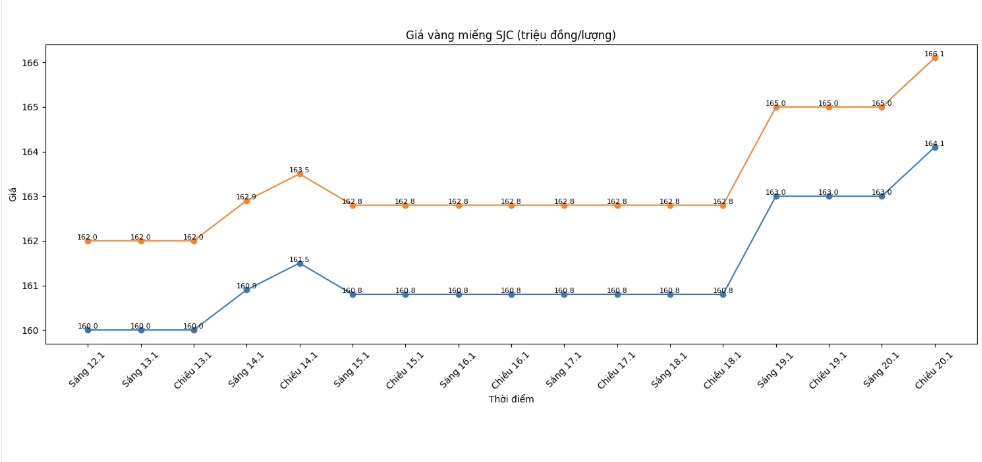

SJC gold bar price

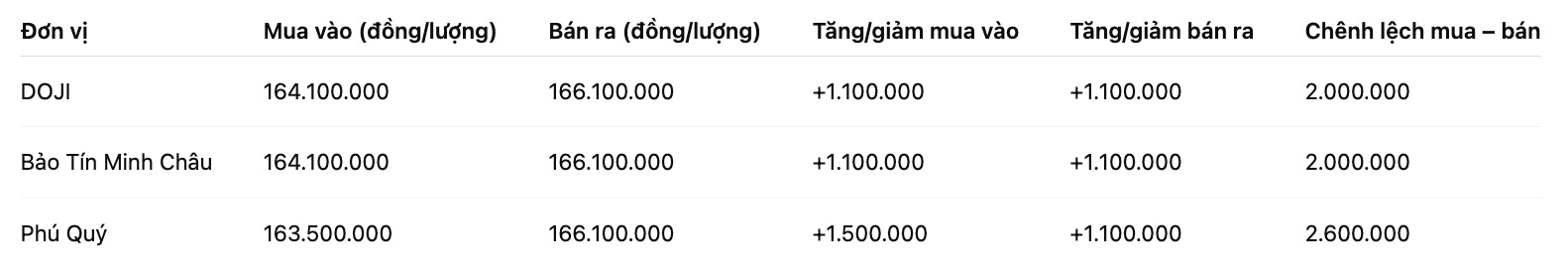

As of 5:00 PM, SJC gold bar prices were listed by DOJI Group at the threshold of 164.1-166.1 million VND/tael (buying - selling), an increase of 1.1 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 164.1-166.1 million VND/tael (buying - selling), an increase of 1.1 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at 163.5-166.1 million VND/tael (buying - selling), an increase of 1.5 million VND/tael on the buying side and an increase of 1.1 million VND/tael on the selling side. The difference between buying and selling prices is at 2.6 million VND/tael.

