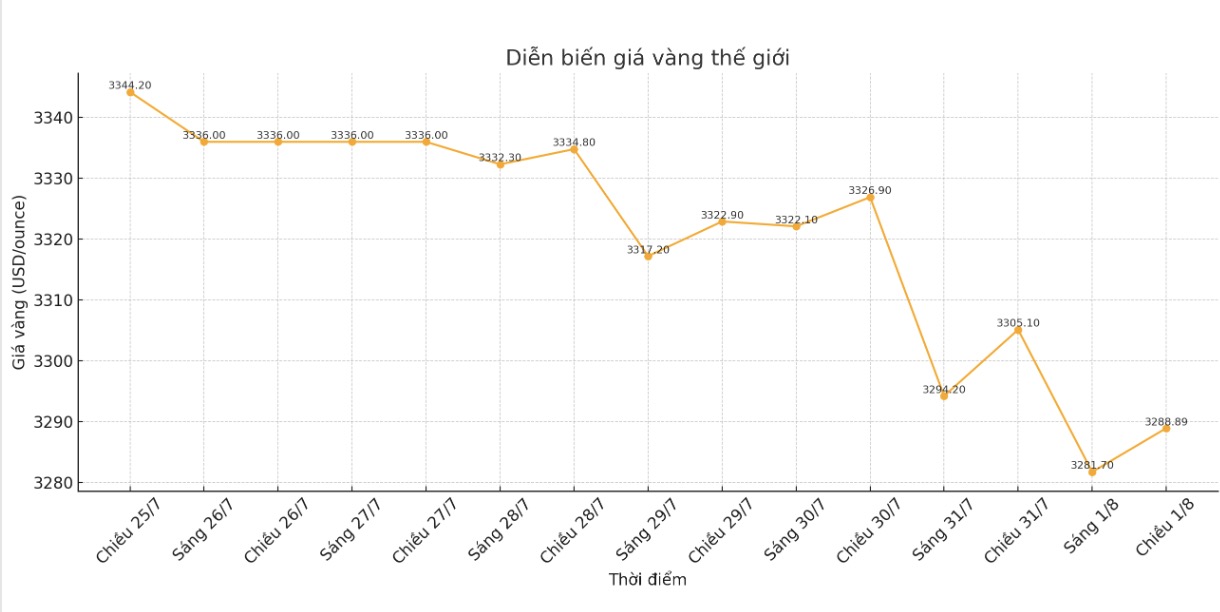

Spot gold prices were stable at $3,288.89/ounce at 7:33 GMT (ie 14:33 Vietnam time). Overall for the week, the precious metal fell 1.4%. US gold futures fell slightly by 0.3%, to $3,339.90.

The US dollar index (.DXY) has risen to its highest level since May 29, making gold more expensive for holders of other currencies.

Gold is still under pressure as the Feds rate cut predictions for the rest of 2025 fall sharply. This week's US economic data such as GDP, weekly jobless claims and PCE have further reinforced the Fed's reservations about its commitment to cut interest rates, Han Tan, senior market analyst at Nemo.Money, said.

The Fed kept interest rates unchanged in a range of 4.25%-4.50% on Wednesday and reduced expectations of a rate cut in September.

US President Donald Trump has imposed high tariffs on exports from dozens of trading partners, including Canada, Brazil, India and Taiwan, to promote plans to restructure the global economy ahead of the trade deal on Friday.

However, the precious metal will still receive support as the impact of US tax policies on global economic growth remains uncertain, Mr. Tan added.

US inflation increased in June as import tariffs began pushing prices of some goods up.

The market is now turning its attention to the US jobs report due later on Friday, which will assess the Fed's policy direction, with forecasts for slowing the pace of job growth in July and the unemployment rate increasing to 4.2%.

Gold is often considered a safe haven asset during times of economic instability and often operates well in low interest rate environments.

physical demand for gold in key Asian markets has improved slightly this week as falling prices stimulated buying activity, despite strong fluctuations that have left some buyers cautious.

Spot silver prices fell 0.7% to $ 36.50/ounce, platinum fell 0.8% to $1,278.4 and gold fell 0.2% to $1,188.28. All three metals are heading for a weekly decline.

See more news related to gold prices HERE...