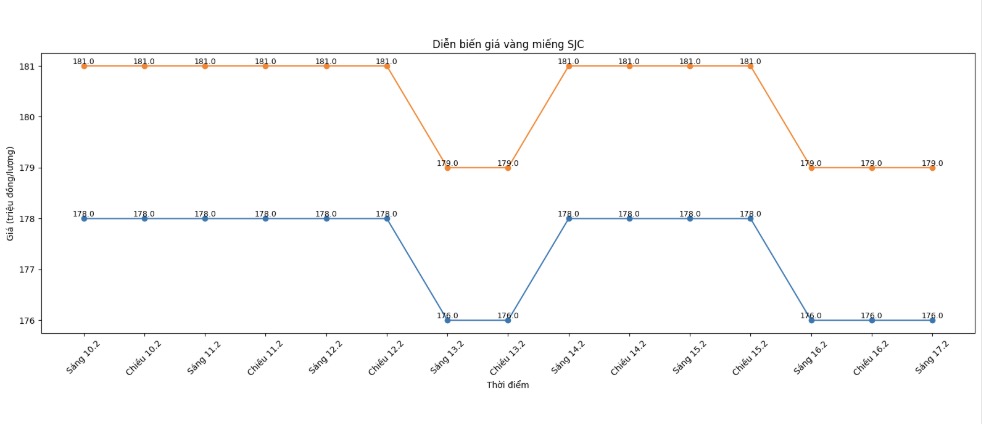

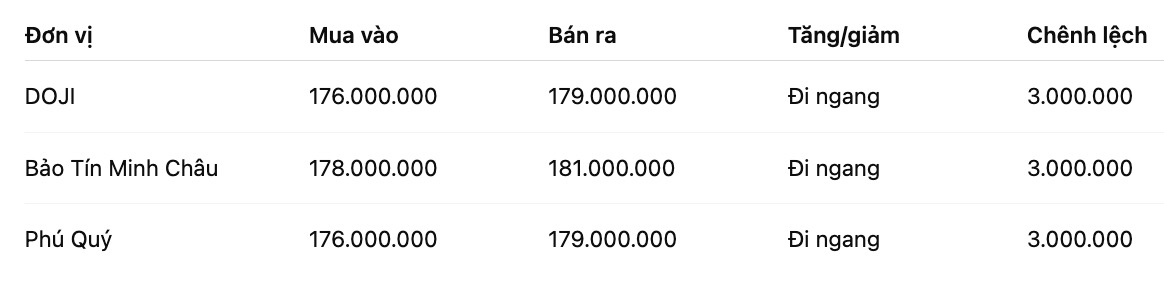

SJC gold bar price

As of 8:00 PM, SJC gold bar prices were listed by DOJI Group at 176-179 million VND/tael (buying - selling), unchanged in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

SJC gold bar price is listed by Bao Tin Minh Chau at 178-181 million VND/tael (buying - selling), unchanged. The difference between buying and selling prices is at 3 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at 176-179 million VND/tael (buying - selling), unchanged in both directions. The difference between buying and selling prices is at 3 million VND/tael.

