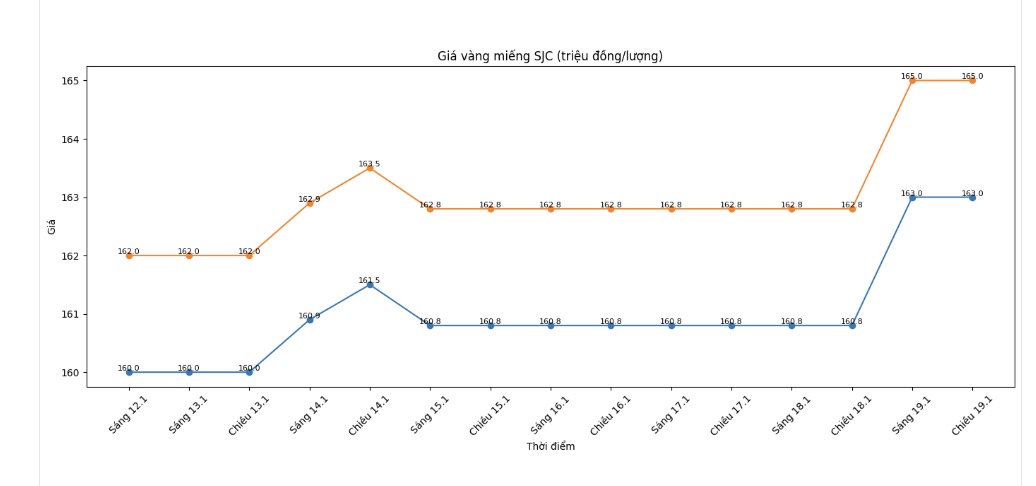

SJC gold bar price

As of 6:00 AM, SJC gold bar prices were listed by DOJI Group at the threshold of 163-165 million VND/tael (buying - selling), an increase of 2.2 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 163-165 million VND/tael (buying - selling), an increase of 2.2 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at the threshold of 162-165 million VND/tael (buying - selling), an increase of 2 million VND/tael on the buying side and an increase of 2.2 million VND/tael on the selling side. The difference between buying and selling prices is at the threshold of 3 million VND/tael.

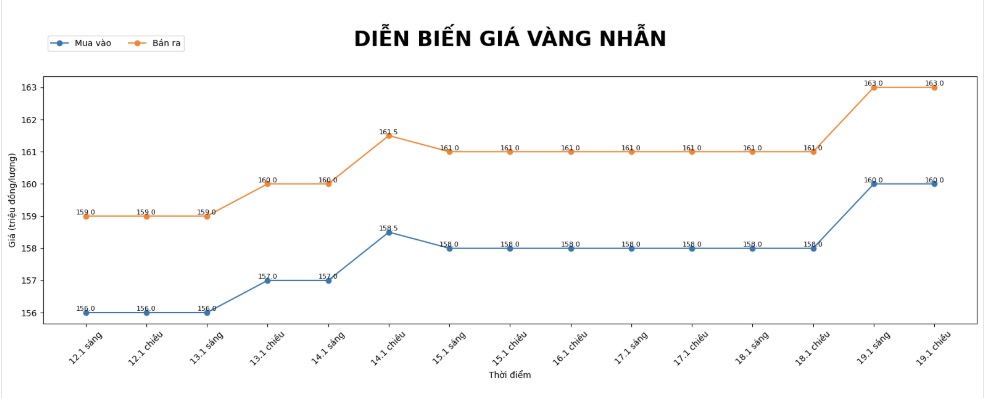

9999 gold ring price

As of 6:00 AM, DOJI Group listed the price of gold rings at 160-163 million VND/tael (buying - selling), an increase of 2 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 161.5-164.5 million VND/tael (buying - selling), an increase of 1.7 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at 160-163 million VND/tael (buying - selling), an increase of 2 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

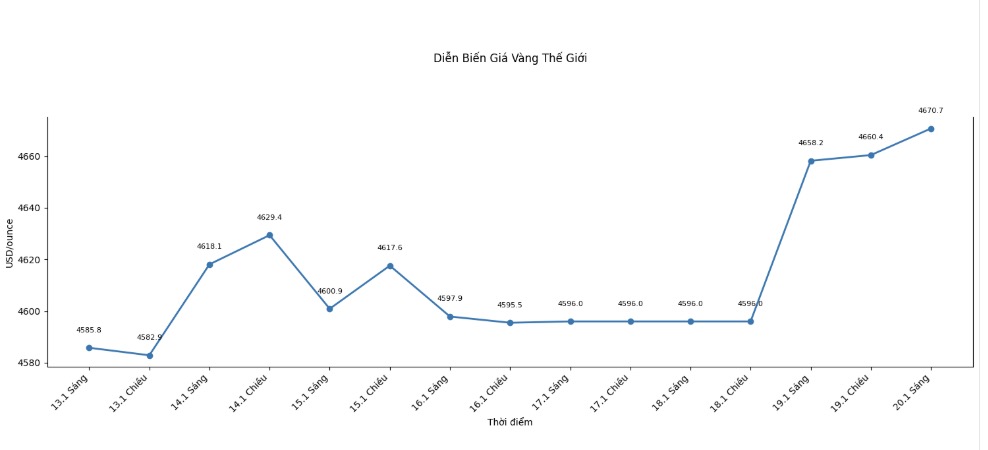

World gold price

At 5:35 am, world gold prices were listed around the threshold of 4,670.7 USD/ounce, a sharp increase compared to the previous day.

Gold price forecast

The hot upward trend of the world gold market in recent sessions is attracting special attention from investors, as a series of geopolitical and trade risk factors appear at the same time. US President Donald Trump's continuous tough statements related to the plan to control Greenland, accompanied by the issue of imposing taxes on European goods, have fueled defensive sentiment in the global financial market.

The European Union is considering retaliatory measures. In that context, gold and silver – traditional safe haven assets – are clearly benefiting as cash flow seeks safe "storm shelters". In just a short time, spot gold prices have approached the $4,700/ounce mark, continuously setting new historical peaks.

Besides political factors, investment capital is also showing a strong shift to the precious metal group. The amount of gold held by global ETF funds has increased rapidly for many consecutive weeks, reflecting the increasing confidence of investors in the upward trend of the market. Notably, buying power from Asia, especially China, is considered an important driving force helping gold prices maintain a sustainable upward momentum.

Commenting on the prospects for the coming time, Mr. Darin Newsom - senior market analyst at Barchart.com - said that short-term corrections are only technical and do not change the main trend. “The trend of the precious metal group, including gold, is still upward. As long as cash flow has not left the market, this trend has not been broken,” Mr. Newsom emphasized.

Sharing the same view, Mr. James Stanley - market strategist at Forex.com - assessed that recent profit-taking is unavoidable after a period of strong increases. However, instead of considering it a reversal signal, he believes that price adjustments will create a more attractive price level for new buying forces to return.

In the context of trade instability, pressure on the USD and concerns surrounding the independence of the US Federal Reserve, many major organizations still maintain an optimistic view of gold. The market is expected to continue to fluctuate strongly, but the medium-term upward trend of this precious metal is still considered to be dominant.

Gold price data is compared to the previous day.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...