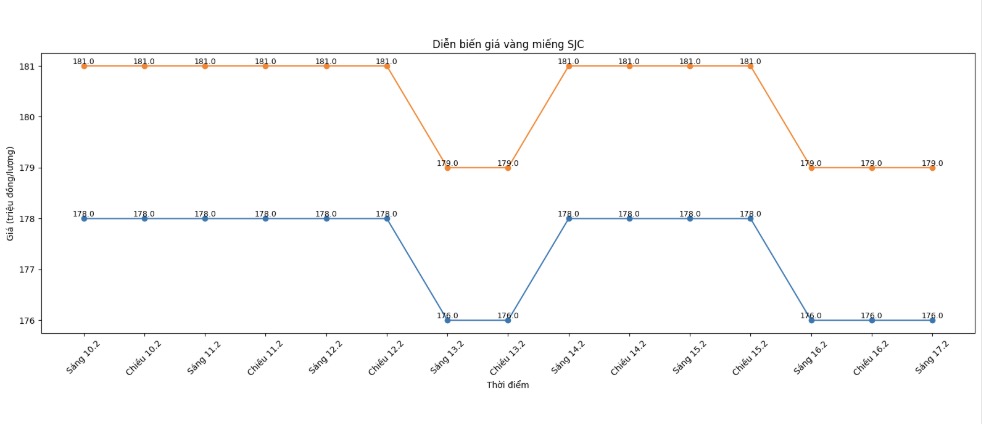

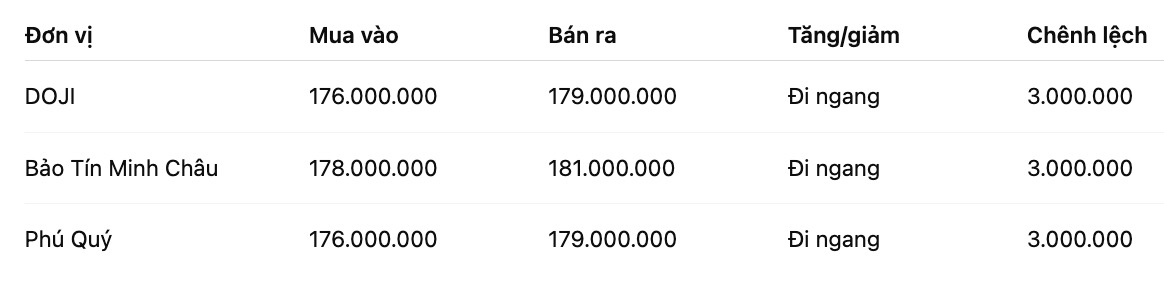

SJC gold bar price

As of 10:00 AM, SJC gold bar prices were listed by DOJI Group at 176-179 million VND/tael (buying - selling), unchanged in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

SJC gold bar price is listed by Bao Tin Minh Chau at 178-181 million VND/tael (buying - selling), unchanged. The difference between buying and selling prices is at 3 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at 176-179 million VND/tael (buying - selling), unchanged in both directions. The difference between buying and selling prices is at 3 million VND/tael.