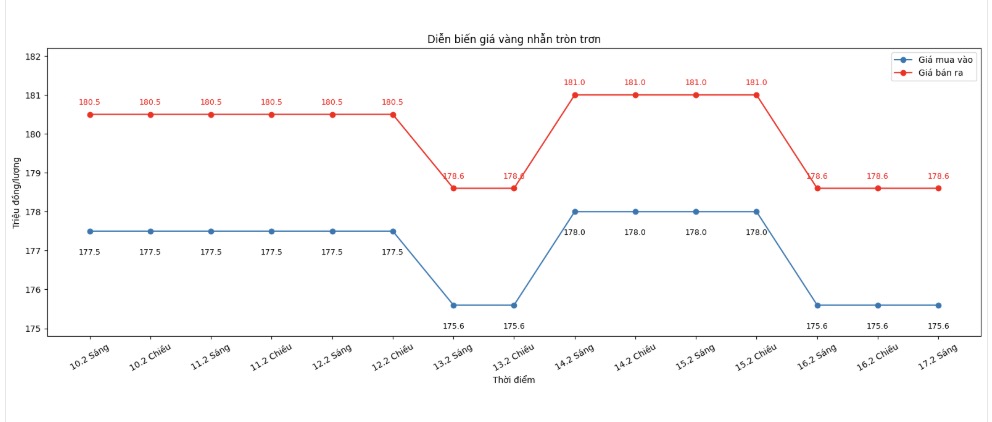

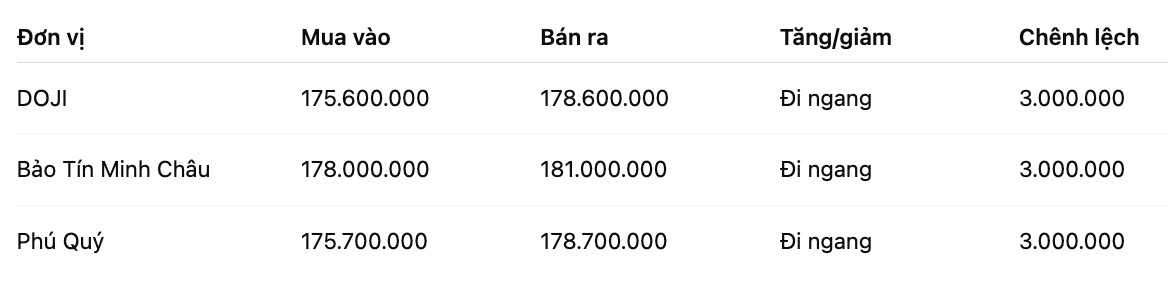

9999 gold ring price

As of 8:00 PM, DOJI Group listed the price of gold rings at 175.6-178.6 million VND/tael (buying - selling), unchanged in both directions compared to the previous day. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 178-181 million VND/tael (buying - selling), unchanged in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

Phu Quy Gold and Gems Group listed the price of gold rings at the threshold of 175.7-178.7 million VND/tael (buying - selling), unchanged in both directions. The buying - selling difference is at 3 million VND/tael.

Currently, the buying - selling price difference of gold is at a very high level, around 3 million VND/tael, posing a risk of losses for investors.

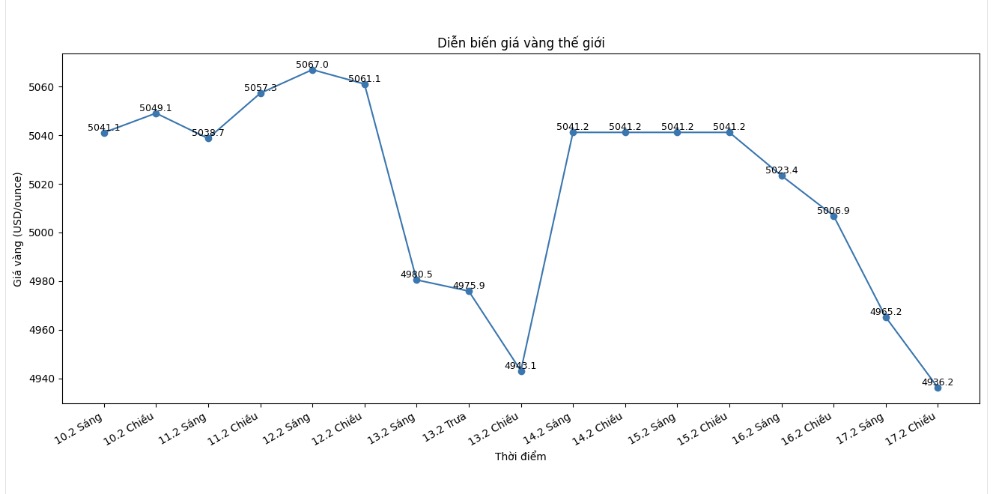

World gold price

At 7:45 PM, world gold prices were listed around 4,936.2 USD/ounce; down 70.7 USD compared to the previous day.

Gold price forecast

The world gold market is experiencing volatile trading sessions as liquidity declines due to holidays at a series of major financial centers. Increased profit-taking pressure, the USD maintains its upward momentum and cautious sentiment in the face of US monetary policy signals have caused precious metal prices to continuously "break down".

In recent sessions, spot gold at one point lost the psychological milestone of 5,000 USD/ounce before recovering slightly. This development reflects the state of stalemate between technical selling pressure and long-term expectations that are still present. Many investors choose to stand aside and observe when the market lacks new cash flow.

Analysts believe that the factor of thin liquidity plays a significant role. When major exchanges in the US and Asia close for holidays, price fluctuations are often amplified. "Gold is fluctuating in the range of around 5,000 USD/ounce in a week of low liquidity due to the holidays," said Giovanni Staunovo - an analyst at UBS.

In addition, the slightly rising USD makes gold – an asset valued in the greenback – more expensive for holders of other currencies. This is a familiar reason for short-term pressure on gold prices, especially in the context of the market lacking supportive momentum.

However, the medium-term outlook for the precious metal still receives positive reviews. The Bank of Australia - New Zealand (ANZ) recently raised its gold price forecast for the second quarter of 2026, saying that the level of 5,800 USD/ounce is feasible if the macroeconomic environment continues to be favorable. According to ANZ, real interest rates tend to decrease, geopolitical risks have not completely subsided and demand from private investment may return to be important supporting factors.

Expectations that the Fed will ease monetary policy this year continue to be a psychological support. Gold is inherently a non-interest-generating asset, often benefiting when the general level of interest rates goes down. However, experts note that technical adjustment may still appear after the previous strong rally.

From a technical perspective, some opinions suggest that gold is facing a near resistance zone, while the support level around the 5,000 USD/ounce mark plays a key role. Short-term volatility is therefore forecast to remain complex, depending on policy signals from the Fed and the diễn biến of the USD.

In that context, investors are recommended to maintain a cautious strategy, closely monitor US economic data and capital inflows into gold ETF funds - factors that could create new momentum for the market in the second quarter of 2026.

Gold price data is compared to the previous day.

See more news related to gold prices HERE...