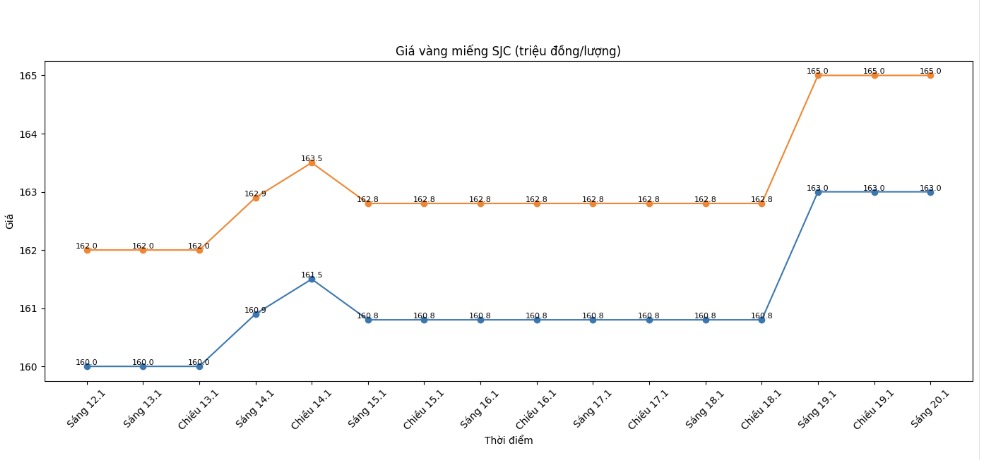

SJC gold bar price

As of 9:40 am, SJC gold bar prices were listed by DOJI Group at the threshold of 163-165 million VND/tael (buying - selling), going sideways in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price is listed by Bao Tin Minh Chau at the threshold of 163-165 million VND/tael (buying - selling), going sideways in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed SJC gold bar prices at the threshold of 162-165 million VND/tael (buying - selling), going sideways in both directions. The difference between buying and selling prices is at the threshold of 3 million VND/tael.

