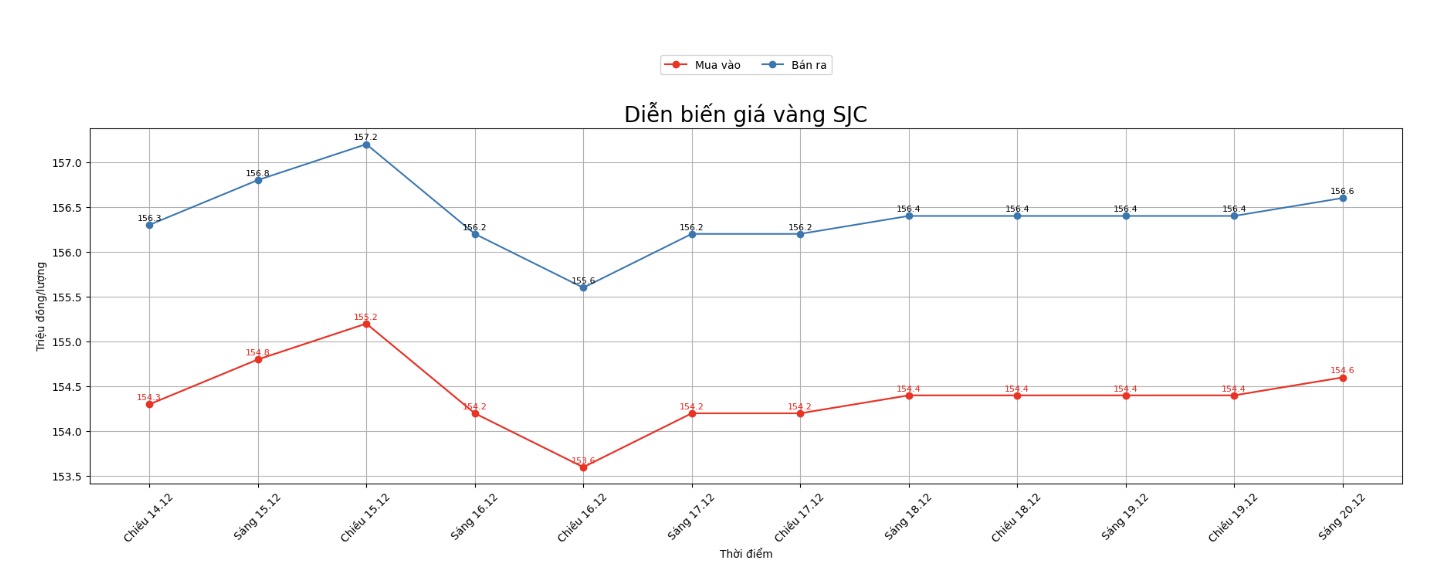

SJC gold bar price

As of 6:00 p.m., DOJI Group listed the price of SJC gold bars at VND154.6-156.6 million/tael (buy in - sell out), an increase of VND200,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 154.6-156.6 million VND/tael (buy - sell), an increase of 200,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 153.6-156.6 million VND/tael (buy - sell), an increase of 200,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

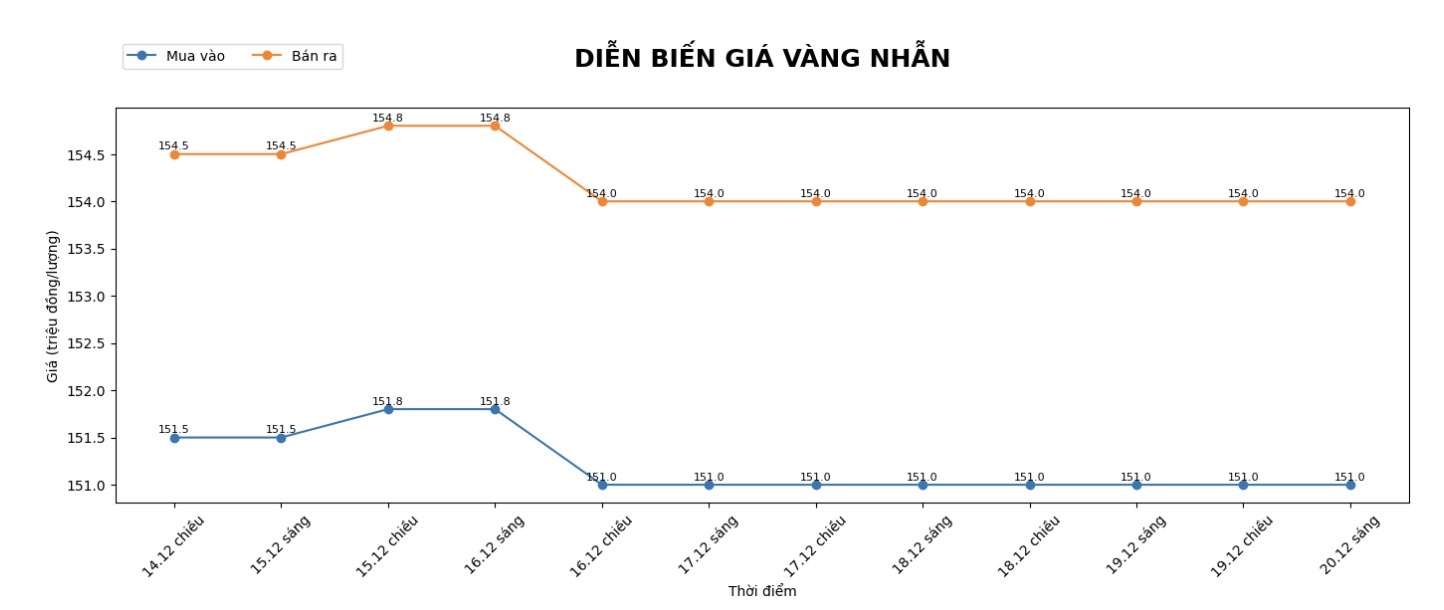

9999 gold ring price

As of 6:00 p.m., DOJI Group listed the price of gold rings at 151-154 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 152.2-155.2 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 151.6-154.6 million VND/tael (buy - sell), an increase of 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

