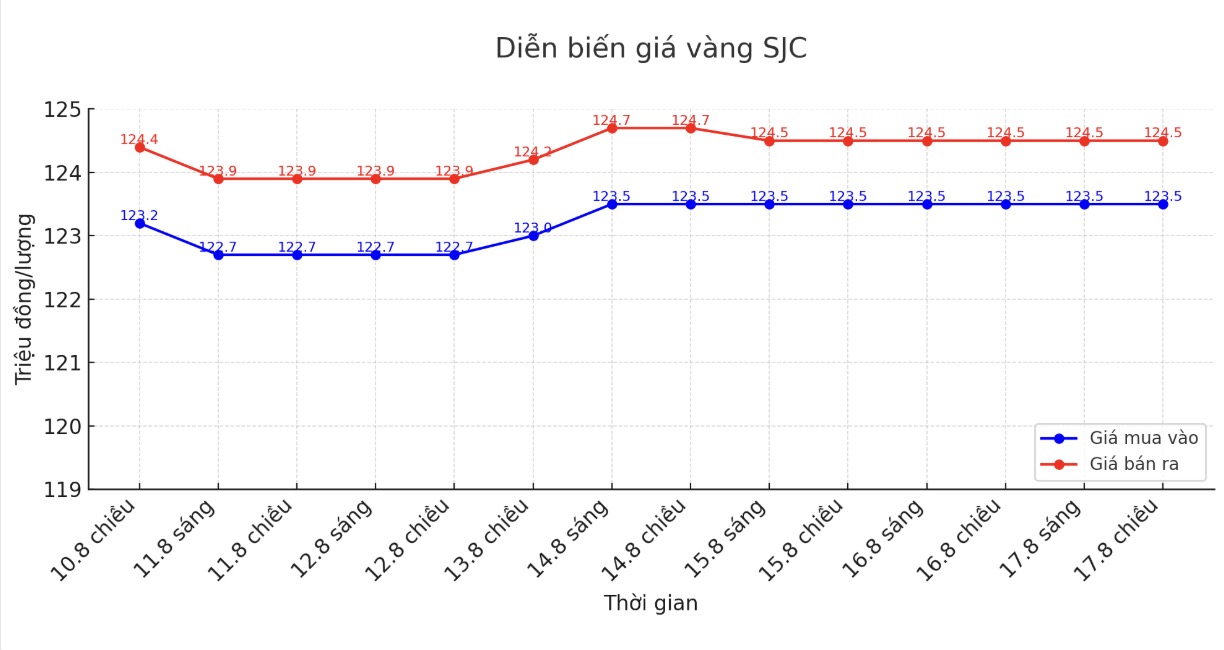

SJC gold bar price

As of 6:00 a.m., the price of SJC gold bars was listed by DOJI Group at 123.5-124.5 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 1 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 123.5-124.5 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 1 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 122.7-124.5 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 1.8 million VND/tael.

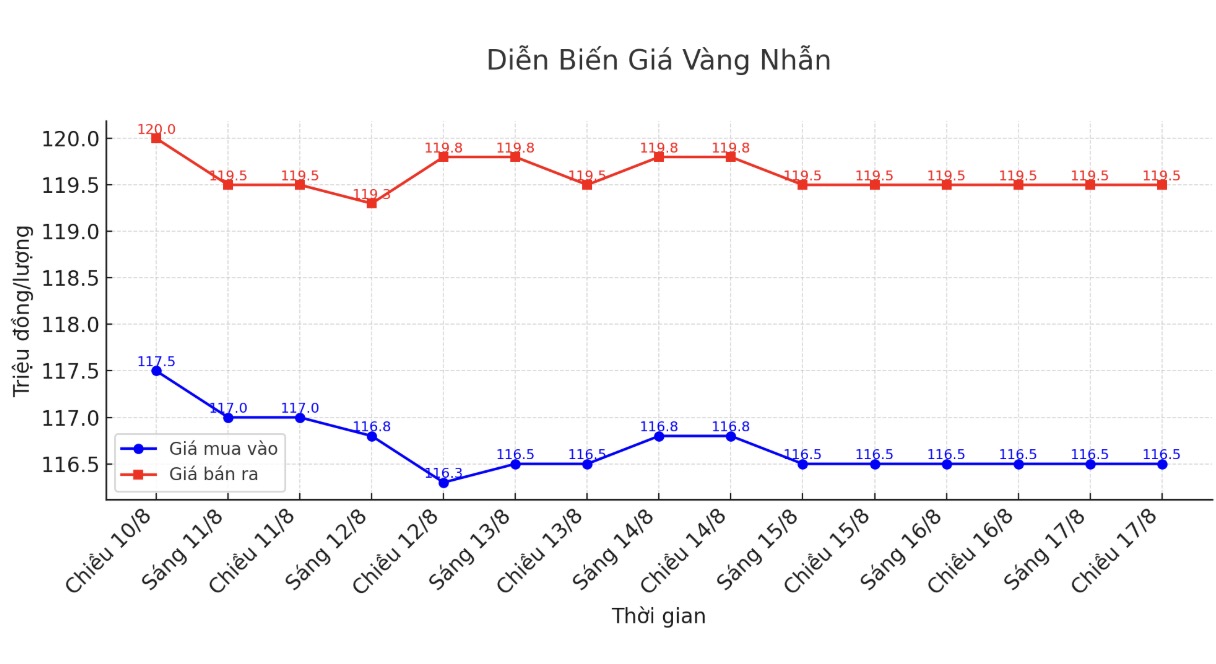

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 116.5-111.5 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116.8 - 119.8 million VND/tael (buy - sell), unchanged. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 116.5-111.5 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Currently, the difference between buying and selling gold rings is at a very high level, around 3 million VND/tael, posing a potential risk of loss for investors.

