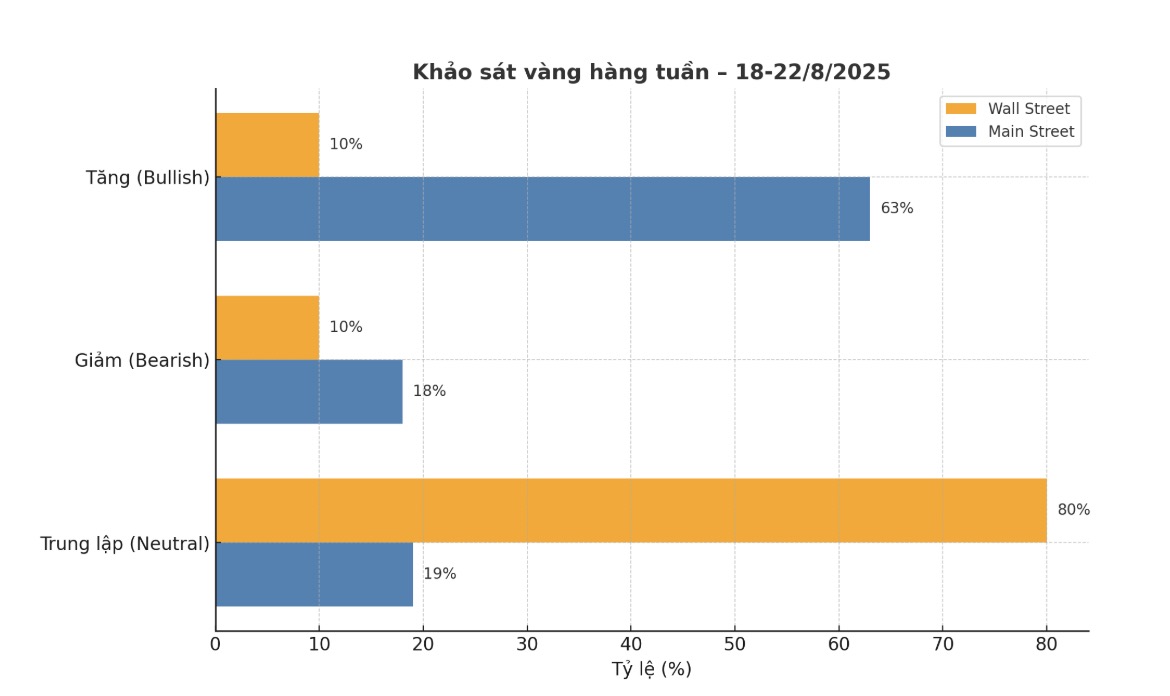

Adrian Day - Chairman of Adrian Day Asset Management - said: "Many things will depend on the outcome of the meeting between US President Donald Trump and Russian President Vladimir Putin, which could cause gold prices to increase or decrease sharply immediately.

In addition to that factor, we see gold continuing to fluctuate within range but tending to increase. The US Federal Reserve's (FED) interest rate cut in September has been reported by the market, so we will need more factors to loosen monetary policy so that gold can break out. So I think gold will "not change", but with many notes attached".

Colin Cieszynski - Director of Market Strategy at SIA Wealth Management - commented: "I am neutral on gold this week. I think the market can be quite quiet.

James Stanley - senior strategist at Forex.com - predicted that gold prices will increase. He said that the precious metal is being supported at the current price range, while the Jackson Hole event this week is unlikely to create a " Haward" surprise.

I dont think central banks will issue a strong signal. Usually they choose to delay and tend to be lax and next week will not be different" - Stanley commented.

According to Ole Hansen - Head of Commodity Strategy at Saxo Bank, this week's inflation data is not enough to prevent the FED from cutting interest rates.

He analyzed: At first, gold fell after a stronger-than-expected PPI data, as the market was concerned that this would make the Fed more cautious. However, the increase in production costs will eventually erode corporate profits, or be shifted to consumers, creating more inflationary pressures. That does not change our long-term optimistic view of gold. The Fed must eventually balance between curbing inflation and supporting the economy.