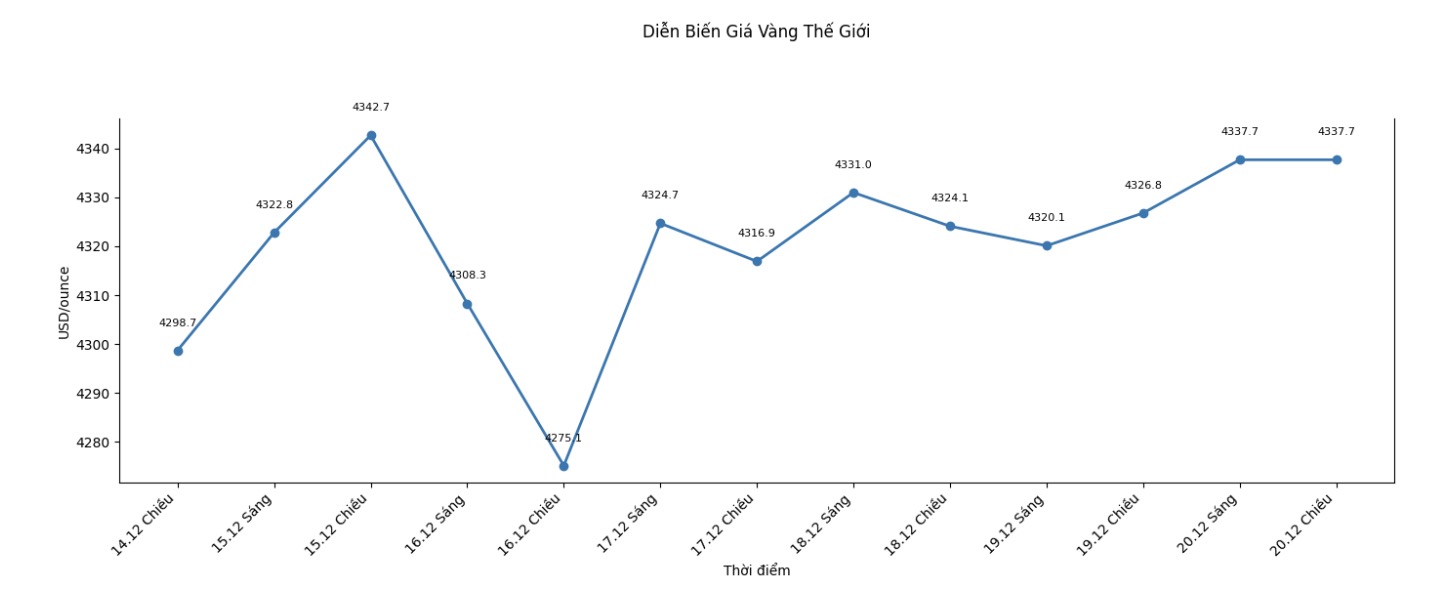

World gold price

The world gold price was listed at 6:05 p.m., at 4,337.7 USD/ounce, up 10.9 USD compared to a day ago.

Gold price forecast

The gold market is setting new highs in the last session of the week, after the latest data showed that consumer confidence in the US declined, while inflation expectations continued to decline.

The University of Michigan said on Friday that the final result of the December Consumer Confidence survey reached 52.9 points.

This figure is lower than the forecast of the economists, when the market consensus expected a rate of 53.5 points, after the preliminary figure of 53.3 points. However, the result is still higher than the 51 point mark for November.

"Consulent confidence in the monthly data confirmed, only increased by less than two points compared to November, is within the range of errors.

While the low-income group recorded an improvement, the psychology of the high-income group remained almost unchanged. Conditions for purchasing durable goods fell for the fifth consecutive month, while expectations for personal finances and business conditions increased in December, said Joanne Hsu, director of Consumer survey.

Analysts at Heraeus warned in the 2026 Quarterly Metro trien lavi Report that silver and other precious metals are likely to fall in at least the first period of 2026.

The price increase has pushed gold and silver to record highs, while platinum metals (PGM) have reached their highest level in many years, pushing prices too far and too fast, the analyst commented. Although prices may continue to increase in the short term, when momentum weakens, a period of accumulation or adjustment is inevitable.

High prices are weakening demand for silver in many areas, experts added. However, if gold continues to increase, silver will likely follow.

Heraeus believes that many silver demand segments will face difficulties in 2026. According to their forecast, demand for silver for the solar power industry will decrease as the trend of saving silver outperforms the growth of installation.

After many years of strong growth, the speed of PV installation is forecast to increase by only about 1% in 2026 due to policy changes in China the worlds largest market, the report said. At the same time, high silver prices have strongly promoted efforts to reduce the amount of silver used in solar panels, including printing thinner conductors, changing cell designs and finding ways to use cheaper metals. Other industrial sectors typically only grow in line with global economic growth, which is modest in the context of US tariffs complicating trade prospects."

See more news related to gold prices HERE...