stressed. Central banks have been diversifying their US dollar reserves for years.

Mr. Day said that even if economic data such as employment has slight changes, they will no longer have a big impact as the US Federal Reserve (FED) is temporarily suspending policy adjustments. Only when the data is too bad that forces the Fed to cut interest rates early will gold bounce strongly, he said.

According to Adrian Ash - Research Director at Bullion Vault (the world's leading gold and silver investment platform for private investors), gold prices fell 0.9% in May. This is the first monthly decrease since December 2024. Gold has not decreased for two consecutive months since October 2022. The past 30 months have been a long period of gold rally, but it is nothing compared to the record 143 months, which began in the summer of 2000 and ended nearly 12 years later.

Notable economic data next week

Monday: US ISM manufacturing index.

Tuesday: July 1st job placement (JOLTS) in the US.

Wednesday: US ADP Employment Report, Bank of Canada monetary policy decision, US ISM Services Index.

Thursday: European Central Bank (ECB) monetary policy meeting, US weekly jobless claims.

Friday: US Non-farm Payrolls.

See more news related to gold prices HERE...