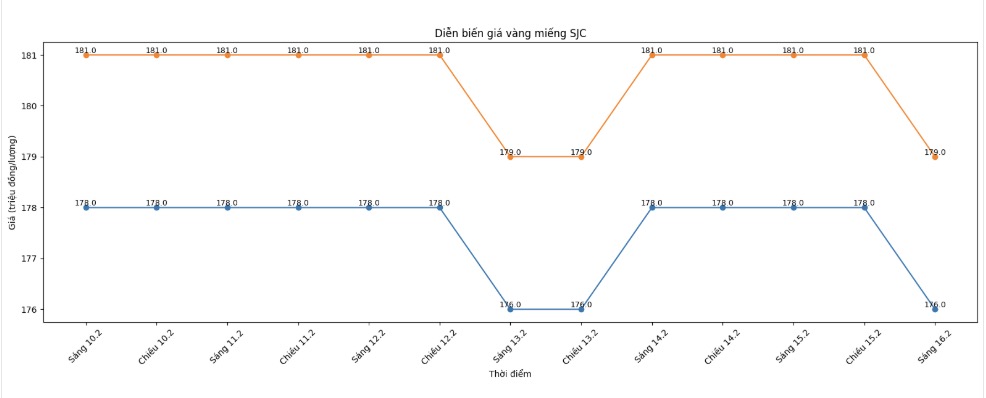

SJC gold bar price

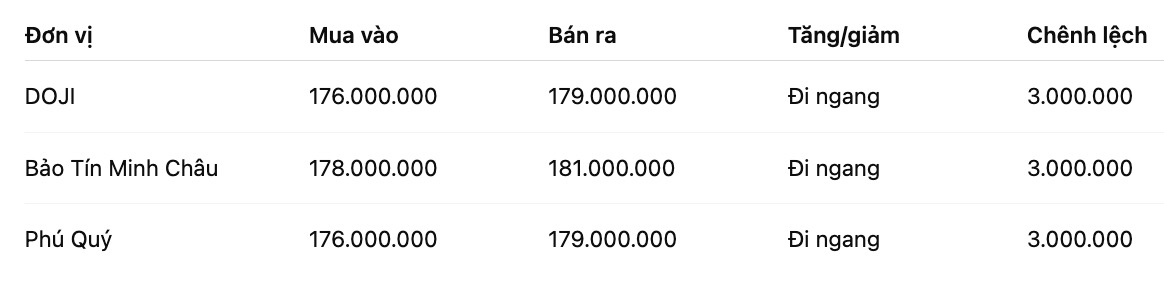

As of 9:20 am, SJC gold bar prices were listed by DOJI Group at 176-179 million VND/tael (buying - selling), unchanged in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

SJC gold bar price is listed by Bao Tin Minh Chau at 178-181 million VND/tael (buying - selling), unchanged. The difference between buying and selling prices is at 3 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at 176-179 million VND/tael (buying - selling), unchanged in both directions. The difference between buying and selling prices is at 3 million VND/tael.