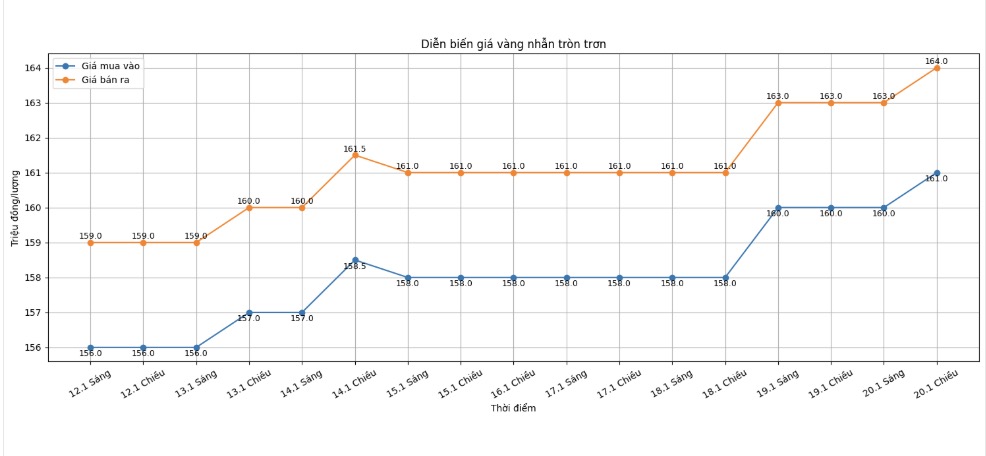

9999 gold ring price

As of 5:00 PM, DOJI Group listed the price of gold rings at 161-164 million VND/tael (buying - selling), an increase of 1 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 163.1-166.1 million VND/tael (buying - selling), an increase of 1.6 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at 161.5-164.5 million VND/tael (buying - selling), an increase of 1.5 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

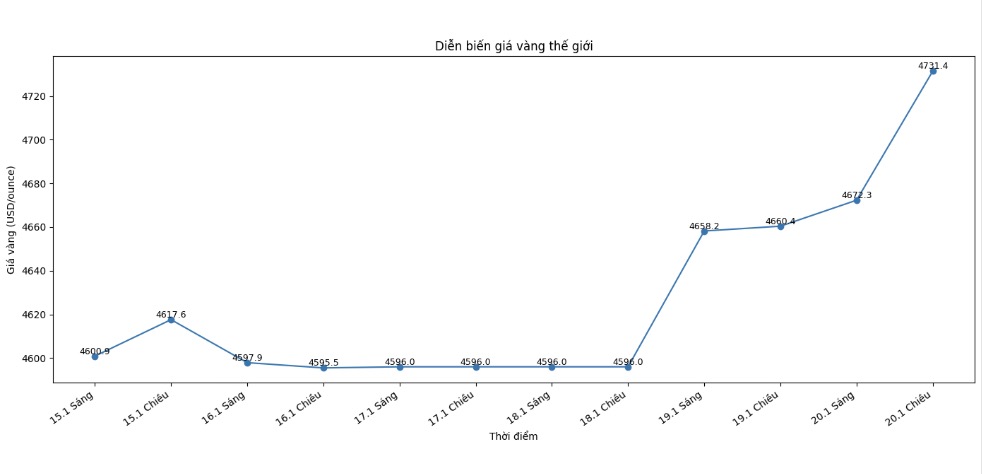

World gold price

At 7:00 PM, world gold prices were listed around the threshold of 4,731.4 USD/ounce, up 71 USD compared to the previous day.

Gold price forecast

The fact that gold prices first surpassed the 4,700 USD/ounce mark is not only technically significant, but also reflects a clear shift in the psychology of global investors. In the context of increasing geopolitical risks, US trade and monetary policy contains many unpredictable factors, gold is being repositioned as an important defensive pillar in the investment portfolio.

According to many analysts, the new gold price level may lead to short-term corrections due to profit-taking activities. However, fundamental factors are still strongly leaning towards a medium and long-term price increase scenario. Tensions between the US and European allies, the risk of expanding trade conflicts, along with the weakening of global economic confidence continue to push cash flow to safe haven assets.

Mr. Aakash Doshi – Head of Gold Strategy at State Street Investment Management – believes that gold's continuous new peak setting does not simply stem from speculation. “A few correction sessions or short accumulation periods do not change the dominant upward trend. The probability of gold approaching the $5,000 mark in 2026 is becoming increasingly clear, as macroeconomic and geopolitical risks remain high,” he said.

In addition, the global interest rate environment is forecast to remain in a "high but vulnerable" state, which also creates favorable conditions for gold. Although the US Federal Reserve (Fed) is likely not to rush to cut interest rates in the first months of the year, the market still expects the easing cycle to return when growth and consumption weaken. Historically, gold has often benefited during periods when the Fed temporarily suspended or reversed policy.

From another perspective, Ms. Linh Tran - senior market analyst at XS.com - believes that the current upward momentum reflects a structural change. "Gold is no longer just reacting to short-term news, but is being revalued in the global asset allocation strategy. If adjustments appear, it is likely just a technical rhythm, not a trend reversal," she assessed.

With the support from the net buying demand of central banks, stable ETF capital flows and prolonged global risk context, many experts believe that the price range of 4,000–5,000 USD/ounce is gradually becoming a "new normal" of the gold market in the coming period.

Gold price data is compared to the previous day.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...