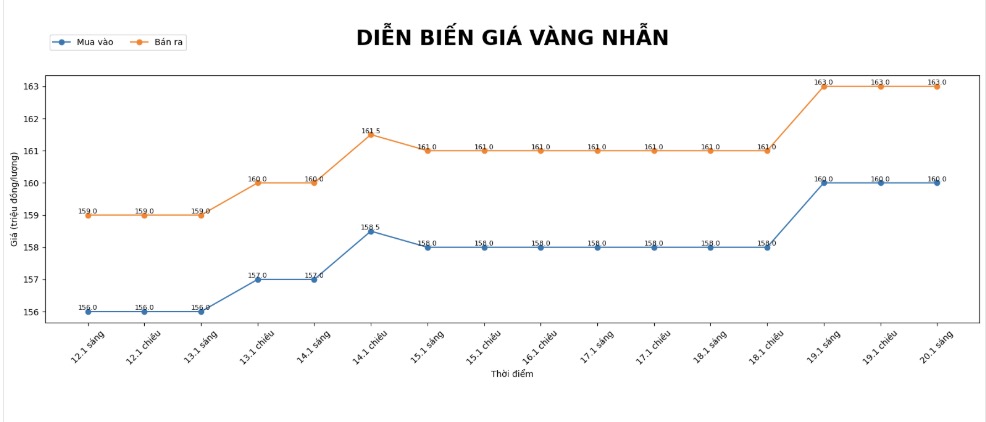

9999 gold ring price

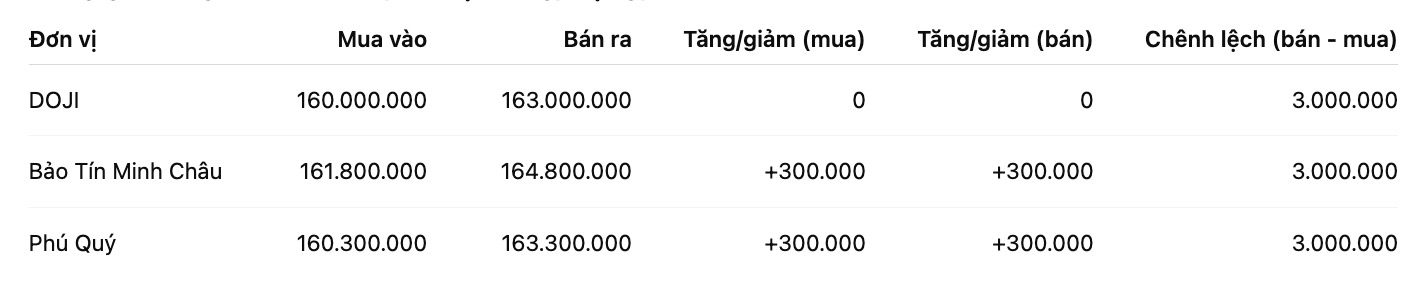

As of 9:45 am, DOJI Group listed the price of gold rings at 160-163 million VND/tael (buying - selling), going sideways in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 161.8-164.8 million VND/tael (buying - selling), an increase of 300,000 VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at 160.3-163.3 million VND/tael (buying - selling), an increase of 300,000 VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

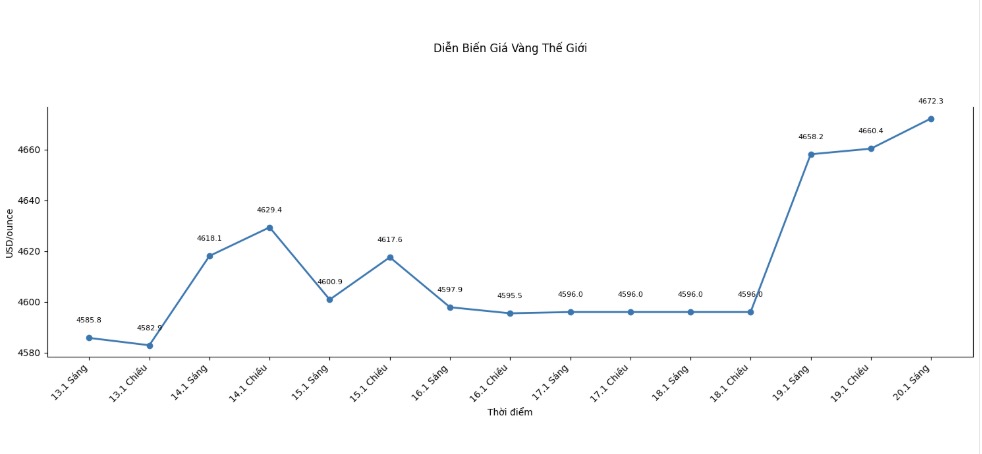

World gold price

At 9:45 am, world gold prices were listed around the threshold of 4,672.3 USD/ounce, up 14.1 USD compared to the previous day.

Gold price forecast

International analysts are still maintaining a positive view of gold price prospects. Sideways movements or slight corrections in previous sessions are considered necessary in the context that precious metals have increased sharply and continuously set new peaks.

Mr. Darin Newsom – senior market analyst at Barchart.com – believes that cash flow is still staying with gold.

The trend of precious metals, including gold, is still upward. As long as capital flows have not withdrawn from the market, this trend has not been broken" - Mr. Newsom emphasized.

An important driving force supporting gold prices comes from the context of global geopolitical and trade instability. US tough statements related to tariffs and foreign policy, along with the risk of escalating tensions between major economies, have fueled safe haven demand. In that environment, gold continues to play its role as a value-preserving channel, attracting strong investment interest.

Besides political factors, investment capital also shows a clear shift to precious metals. Gold holdings at global ETF funds have increased steadily for many weeks, reflecting long-term market confidence. Notably, buying power from Asia, especially China, is considered one of the pillars helping gold prices maintain a sustainable upward momentum.

Sharing the same view, Mr. James Stanley - market strategist at Forex.com - said that the recent profit-taking waves are unlikely to be avoided after a long streak of increases. "These retreats are not a reversal signal, but create conditions for new buying forces to participate at a more reasonable price level," Mr. Stanley assessed, and said that if prices fall deeper, potential demand will soon appear.

Notable economic data of the week

US President Donald Trump speaks at WEF, US announces data on houses waiting for sale

US announces Q3 GDP (last figures), PCE index, weekly jobless claims

US S&P's preliminary PMI index of manufacturing and services

Gold price data is compared to the previous day.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...