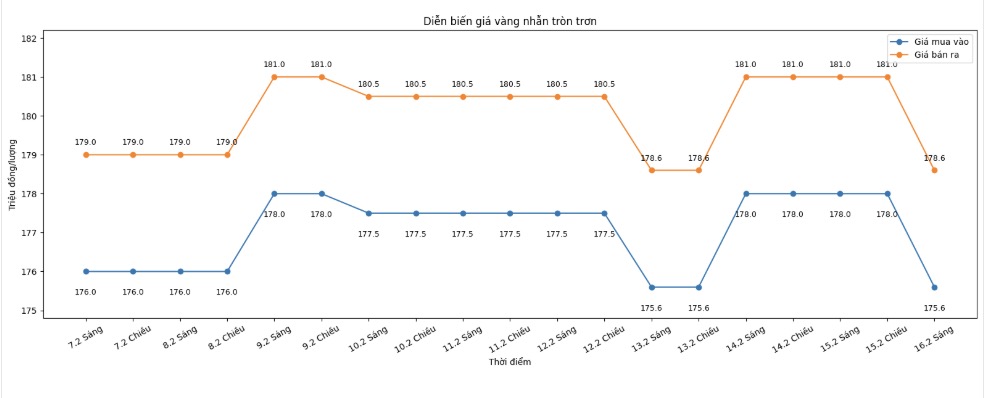

9999 gold ring price

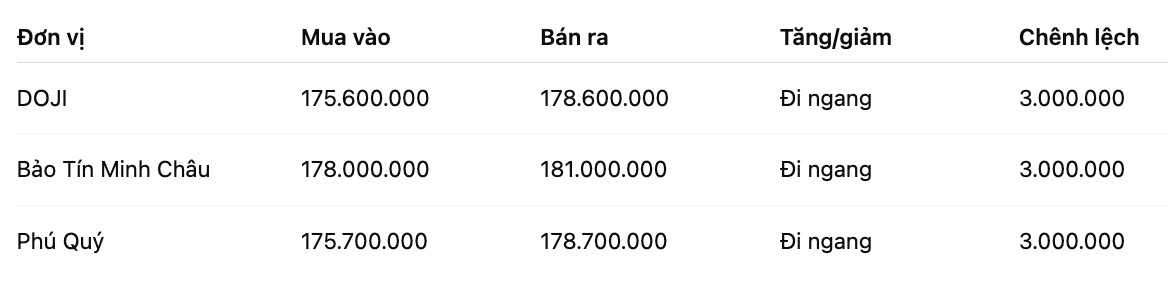

As of 9:30 am, DOJI Group listed the price of gold rings at 175.6-178.6 million VND/tael (buying - selling), unchanged in both directions compared to the previous day. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 178-181 million VND/tael (buying - selling), unchanged in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

Phu Quy Gold and Gems Group listed the price of gold rings at the threshold of 175.7-178.7 million VND/tael (buying - selling), unchanged in both directions. The buying - selling difference is at 3 million VND/tael.

Currently, the buying - selling price difference of gold is at a very high level, around 3 million VND/tael, posing a risk of losses for investors.

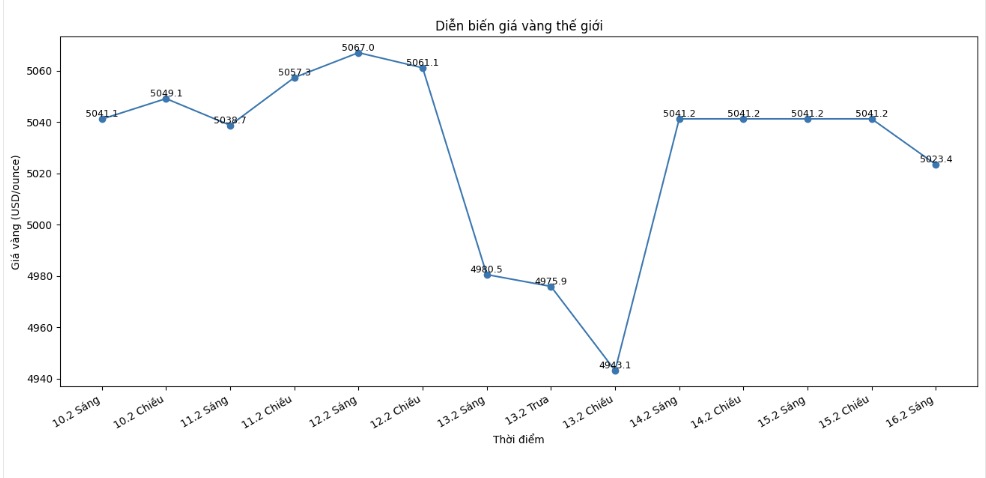

World gold price

At 9:20 am, world gold prices were listed around the threshold of 5,023.4 USD/ounce, down 17.8 USD compared to the previous day.

Gold price forecast

After the strong fluctuations of the international market, many Wall Street experts continue to maintain a cautious view on the short-term outlook of gold prices.

The deep decline in a very short time in the last session of the week is considered a signal that the risk of adjustment is still present, despite the prolonged upward trend from the beginning of the year.

Mr. Alex Kuptsikevich - senior market analyst at FxPro said that gold may face downward pressure not only next week but also extending to the subsequent period. According to him, the fact that the price fluctuated for most of the time in the high zone but suddenly plunged nearly 4% in less than an hour has sent a noteworthy warning.

Gold has maintained an upward trend since February, but the recent shock drop shows that the selling side has not retreated. This reflects that market sentiment is becoming more fragile," Mr. Kuptsikevich analyzed.

This expert also pointed out a less positive picture from other precious metals. While silver continuously forms lower peaks, platinum also weakens after each recovery. According to him, this divergence usually appears when cash flow begins to be more cautious with the safe-haven asset group.

From a technical perspective, Kuptsikevich believes that gold prices may retreat to the 4,600 - 4,700 USD/ounce range, where important support levels converge, including the 50-day moving average. If this area is breached, selling pressure may increase significantly.

Meanwhile, Mr. Adam Button - Head of Currency Strategy at Forexlive. com said that the sudden sell-off at the weekend is a reminder of the unpredictability of the current gold market. According to him, immediately after the strong fluctuation, many speculations appeared but there was no truly convincing explanation.

This is a type of session that makes analysts more cautious. Price volatility cannot always be explained by economic data or macroeconomic news," Mr. Button said.

He leans towards the possibility that the market will be affected by position clearing or margin calls, rather than fundamental factors. Buttons warning of a volatile environment are making valuation and trading strategy making it more difficult.

In the short term, this expert assesses that adjustment risk still prevails, as the market has not yet seen a strong enough catalyst to pull prices up sustainably. According to him, gold may need more time to accumulate and stabilize the fluctuation band before attracting investment capital back.

Gold price data is compared to the previous day.

See more news related to gold prices HERE...