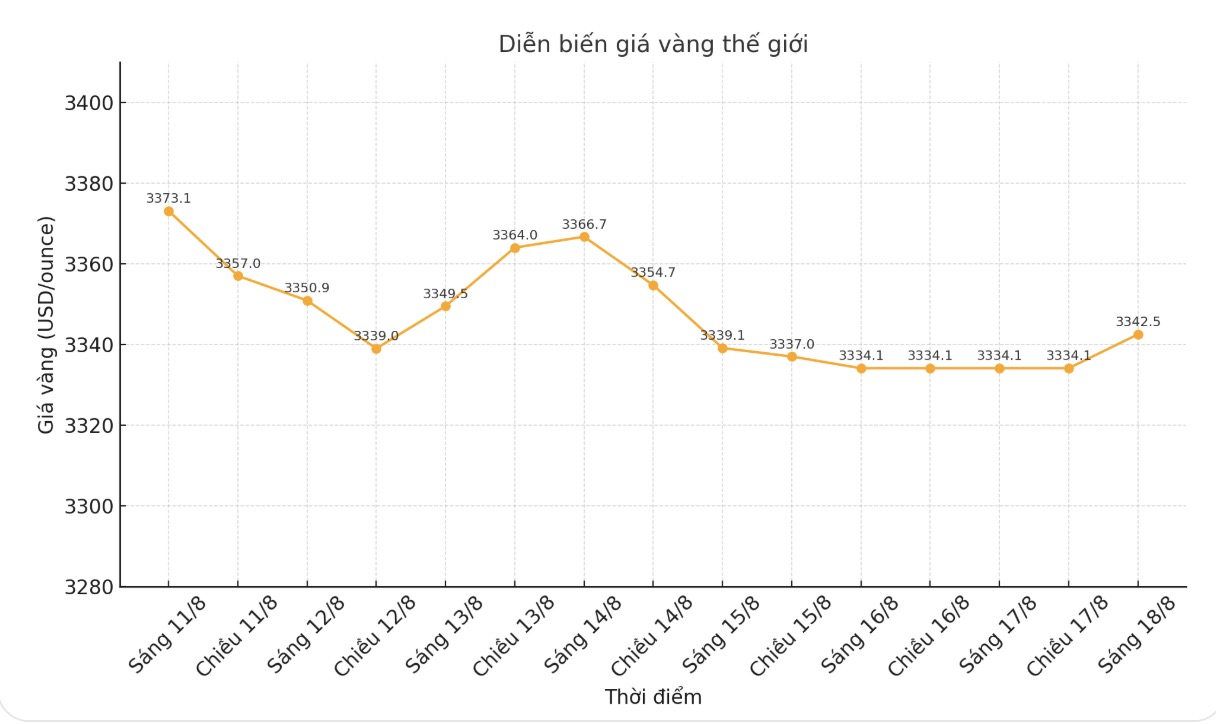

Hansen said gold prices are currently stuck in the $200 range around $3,350/ounce. However, demand for ETFs is still very high, reaching a two-year peak of 2,878 tons, showing that the long-term trend is still positive.

Daniel Pavilonis - senior commodity broker at RJO Futures - said that gold is still moving sideways after a series of fluctuations from Swiss gold tax and inflation data. We have seen gold prices bounce back thanks to tax information, then fall again. Stocks recovered, but gold remained stuck within range. I used to predict gold would fall below $3,000/ounce, but now I think prices could increase slightly or maintain the current range.

If the Fed cuts interest rates and inflation increases, it will be a boost for gold. If gold cannot make a new peak by October-November, the risk of prices falling to the 200-day average around $2,964/ounce is real.

Marc Chandler - CEO of Bannockburn Global Forex - said that gold is building a solid foundation around 3,330 USD/ounce, with an range of 3,250 to 3,400 USD/ounce.

"This causes difficulties for investors following trends, because the market lacks motivation. With a rather light economic calendar for next week, except for the preliminary PMI and the Jackson Hole conference, the possibility of gold continuing to move sideways is very high. I like to buy when the price is adjusted down than sell when the price increases. The bottom at the end of July around $3,270/ounce will be an attractive buying opportunity if it repeats.

Kevin Grady - President of Phoenix Futures and Options - emphasized that interest rates should have decreased earlier. Some have even proposed a 50 basis point reduction. The only factor preventing inflation from increasing is inflation, but if analyzed in detail, the main reason is from tariffs. Eliminate this factor, inflation is only around 2%. I think the Fed should cut at least 25 basis points. If Fed Chairman Jerome Powell had more accurate data on employment in the past two months, the decision to cut interest rates had been made.

Grady also analyzed that the market is still experiencing the shock of the EFP contract. Last week, the EFP gap soared to more than $100, up from just $8 on July 21. After the government announced that gold was not taxed, EFP dropped it to $60. This is a terrible change for banks and physical gold traders. The market has not recovered. The problem is that no one wants to trade if they are not sure about the difference in delivery, because the risk of loss is too great".

Michael Moor - founder of Moor Analytics - is leaning towards a discount scenario, based on technical milestones showing increasing selling pressure.

Meanwhile, Jim Wyckoff - senior analyst at Kitco - said that gold will continue to fluctuate erratically, move sideways and lack a clear trend until a new fundamental factor appears strong enough to lead prices.