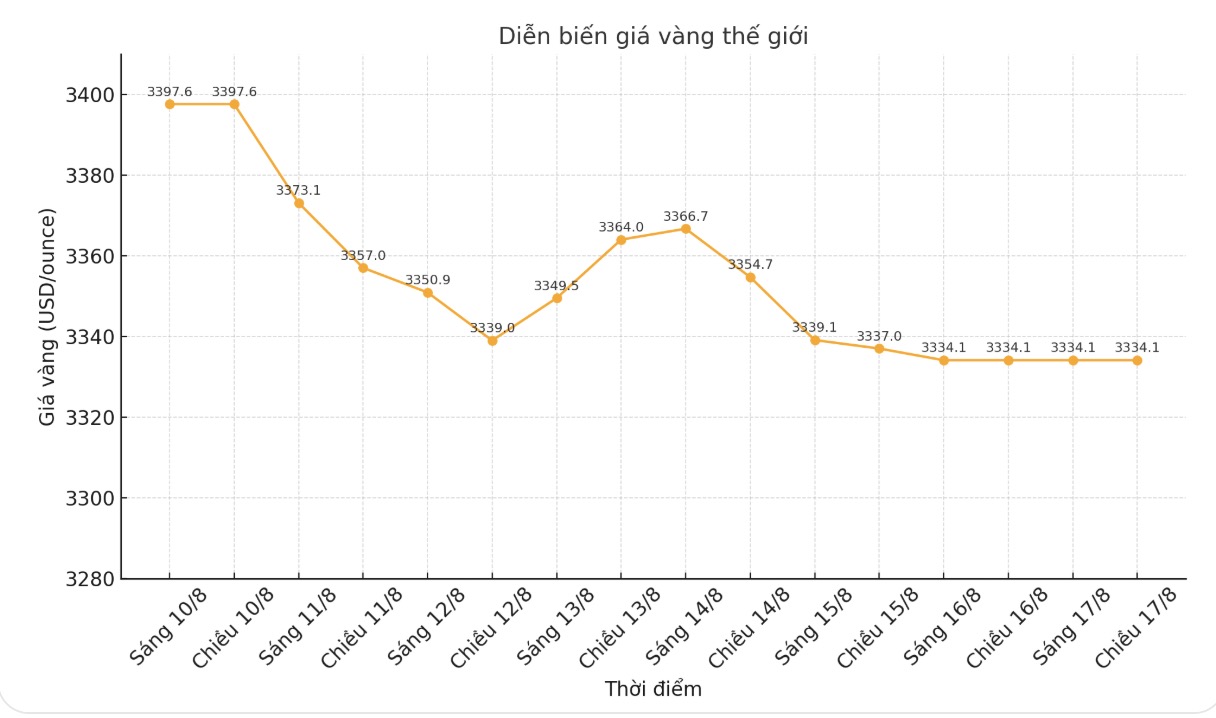

World gold price

The world gold price was listed at 6:00 a.m. at 3,334.1 USD/ounce.

Gold price forecast

Most Wall Street experts this week unexpectedly made a neutral assessment of the short-term gold price outlook.

Of the 10 experts participating, only 1 (10%) predicted gold prices to increase, 1 person (10%) predicted a decrease, while the majority (80%) expected prices to move sideways this week.

In contrast to Wall Street, individual investors on Main Street still maintain an optimistic mentality. Of the 183 online survey participants, 115 people (63%) expect gold prices to increase, 33 people (18%) predict a decrease and 35 people (19%) believe that prices will continue to accumulate.

Mr. Adrian Day - Chairman of Adrian Day Asset Management said that gold prices will continue to fluctuate within a narrow range with a steady uptrend. The US Federal Reserve (FED) is expected to cut interest rates in September, which has been reported by the market, so gold prices need more monetary easing moves to break out stronger.

Meanwhile, Ole Hansen - Director of Commodity Strategy at Saxo Bank said that although the US PPI increased more strongly than expected, this will not prevent the FED from cutting interest rates. This information has put pressure on gold prices, as the market is concerned that the FED will be more cautious in monetary policy.

Hansen said rising production costs could reduce corporate profits or push inflation higher, but this does not change the long-term outlook for gold. "The Federal Open Market Committee (FOMC) will eventually have to balance inflation control and economic support," he said.

Colin Cieszynski - chief market strategist at SIA Wealth Management will maintain a neutral view on gold next week. He said two major events, today's summit and next week's Jackson Hole summit, are likely to impact the US dollar, which could impact gold. However, between these two events, I think the market will be quite quiet.

Notable US economic data next week

Last week, many data had a mixed impact, causing gold prices to continuously reverse. Next week, the focus will be on the Fed.

Tuesday: Announcement of housing data for construction and construction permits in July, Governor bowman said.

Wednesday: Minutes of the July FOMC meeting, Waller and Bostic speech, opening of the Jackson Hole Conference.

Thursday: Philadelphia Fed manufacturing index, weekly jobless claims, S&P Global comprehensive PMI in August, existing home sales in July.

Friday: FED Chairman Jerome Powell speaks at Jackson Hole an event closely watched by global investors.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...