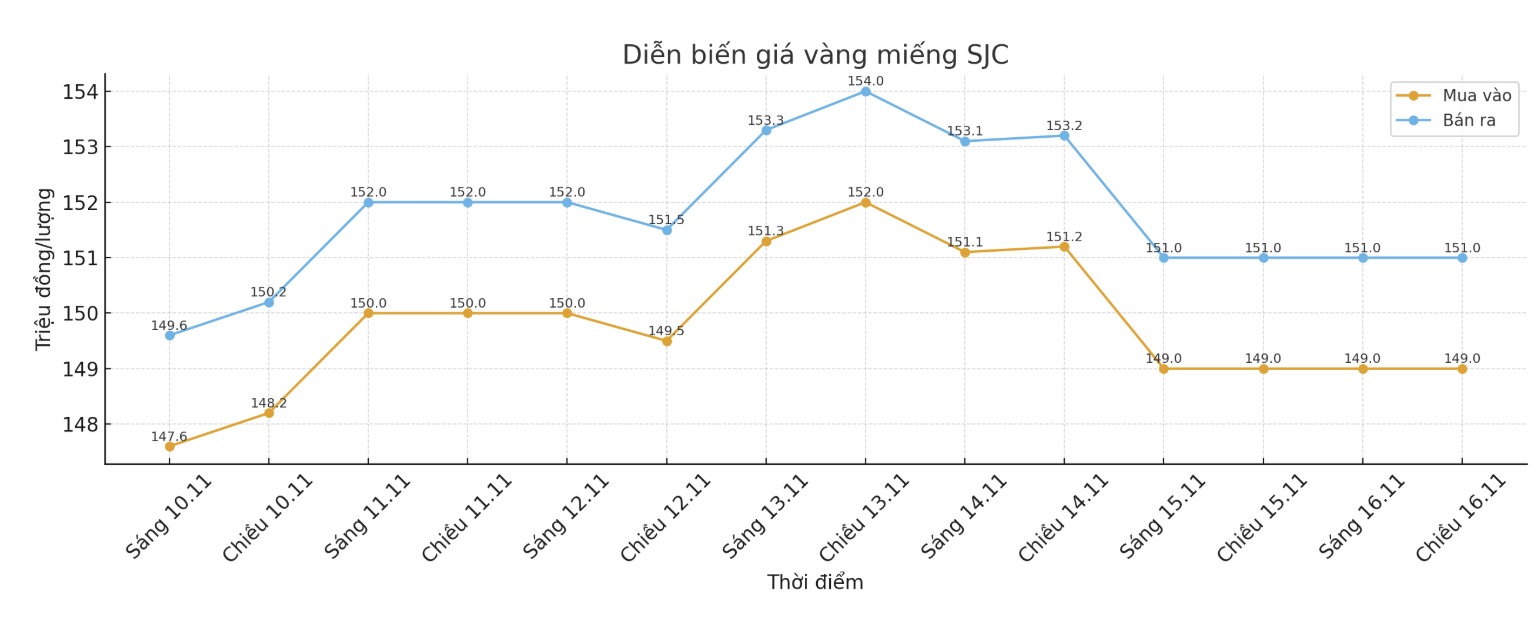

SJC gold bar price

As of 6:00 a.m., the price of SJC gold bars was listed by DOJI Group at 149-151 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 149-151 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 148-151 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 3 million VND/tael.

