SJC gold bar price

As of 5:05 p.m., DOJI Group listed the price of SJC gold bars at 149-151 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 149.5-151 million VND/tael (buy - sell), an increase of 500,000 VND/tael for buying and unchanged for selling. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 148-151 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 3 million VND/tael.

9999 gold ring price

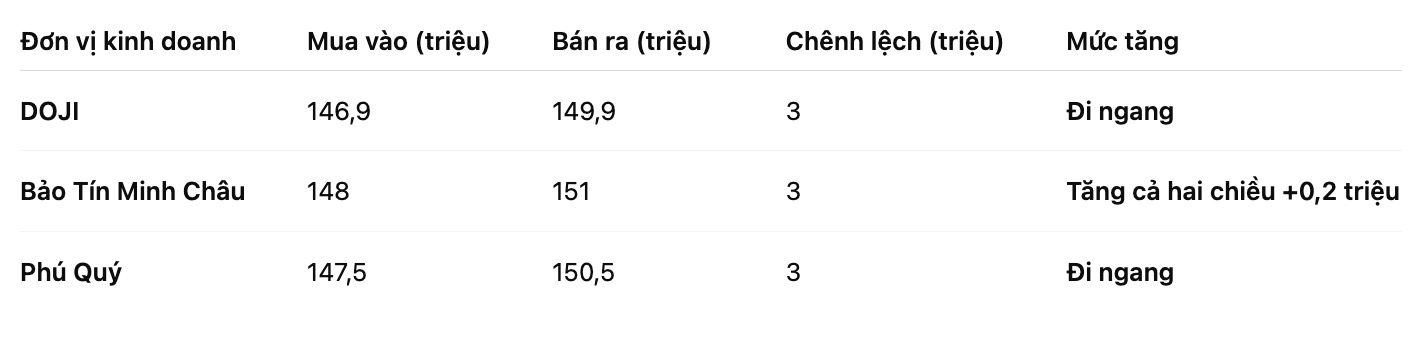

As of 5:05 p.m., DOJI Group listed the price of gold rings at 146.9-149.9 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 148-151 million VND/tael (buy - sell), an increase of 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 147.5-150.5 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

World gold price

The world gold price was listed at 5:05 p.m., at 4,088.3 USD/ounce, up 7.6 USD compared to a day ago.

Gold price forecast

Gold prices fluctuated in the second session of the month, under pressure from the increase of the USD as investors waited for a series of US economic data to be released this week to better clarify the interest rate roadmap of the Federal Reserve (FED).

Mr. Tim Waterer - Head of Market Analysis at KCM Trade - commented: "Expectations of the FED cutting interest rates next month have been narrowed, and this is actually hampering gold from the yield perspective.

Even if the government shutdown is over, there is no guarantee that the market or even the Fed will have enough data to assess the economy... The hawkish comments from Fed officials do not bring any benefits to gold".

Mr. Adrian Day - Chairman of Adrian Day Asset Management - commented: "There is still a lot of uncertainty surrounding the US economy, taxes and further interest rate moves. Gold may have to re-evaluate the recent bottom around $3,930/ounce before recovering convincingly. However, if there is an adjustment, it will likely be short and shallow, because the core factors supporting gold are still there."

Meanwhile, Ole Hansen - Director of Commodity Strategy at Saxo Bank - said that he is optimistic about gold this week, unless the stock market experiences a strong sell-off. The S&P 500 index this week was under significant selling pressure but still maintained the important support zone above 6,600 points.

Hansen believes that in the event of a widespread stock market slump, no asset - other than the Japanese Yen - can avoid short-term selling pressure.

In a remarkable development, SPDR Gold Trust, the world's largest gold ETF, said its holdings fell 0.47% to 1,044 tons on Friday from 1,048.93 tons on Thursday.

Notable US economic data for the week

Monday: Empire State Production Survey.

Wednesday: Minutes of the Federal Open Market Committee (FOMC) meeting.

Thursday: Philly FED Production Survey, Weekly Unemployment claims, existing home sales.

Friday: S&P's preliminary PMI, University of Michigan Consumer Confidence Index (edited version).

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...