Fluctuations will be the main factor of the precious metals market in 2026, as US Federal Reserve (Fed) policy and the level of exposure to the USD continue to dominate demand. This assessment was made by Mr. James Steel - Head of Precious Metals Analysis at HSBC.

In an interview with CNBC on Sunday evening, Mr. Steel was asked why gold prices did not seem to react to the decline in the yield of 10-year US Treasury bonds - from 4.30% a few days ago to 4.00%.

Mr. Steel believes that the above assessment is completely accurate. According to him, a turning point appeared in 2022. Before this period, gold prices often fluctuated in the opposite direction to the actual interest rate of 10-year US bonds - calculated by nominal yield minus inflation.

This relationship has been stable for decades, since the Bretton Woods system ended and gold is no longer anchored to the USD.

According to Mr. Steel, this relationship has clearly weakened in recent years. "Gold is no longer as sensitive to real interest rates, especially 10-year yields, as before," he said. "At the same time, the market witnessed a wave of buying from individual investors, increased geopolitical risks and strong gold buying activity from central banks.

I'm not saying that relationship won't come back. But clearly now it's not as strong as before," he added.

Mr. Steel was also asked if the nomination of Kevin Warsh was related to the trend of yields falling but gold prices not rising, in the context that Mr. Warsh had expressed his desire to narrow down the Fed's balance sheet.

As long as the Fed maintains its independence - which I believe will continue - it remains a key factor. Any threat to the central bank's independence tends to push gold prices up," Mr. Steel said.

Regarding whether the high gold price reflects the role of hedging against currency devaluation risks, Mr. Steel said that HSBC does not see it completely in that direction.

We believe that the USD will continue to be a global reserve currency in the near future, even for a very long time. However, that does not mean that every central bank needs to hold as many USD as it does now. One of the ways to reduce dependence on the USD is to buy gold," he said.

He believes this is an important driving force behind the gold buying activities of central banks. "Since 2022, gold purchases have been 2-2.5 times higher, even at times 3 times higher than the 10-year average.

Referring to the fact that cash flow has not shifted strongly to the EMEA area or into gold in the context of volatile AI technology stocks, Mr. Steel said that this does not weaken the long-term upward trend.

Gold has recorded significant increases in recent years. The previous nominal peak was $850/ounce in January 1980. If inflated, this figure is equivalent to about $3,400 today. Gold exceeded that threshold in April," he said.

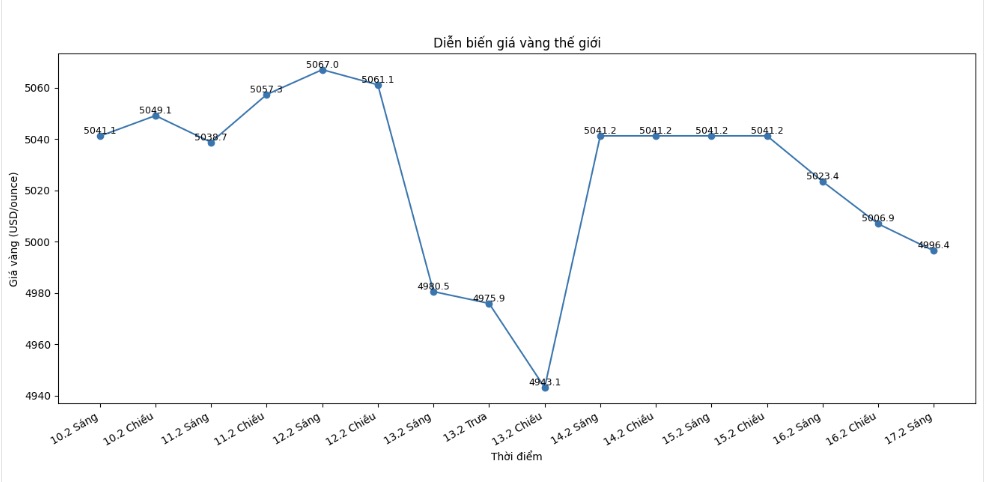

Mr. Steel said that the fact that gold prices have not increased sharply again recently does not mean that the long-term upward trend has ended. He emphasized that the strong upward momentum, even "parabol" at the beginning of the year, often entails large fluctuations.

When a market is so hot, volatility is unavoidable. I think the keyword shaping this year's gold market will be volatility" - he said - "Just because gold is a safe haven asset and of high quality, does not mean it is not volatile".