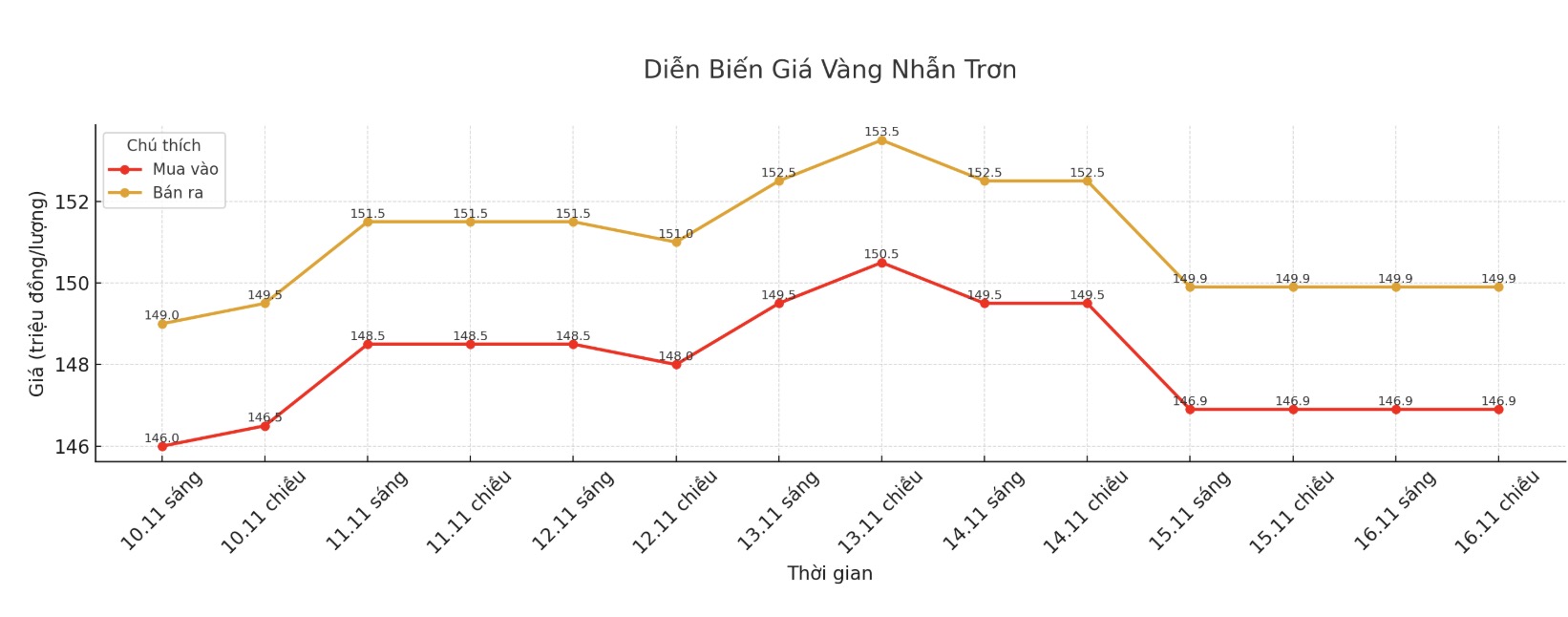

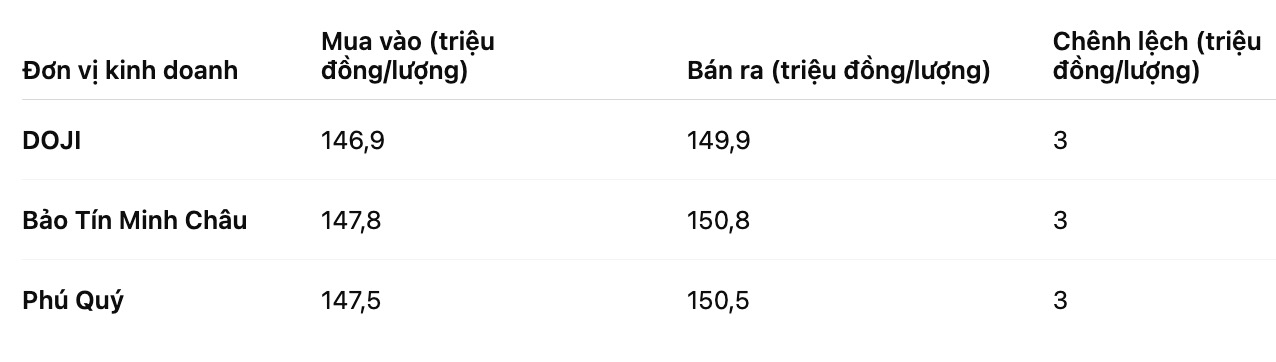

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 146.9-149.9 million VND/tael (buy in - sell out). The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 147.8-150.8 million VND/tael (buy in - sell out). The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 147.5-150.5 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