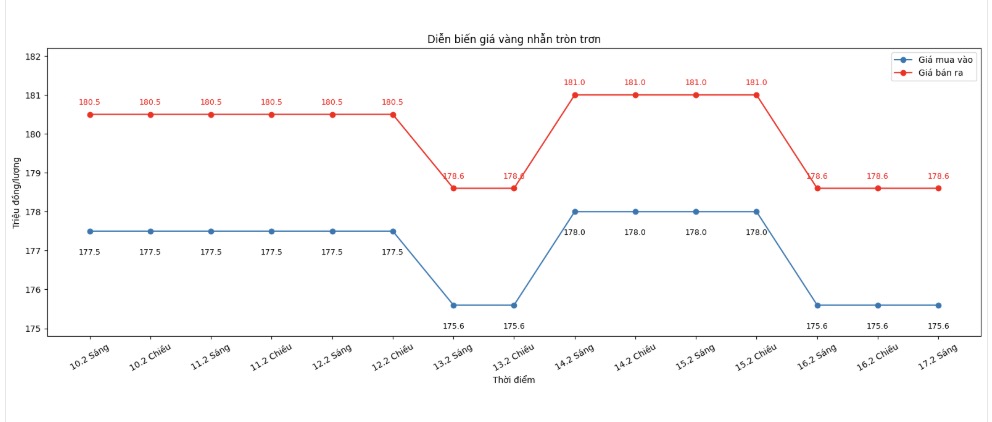

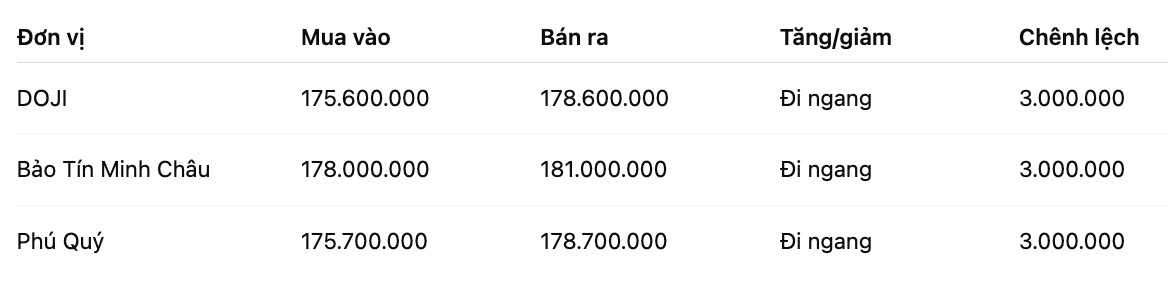

9999 gold ring price

As of 10:00 AM, DOJI Group listed the price of gold rings at 175.6-178.6 million VND/tael (buying - selling), unchanged in both directions compared to the previous day. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 178-181 million VND/tael (buying - selling), unchanged in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

Phu Quy Gold and Gems Group listed the price of gold rings at the threshold of 175.7-178.7 million VND/tael (buying - selling), unchanged in both directions. The buying - selling difference is at 3 million VND/tael.

Currently, the buying - selling price difference of gold is at a very high level, around 3 million VND/tael, posing a risk of losses for investors.

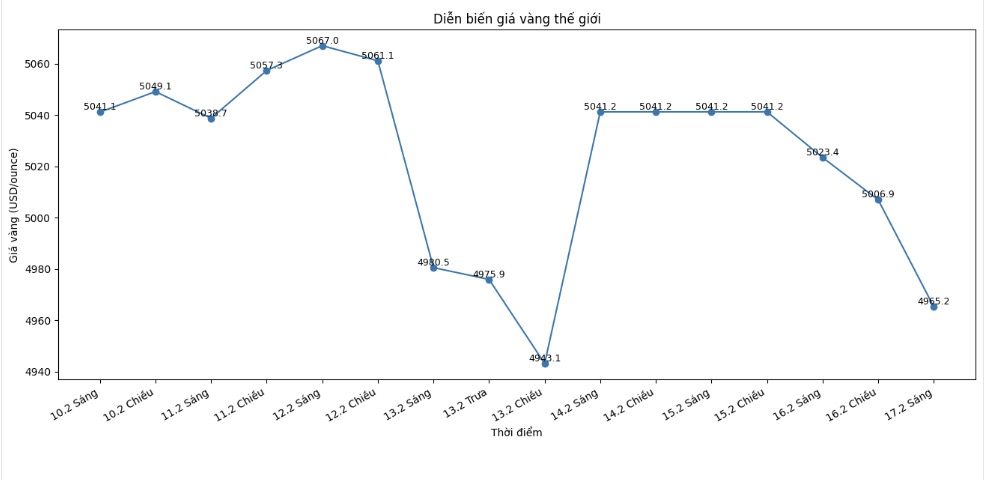

World gold price

At 10:00 AM, world gold prices were listed around the threshold of 4,965.2 USD/ounce, down 58.2 USD compared to the previous day.

Gold price forecast

World gold prices entered the new week in a state of strong fluctuations as weak cash flow and cautious sentiment overwhelmed the market. Low liquidity due to many major exchanges in the US and Asia having holidays widened the fluctuation range, while the USD maintaining its upward momentum continued to put pressure on the precious metal.

In that context, spot gold at one point fell below the 5,000 USD/ounce mark before recovering slightly. This development reflects the tug-of-war between short-term profit-taking selling pressure and expectations of monetary policy easing by the US Federal Reserve (Fed).

Recent US economic data shows mixed signals. Inflation in January increased lower than forecast, strengthening expectations that the Fed will cut interest rates this year. However, the labor market still maintains heat, making the possibility of early easing not really certain. Investors are currently leaning towards the scenario that the Fed will keep interest rates unchanged at the March meeting and may start a downward cycle from mid-year.

According to Mr. Giovanni Staunovo, UBS analyst, gold prices are likely to continue to fluctuate around the 5,000 USD/ounce range in low-liquidity weeks. "The market is lacking clear momentum to break through as investors are waiting for further policy signals from the Fed," the expert said.

From a more cautious perspective, Mr. Zain Vawda - an analyst at MarketPulse by OANDA said that the previous strong increase pushed gold into a sensitive zone for technical corrections. "I temporarily lowered the medium-term gold price target to the 5,100 - 5,200 USD/ounce range. The market is still very volatile and easily reacts strongly to macroeconomic information," he said.

The USD factor is assessed to continue to play a key role. As the USD index increases, gold becomes more expensive for investors holding other currencies, thereby limiting buying power. Conversely, any weakening signal of the greenback could support gold recovery.

In addition, geopolitical risks and the gold buying trend of central banks are still important variables. Prolonged tensions in the Middle East and the need to diversify foreign exchange reserves may help gold prices maintain high prices, although short-term corrections still appear.

Gold price data is compared to the previous day.

See more news related to gold prices HERE...