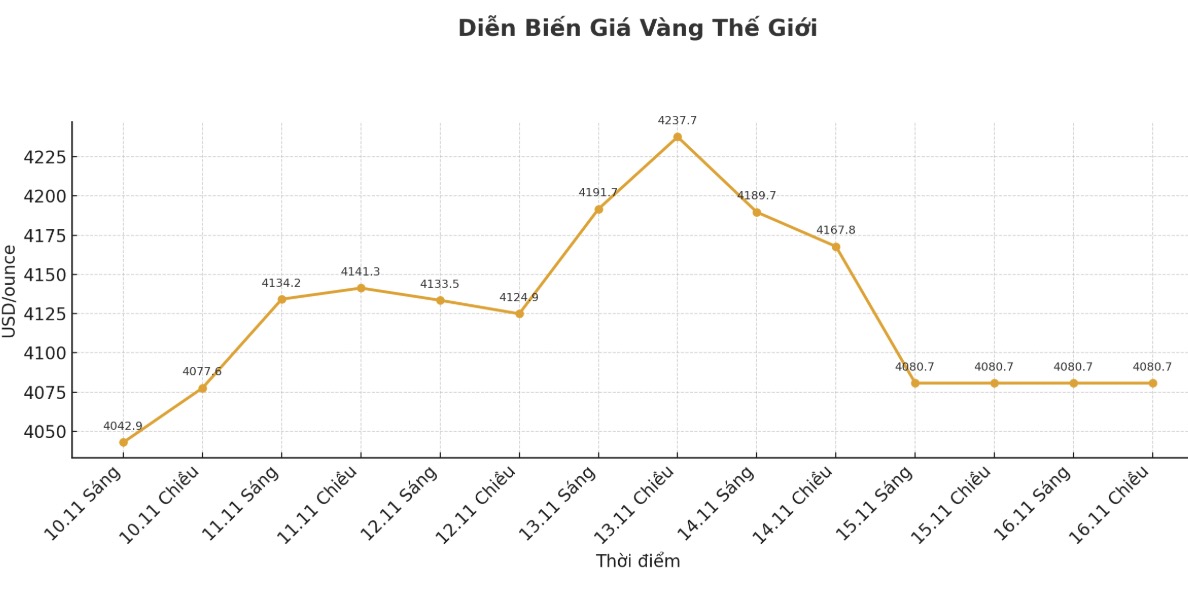

World gold price

The world gold price was listed at 6:00 (Vietnam time) at 4,080.7 USD/ounce.

Gold price forecast

After a sharp decline last weekend, Wall Street experts gave a less optimistic assessment of the short-term gold price outlook.

The latest weekly gold survey by an international financial information platform shows that negative sentiment continues to cover the market.

This week, 17 Wall Street experts participated in a gold price survey. Of these, eight (47%) predict gold prices will fall in the short term. Six experts (35%) are neutral for next week, while only three (18%) see prices continuing to rise.

Mr. Jim Wyckoff - senior analyst at Kitco.com - is leaning towards the scenario of gold prices falling next week: "Buyers' momentum has run out very quickly and short-term technical indicators have deteriorated a bit".

Meanwhile, Mr. Alex Kuptsikevich - senior analyst at FxPro - commented: "The weakening of the USD and the rumor that the FED could resume the asset purchase program have been the main drivers of gold prices to increase since the beginning of the week; but the developments on Thursday and Friday showed that the market is no longer one-sided."

Kuptsikevich predicts gold prices will fall next week and believes that investors are likely to sell as prices increase: Gold has been continuously sold strongly after each increase since the end of last month, as an effort by the selling side to prove that they have broken the buying side.

Like other risky assets, gold weakened over the weekend due to a sharp decline in the probability of the Fed cutting interest rates in December. If FOMC members continue to orient the market in this direction, the USD will certainly increase and gold will decrease, he said.

However, we also see a greater risk that upcoming US economic data will show a worsening economic picture. At that time, the USD will strengthen and the risk-off sentiment will increase. In such scenarios, gold often spikes in the early stages, but can then plummet," the expert added.

Note: The world gold market operates through two main pricing mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries. Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

Gold price data was compared to a day earlier.

See more news related to gold prices HERE...